Senior Reporter

Diesel Sheds 0.2¢ a Gallon to $3.342

[Stay on top of transportation news: Get TTNews in your inbox.]

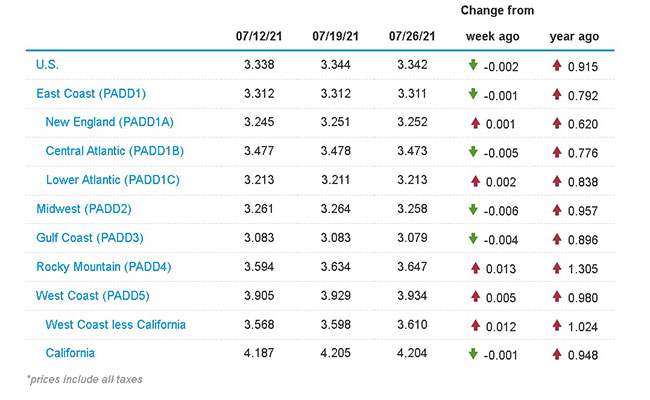

The national average price for a gallon of diesel dipped two-tenths of a cent to $3.342 a gallon, according to Energy Information Administration data released July 26.

- Diesel declined for the first time after 12 consecutive weekly increases, totaling 22 cents, beginning May 3.

- The last time trucking’s main fuel dropped in price was April 19, when it went down a half-cent to $3.124 a gallon.

- Of the 10 regions in EIA’s survey, the cost of diesel went down in five and rose in five. The Midwest region had the biggest dip at six-tenths of a cent. The Rocky Mountain region had the biggest rise at 1.3 cents.

The fast-spreading COVID-19 delta variant has led to renewed restrictions in some regions and raised concerns about short-term demand, Bloomberg News reported, although there are expectations the oil market will continue to tighten.

U.S. average on-highway #diesel fuel price on July 26, 2021 was $3.342/gal, DOWN 0.2¢/gallon from 7/19/21, UP 91.5¢/gallon from year ago https://t.co/udJUIWIxAW #truckers #shippers #fuelprices pic.twitter.com/k3eJD4Yn6s

— EIA (@EIAgov) July 27, 2021

West Texas Intermediate crude futures on the New York Mercantile Exchange closed at $71.91 per barrel on July 26 compared with $66.42 on July 19.

Bloomberg noted the surge in crude has been matched or exceeded by natural gas, metals and other bulk raw materials.

Meanwhile, EIA reported several former petroleum refineries plan to begin producing renewable biodiesel. In particular, Marathon Petroleum’s refinery in Martinez, Calif., plans to start producing renewable diesel in 2022 and could reach its full production capacity of 730 million gallons a year, or 48,000 barrels per day, in 2023.

Phillips 66’s Rodeo Renewed project in San Francisco, EIA added, plans to produce 800 million gallons a year (52,000 barrels per day) of renewable fuels when completely converted in 2024. “If realized, this project would be the world’s largest facility of its kind.”

U.S. average price for regular-grade #gasoline on July 26, 2021 was $3.136/gal, DOWN 1.70¢/gallon from 7/19/21, UP 96.1¢/gallon from year ago https://t.co/EiAEsCnVkD #gasprices pic.twitter.com/pHZCkEd5Oo — EIA (@EIAgov) July 27, 2021

The Department of Energy agency also pointed out one of the primary risks to the expansion in renewable diesel production capacity is the availability of fat, oil and grease feedstocks. “Prices for most renewable diesel feedstocks have increased as renewable diesel production has increased. Biodiesel and renewable diesel producers have been relying on incentives such as the biomass-based diesel tax credit and tradeable credit prices for renewable diesel in the federal RFS [renewable fuel standard] and LCFS [low-carbon fuel standard] to make a profit. Feedstock availability and government incentives will likely continue to play a role in the financial viability of new renewable diesel production capacity in the near term,” the agency said.

EIA said U.S. petroleum consumption accounted for about 45% of the U.S. total, in 2020. About 77% of petroleum CO2 emissions occurred in the transportation sector in 2020.

In related news, from the expanding world of alternative fuels for heavy-duty trucks comes a report of gains in heavy-duty natural gas fueled trucks, and, separately, a plan to bring 2,000 hydrogen fuel cells to a private fleet in partnership with the company that holds the overall lead in Class 8 engines supplied in North America.

For the first five months of 2021, U.S. and Canadian Class 8 natural gas truck retail sales rose 19% year-to-date against a somewhat unfair pandemic-era comparison with the same time period in 2020, according to ACT Research.

In May, the latest data, those retail truck sales notched solid, across-the-board improvement, ACT reported, with sales 206% higher compared with the year-ago level, and jumping 23% sequentially.

“We’re seeing an overall increase in electric charging stations, but a continuing decline of total natural gas stations,” noted ACT Vice President Steve Tam.

A Cummins hydrogen fuel cell tractor. (Cummins/Air Products)

He said natural gas station operators have over time zeroed in on the right locations for stations to help support vehicles in the field.

“We continue to see articles about natural gas use in transportation, as well as discussions about hydrogen fuel cells and investments in electric commercial vehicle development, making waves in trade-industry headlines,” Tam said.

Meanwhile, Air Products and Cummins Inc. have reached a memorandum of understanding to work together to accelerate integration of hydrogen fuel cell trucks in the Americas, Europe and Asia. Cummins will provide hydrogen fuel cell electric powertrains integrated into selected OEM partners’ heavy-duty trucks for Air Products, as Air Products begins the process of converting its global fleet of distribution vehicles to hydrogen fuel cell vehicles.

“We believe hydrogen is the future for heavy-duty segments of the transportation market and we can demonstrate to the world its merits by being a first-mover in transitioning our heavy-duty fleet of trucks to hydrogen fuel cell electric vehicles,” said Air Products Chairman and CEO Seifi Ghasemi.

Air Products ranks No. 73 on the Transport Topics Top 100 list of the largest private carriers in North America.

U.S. On-Highway Diesel Fuel Prices

EIA.gov

Want more news? Listen to today's daily briefing below or go here for more info: