Senior Reporter

CVG's Challenges in Q1 Send Net Income, Revenue Lower

[Stay on top of transportation news: Get TTNews in your inbox.]

Diversified supplier Commercial Vehicle Group Inc. reported net income fell sharply and revenue slipped in the first quarter as it dealt with inflationary headwinds, COVID in China and Russia’s war on Ukraine affecting production.

The key effects of inflation it felt were increased prices in steel, ocean freight and labor, the New Albany, Ohio-based company noted.

Net income fell to $3.9 million, or 12 cents per diluted share, compared with $8.4 million, 26 cents, a year earlier. Revenue was almost flat at $244.4 million compared with $245.1 million a year earlier.

Bevis

“Importantly, we made significant strides repricing our legacy supply contracts, and we secured improved pricing with our top two Class 8 truck maker customers,” CEO Harold Bevis said during the earnings call. The two customers represent about 30% of its annual revenue.

The bulk of its new pricing takes effect July 1.

CVG’s commercial vehicle products include wiper systems, mirrors, seating, sleeper and cab structures, trim and electrical systems.

Bevis said the company recently launched its Unity seat line in the U.S., Mexico and China, and modified its production facilities.

“It was a bit harder to do than we thought, but we’re getting to the finish line. And our Unity seat allows for a high level of customization based upon customer needs and is a true source of competitive advantage for CVG versus our competition,” he said.

“We believe this seat will allow us to take market share across a broad range of focused areas, including last-mile delivery vans, construction equipment and trucks, but also position CVG to take back some share we lost in the aftermarket segment over the last few years,” Bevis added.

CVG expected supply chain challenges to limit production and North American Class 8 builds to be in a range of 275,000 to 295,000 trucks — up from its Q4 expectation of 270,000.

CVG reported in Q1 it won $89 million of new annualized business — with the majority of those in electrification and electric vehicles and the bulk of its wins in this area.

Where in the World is CVG?

Manufacturing operations are located in:

• United States

• Mexico

• China

• United Kingdom

• Belgium

• Czech Republic

• Ukraine

• Thailand

• India

• Australia

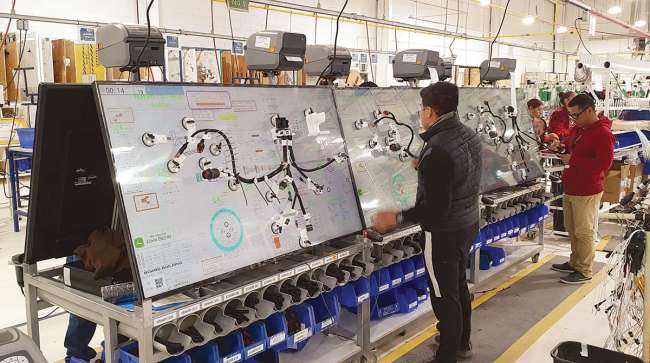

Multiple projects are underway to redesign its manufacturing systems with new capacity, repositioned capacity and lower total cost locations, CVG reported.

Bevis said the company was building up inventories with increased domestic production in light of the COVID shocks.

“And the biggest impact we had was in our vehicle solutions business, because 70% of our company’s revenue is in North America, and that business had been sourcing parts from China forever,” he said. “And so we ordered robotic welding, powder coating, metal fabrication equipment. We are installing it into our plants as it comes in.

“And we are going to eliminate this in-transit [time] that we have. So, the supply chains from China are 22 weeks, and they have been running at six weeks, eight weeks for years. And so that really put a kink into what we were doing.”

Segment results included:

• Vehicle solutions: Revenue jumped to $140.2 million compared with $124.3 million a year earlier, primarily resulting from material cost pass-through and new business wins offset by lower shipments caused by the COVID lockdowns in China. Operating income was $6.3 million compared with $7.5 million in the prior-year period.

Host Michael Freeze discusses insurance coverage and costs with Jane Jazrawy of Carriers Edge and David Berno of Hub International. Tune in above or by going to RoadSigns.TTNews.com.

• Electric systems: Revenue fell to $39.9 million compared with $46.5 million in the 2021 period due to lower volume caused by the war in the Ukraine, supply chain constraints and semi-conductor chip shortages at customers’ plants. Operating income was $1.8 million compared with operating income of $4.9 million a year earlier, primarily due to new business startup costs, lower volumes and a lag in price-cost offsets. A program is underway to invest in its footprint in this segment and prices were increased at top accounts.

• Warehouse automation: Revenue fell to $34.1 million compared with $44.4 million a year earlier due to lower demand levels. Operating income slipped to $3.7 million compared with $3.9 million.

• Aftermarket and accessories: Revenue inched up to $30.2 million compared with $29.9 million a year earlier. Operating income dropped to $2.6 million compared with $4.2 million, primarily attributable to supply chain constraints and material cost inflation incurred in advance of price increases.

Want more news? Listen to today's daily briefing below or go here for more info: