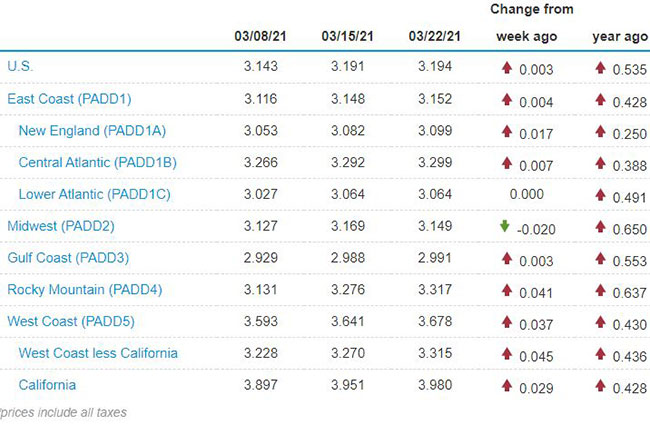

Diesel Nudges Up Three-Tenths of a Cent to $3.194 a Gallon

[Stay on top of transportation news: Get TTNews in your inbox.]

The national average price for a gallon of diesel rose three-tenths of a cent to $3.194 a gallon, according to Energy Information Administration data released March 22.

Trucking's primary fuel has risen for 20 consecutive weeks, although it has increased at a lesser rate each of the past three weeks.

“Everybody instantly thinks it’s bad for trucking and it is to start, but then we adjust to it with a fuel surcharge, so it just makes everything else go up,” Mesilla Valley Transportation CEO Royal Jones told Transport Topics. “But to me, the bigger thing that high fuel does is takes away the expendable income from families and single moms and people working because all of a sudden when they’re putting too much money in their gas tank to get to work and back every day, they can’t buy as much other than food items.”

Highlights

• The increase marked the 20th consecutive rise in price for trucking’s main fuel, but the cost has gone up at a lesser rate over the past three weeks.

• Diesel last slipped in price Nov. 2, 2020, when it declined 1.3 cents from the week before.

• Since Nov. 2, a gallon of diesel has increased 82.2 cents.

• The national average price of a gallon of gasoline went up 1.2 cents to $2.865, which is 74.5 cents per gallon more than last year at this time.

Jones expressed concern that when the general economy is hit, that hurts trucking because less freight gets transported. He also attributed much of the higher fuel prices in recent weeks to the shutdown of the Keystone XL Pipeline.

Mesilla Valley Transportation ranks No. 78 on the Transport Topics Top 100 list of the largest for-hire carriers in North America.

“With the COVID-19 vaccine rollout in full swing and case counts improving, it’s not surprising to see a strong rebound in consumer demand for gasoline,” Groendyke Transport Chief Financial Officer Mike Barnthouse told TT. “People are ready to get out and about. Also, this time of year generally sees an increase in travel, which increases demand. On the diesel side, trucks have been running all during the pandemic, so this is a supply-and-demand issue. The recent catastrophic winter storm in Texas didn’t help matters with many refineries just now coming back online.”

Barnthouse

Barnthouse added the price of crude has rebounded to a more normal level and seems to be supported by stable output from the Organization of the Petroleum Exporting Countries (OPEC) and reasonable output by U.S. producers. He doesn’t see prices dropping any time soon, but wholesale prices may indicate that retail prices could soon fall.

Groendyke Transport ranks No. 99 on the for-hire TT100.

“Really the story for, let’s say the second half of March, is that we’ve had something between a slump and a collapse in terms of wholesale prices for both gasoline and diesel,” Tom Kloza, co-founder and global head of energy analysis for Oil Price Information, told TT. “And yet, if you look at the street average, you look at the averages, they barely moved.”

Kloza added those circumstances dictate that it’s easy to predict that prices should drop. He noted that is good news for the trucking industry. “The fleets are probably beneficiaries of the price drops because in many cases they go on a cost-plus formula basis, which are tied to the wholesale numbers,” Kloza said. “It’s the smaller people who just pull into stations or truck stops or whateve. They haven’t really seen the numbers drop, but they will. Those numbers will drop, but it’s definitely at a feather’s pace.”

U.S. On-Highway Diesel Fuel Prices

EIA.gov

Kloza added that much of the wholesale drop is because crude prices simply got too high. He believes people stating this has been a trend change are being premature. But Kloza thinks those saying it’s a long-overdue correction are probably being more appropriate.

“There was just too much enthusiasm and too many buyers pouring into futures,” Kloza said. “So we’ll see where we go from here. We can see a very congested market for a long time, particularly with reports about lockdowns continuing abroad. We could resume the uptrend maybe in April or so. April does bring another OPEC+ meeting. So that’ll be interesting as well.”

Want more news? Listen to today's daily briefing below or go here for more info: