Senior Reporter

Diesel Climbs 9.9¢, Tops $3 a Gallon

[Stay on top of transportation news: Get TTNews in your inbox.]

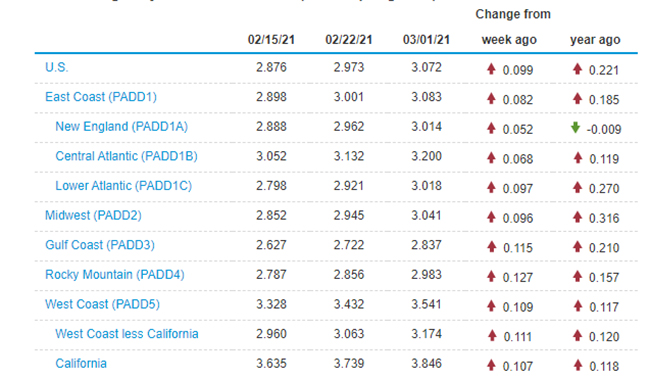

The national average price of diesel continued to skyrocket, surging 9.9 cents to $3.072 a gallon, according to data released by the Energy Information Administration on March 1.

The spike marked the second consecutive increase above 9 cents after a 9.7-cent rise last week.

Before Feb. 22, the last gain of at least 9 cents came Sept. 23, 2019. The latest rise is the steepest since a 15.3-cent spike Sept. 4, 2017.

Highlights

- The increase marked the second consecutive increase above 9 cents, following a 9.7-cent rise. Before Feb. 22, the last gain of at least 9 cents came Sept. 23, 2019.

- The rise is the steepest since a 15.3-cent spike Sept. 4, 2017.

- Diesel topped $3 a gallon for the first time since Jan. 27, 2020.

- The price of trucking’s main fuel has increased for 17 consecutive weeks.

- Gasoline also jumped significantly, by 7.8 cents a gallon to $2.711 for the national average.

Also, Diesel topped $3 a gallon for the first time since Jan. 27, 2020, in what was the 17th consecutive price gain for trucking’s main fuel.

Gasoline also jumped, but to a lesser extent than diesel. It rose 7.8 cents a gallon for a national average of $2.711.

Prices for diesel were higher in every region of the country except New England compared with a year earlier, as measured by EIA.

One analyst expects diesel prices to continue to rise with bullish oil prices and winter storm-related refinery production challenges.

“I think it is going to be a tough time. Let’s face it, the Biden administration wants carbon prices higher. You have an unsympathetic ear in the White House when it comes to diesel, especially diesel,” Phil Flynn, senior market analyst for The Price Futures Group, told Transport Topics.

In tracking the four-week trend for products supplied, a marker for customer demand, EIA on March 3 reported over the previous four weeks, distillate fuel — primarily ultra-low-sulfur diesel — — averaged 4.2 million barrels, up 6.4% from the year-ago period. Distillate fuel is used in transportation and to a lesser degree as heating oil.

Motor gasoline averaged 7.8 million barrels a day, down 12.3% compared with the 2020 period.

Meanwhile, the practice of sustainability, after first taking root among shippers, is something carriers are starting to embrace. Early adopter fleets, such as Schneider, are putting the longer-range focus on alternative powertrains even as they order cleaner Class 8s powered by diesel to reduce the average of the their fleet.

U.S. On-Highway Diesel Fuel Prices

EIA.gov

“We are committed to operating one of the most fuel-efficient and sustainably minded fleets on the road,” Schneider CEO Mark Rourke said. “It is our responsibility.”

The truckload, intermodal and logistics company operates about 9,000 heavy-duty tractors. Its latest plans call for reducing the average age of its fleet to 24 months from 30 months — bringing into the fleet the driver amenities, safety features and increased fuel efficiency found in new trucks.

Schneider’s approach to reducing its environmental impact starts with reducing greenhouse gas emissions, improving fuel efficiency and changing global operational policies to reduce its carbon footprint, according to the Green Bay, Wis.-based company.

“Sustainability has been and will continue to be embedded into everything we do,” said Mark Rourke, president and CEO.

“We are committed to operating one of the most fuel-efficient and sustainably-minded fleets on the road. It is our responsibility.” https://t.co/QszE0X5foy — Schneider (@WeAreSchneider) March 3, 2021

“At Schneider, we’re constantly addressing ways to not only meet, but go beyond industry standards and expectations because the demand for sustainable transportation solutions grows daily,” Rourke said.

Schneider has committed to the future of fleet electrification, making necessary short- and long-term investments such as testing electrified powertrains, developing strategic zero-emission vehicle adoption plans and building relationships with key stakeholders and industry partners. The company has been piloting the use of an electric eCascadia truck by Freightliner in California for local and regional delivery and pick-up.

Freightliner is a brand of Daimler Trucks North America.

“We think we’ll have more electric test points in 2021,” Rourke said in Schneider’s Q4 earnings call.

Schneider ranks No. 5 on the Transport Topics Top 100 list of the largest for hire carriers in North America. It ranks No. 18 on the TT list of the 50 largest logistics companies in North America.

In TT’s fleet rankings, tractor count includes company-owned, lease-to-own and owner-operator tractors.

Fleets are investing in tech-based safety tools that inform and forewarn potential risk. But how do they condition and prepare drivers to respond to safety alerts? Find out as the RoadSigns Team speaks with Tom DiSalvi, VP of safety at Schneider National, and Charlie Mohn, director of product innovation at Drivewyze. Hear a snippet, above, and get the full program by going to RoadSigns.TTNews.com.

Meanwhile, EIA said the severe winter storm that swept deep into the country in late February acted as a brake on the refining of fuels. Refineries operated at 68.6% of capacity for the week ending Feb. 26. Distillate fuel production decreased, averaging 3.6 million barrels per day. Gasoline production decreased, too, averaging 7.7 million barrels per day.

Crude oil futures remain high, and have surged this year from $47.62 on Jan. 4.

West Texas Intermediate crude futures on the New York Mercantile Exchange closed at $61.24 March 3 compared with $61.50 per barrel Feb. 26.

The Organization of Petroleum Exporting Countries and its allies have been constricting oil supplies since the pandemic crushed demand almost a year ago, Bloomberg News reported. To disperse the lingering stockpile surplus, the Saudis pledged extra reductions during February and March. Their efforts have paid off, reviving oil prices back to pre-crisis levels above $60 a barrel in London.

Flynn said the most recent indications point to the Saudis rolling over their current 1 million-barrel voluntary cut into April. “They are feeling their power, will make up for lost revenue in the past and keep the prices higher.”

Want more news? Listen to today's daily briefing below or go here for more info: