Staff Reporter

ELFA: Financing Business Volume Up 2% in December, 5% in 2019

[Stay on top of transportation news: Get TTNews in your inbox.]

Despite a weaker freight market and tariffs against China that some economists said slowed the economy, new business volume for financing or leasing heavy equipment was up 5% in 2019 from a year ago, according to the Equipment Leasing and Finance Association.

For December alone, overall new business volume was $12.9 billion, up 2% from the same month a year ago, according to the association’s Monthly Leasing and Finance Index of economic activity from 25 companies representing a section of the $900 billion equipment finance sector.

Sequentially, December’s volume climb was 65% from $7.8 billion in November, in what the association called a typical end-of-year spike.

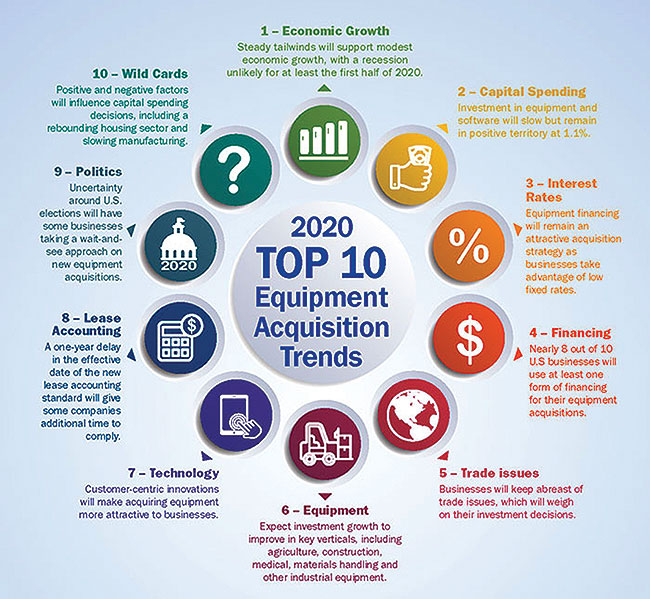

NEW RELEASE: @ELFAOnline's #Top10 Equipment Acquisition Trends for 2020! Watch the #video, download the #infographic https://t.co/WvcYtU6uI4 #ELFATrends #equipment #LeaseFoundation pic.twitter.com/KNTeVWtJqf — ELFA (@ELFAOnline) January 23, 2020

“Equipment finance companies ended the year with steady 5% cumulative new business growth,” said Ralph Petta, CEO of ELFA. “However, some ELFA member organizations are seeing slightly elevated levels of stress in their portfolios, corroborating evidence that soft patches can be found in some sectors of the U.S. economy.”

Whether recent relaxation of nagging trade tensions between the U.S. and trading partners improves conditions in the industrial and agricultural sectors remains to be seen, he added.

Washington-based ELFA reported credit approvals for equipment in December were 77.1%, up from 75.7% % in November.

Eric Starks, chairman and CEO of FTR, a Bloomington, Ind.-based transportation intelligence agency, told Transport Topics the December year-over-year numbers sound like what he is seeing as FTR researches buying and leasing of heavy trucks.

“There is still a need for equipment,” said Starks. “We have seen orders for trucks hovering near replacements levels.”

Starks said that means he expects total new truck orders for 2020 to be about 240,000 units.

One finance official said his business was steady in 2019, leading to his optimistic view for 2020.

“We have done well for the past 12 months,” said Tony Golobic, CEO of GreatAmerica Financial Services. “While our new business volume has increased a modest 6%, our spreads have shown a nice improvement and the quality of our business is quite satisfactory.”

Ryder System Inc. said its Ryder ChoiceLeaseTM revenue increased 9% at the end of the third quarter, compared with the same period in 2018. And Ryder’s lease fleet grew by 2,900 vehicles during the quarter ended Sept. 30, 2019.

Ryder CEO Robert Sanchez said during the company’s Oct. 29 earnings release that “year-to-date capital expenditures increased to $3 billion in 2019, compared with $2.3 billion in 2018. The increase in capital expenditures reflects higher planned investments to grow and refresh the lease fleet.”

Ryder ranks No. 11 on the Transport Topics Top 100 list of largest for-hire carriers in North America, and No. 6 on TT’s Top 50 list of the largest logistics companies in North America.

ELFA said it has 575 member companies, including leasing and finance, financial services and investment banks, manufacturers and packagers.

Want more news? Listen to today's daily briefing: