Staff Reporter

Diesel Surges 6.3¢ for Biggest Weekly Rise Since 2019

[Stay on top of transportation news: Get TTNews in your inbox.]

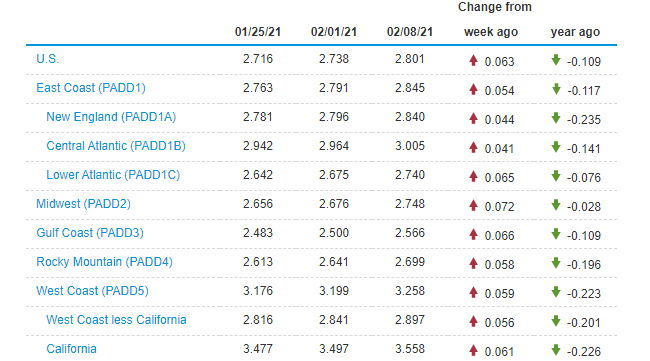

The nationwide average price of diesel fuel increased by 6.3 cents per gallon to $2.801, marking the 14th straight week with a gain and the largest rise in nearly 17 months, according to U.S. Energy Information Administration data released Feb. 8.

The price of trucking’s main fuel jumped 9.4 cents to $3.081 on Sept. 23, 2019, from $2.987 the week before.

It reflected the first gain of at least 6 cents since Dec. 21, when it rose 6 cents to $2.619.

U.S. average on-highway #diesel fuel price on February 08, 2021 was $2.801/gal, UP 6.3¢/gallon from 2/01/21, DOWN 10.9¢/gallon from year ago https://t.co/nHG6qC6RkW #truckers #shippers #fuelprices pic.twitter.com/UeuT1gvxd1 — EIA (@EIAgov) February 9, 2021

Diesel now costs 10.9 cents a gallon less than it did a year ago.

Each of the 10 regions in EIA’s survey saw the price of diesel rise. The Midwest experienced the most significant jump, 7.2 cents to $2.748. The Central Atlantic saw the smallest rise at 4.1 cents to $3.005.

The least expensive diesel is in the Gulf Coast region, despite a 6.6-cent jump to $2.566. The most expensive diesel is in California, where it increased 6.1 cents from the previous week to $3.558.

Meanwhile, gasoline’s spike of 5.2 cents per gallon for the national average lifted it to $2.461 a gallon and past its year-ago price by 4.2 cents. Retail gasoline prices have steadily risen since Nov. 23 when they decreased by 0.9 cent to $2.009.

One industry expert says there’s a lot to watch in the coming months on the broader fuel market.

“If people are watching the retail numbers — and they’re watching what’s happened so far in the first six weeks of 2021 and they’re assuming that this is going to continue for the other 46 weeks — I think they’re mistaken,” Tom Kloza, founder and global head of energy analysis for the Oil Price Information Service, told Transport Topics. “There’s a lot of potential speed bumps down the road. Not the least of which is at the end of March you’re going to have Saudi Arabia and Russia looking to increase production in the second quarter.

“There’s still an awful lot of trouble ahead for gasoline — and even diesel demand,” Kloza said. “We are still at miserable levels compared to virtually any period in the 21st century prior to the pandemic. That’s particularly true for gasoline. Diesel gets a little bit pumped up this time of year when you get cold weather.”

Kloza noted that the retail market is still lagging wholesale, which has been up close to 80% this year. Low demand for jet fuel is also helping prices on the retail market.

“The last thing you want to make is jet fuel because people aren’t going to be flying for months,” Kloza said. In fact, he doesn’t expect demand for jet fuel to fully return to 2019 levels until the middle of this decade.

U.S. average price for regular-grade #gasoline on February 08, 2021 was $2.461/gal, UP 5.2¢/gallon from 2/01/21, UP 4.2¢/gallon from year ago https://t.co/fgKJ8eyW8N #gasprices pic.twitter.com/BXVRP5uMne — EIA (@EIAgov) February 9, 2021

Diesel demand is more steady, he said.

“Diesel doesn’t so much have a demand problem because it is the product that surges the most in demand when you have a high GDP,” he said. “It’s just too easy to make a lot of it right now.”

He also doesn’t see huge gains for gasoline on the horizon.

“Demand for gasoline is still miserable,” he said. “It’s always miserable in January and February because people cocoon in the wintertime. But it’s more miserable this year because, notwithstanding the good news on vaccines, we’ve only got a small percentage of the population vaccinated.”

Kloza added, “I do think demand in the summer for gasoline is going to be OK. On an annualized basis or on a quarterly basis, I don’t think we’re going to see the numbers that we saw in 2016 through 2019.”

U.S. On-Highway Diesel Fuel Prices

EIA.gov

Want more news? Listen to today's daily briefing below or go here for more info: