Diesel Climbs 2.6¢ to $2.904, Spread With Gasoline Narrows

By Michael G. Malloy, Staff Reporter

This story appears in the May 25 print edition of Transport Topics.

Diesel’s national average price rose for the fifth straight week, climbing 2.6 cents to $2.904 a gallon, the Department of Energy reported May 18.

Gasoline also rose for a fifth week, gaining 5.3 cents to $2.744, DOE said after its weekly survey of filling stations. The motor fuel was at its highest level since Dec. 1 but is still selling at 92.1 cents below year-ago levels.

Last week was the first time in two months that diesel’s price has topped $2.90, and despite its recent gains, it was $1.03 below the corresponding week last year.

Diesel prices are at the equivalent of more than $81 a barrel compared with crude’s current price of around $60, one analyst said last week.

Because of that, “there is plenty of incentive [for refiners] to manufacture a lot of diesel, whether for domestic use or export,” said Tom Kloza, global head of energy analysis for the Oil Price Information Service in Wall, New Jersey.

“In the second half of this year, we’ll see the startup of some large overseas refineries that will produce a lot of diesel,” he said, and “there is no real catalyst to drive diesel prices higher” until the weather cools in the fall.

Gasoline prices, are rising on a much steeper trajectory than diesel. The motor fuel has surged 33.6 cents in the past five weeks — more than twice that of diesel’s 15-cent increase.

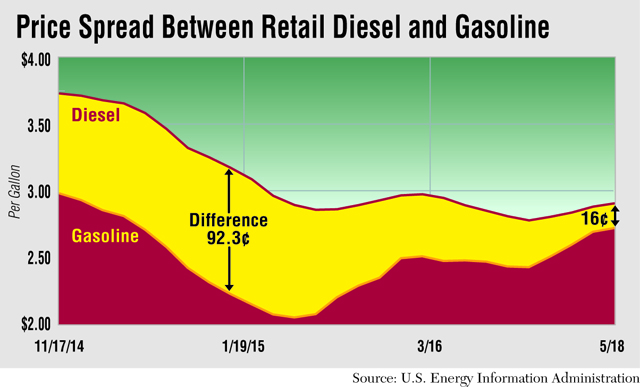

Last week’s 16-cent differential between the two fuels was the smallest in almost four years — since a 15.9-cent spread in June 2011, DOE figures showed. It was nearly $1 in January.

Kloza attributed gasoline’s recent higher climb to standard seasonal factors, including the summer driving season ramping up as the Memorial Day holiday approached.

Gas prices also have jumped in recent weeks due to “a very long and issue-haunted refinery turnaround season [and] the purge of winter gas and replacement of summer gas,” he said.

Gas prices “should tumble after Labor Day, per usual, when the diesel-versus-gasoline gap will widen to 40 to 50 cents,” he said.

Mike Meehan, vice president of sales for Fort Lauderdale, Florida-based Fleet Advantage, which provides data analytics, said last week that, even when diesel prices are at a relatively low level, fleets should continue to focus on reducing their gallons burned.

Despite upfront capital costs, newer-model trucks with such equipment as automated manual transmissions can offer fleets a higher return on investment, said Meehan.

“One of our fleet clients said that because the price is down, people aren’t always focusing on the things that they can do to burn less fuel,” he said.

Current diesel prices that are below historical averages “are offering significant relief to many carriers’ budgets, but we’re advising them not to take their eye off the ball,” he added.

For most carriers that run Class 8 equipment, fuel accounts for 60% to 70% of the cost per mile, Meehan noted. “The biggest difference we’re seeing is fleets are running more newer-model equipment and seeing improved fuel economy. When you do the math on that, the justification is double-digit return on investment,” he said.

New Class 8 trucks “are a very good investment when you look at it at cost-per-mile,” he added. A 2010 truck, for example, has higher maintenance costs and gets about 0.5 to 1 mpg less than more current 2014-2015 models.

Many fleets might not be ready to replace 2010 equipment and want to run them for another year or two, but “that’s two years of opportunity costs down the drain,” Meehan said. “When you net out the total cost per mile, the difference can be as much as $1,000 per month, per truck.”

Oil prices, meanwhile, fell to a three-week low of $57.26 last week, holding below the $60 mark of earlier in May.

DOE reported on May 19 that supplies of crude, gasoline and distillate fuels, which include diesel, all fell for the week ended May 15, although U.S. refinery utilization rose 1.2 percentage points to 92.4%.