Bloomberg News

Consumer Confidence in US Posts Biggest Gain in 17 Years

[Ensure you have all the info you need in these unprecedented times. Subscribe now.]

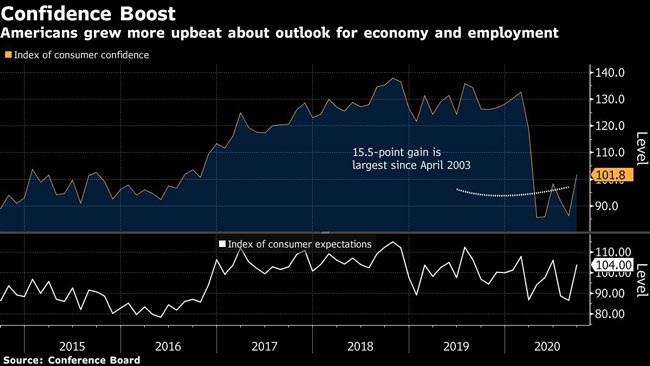

Consumer confidence rebounded in September by the most in more than 17 years as Americans grew more upbeat about the outlook for the economy and job market, though sentiment remained below pre-pandemic levels.

The Conference Board’s index increased 15.5 points, the most since April 2003, to 101.8 from August’s upwardly revised 86.3, according to a report issued Sept. 29. The median forecast in a Bloomberg survey of economists called for a reading of 90 in September, and the figure exceeded all estimates.

The group’s gauge of current conditions rose 12.7 points to 98.5, while a measure of the short-term outlook jumped 17.4 points to a three-month high. The gain in the expectations index was the largest since 2009. The S&P 500 turned positive after the report.

Even with the outsize improvement in September, Americans remain downbeat about the current state of the job market and the coronavirus. Headed into the final months of the year, an increase in infection rates and the absence of fiscal relief for the millions of unemployed could weigh on confidence and upend what’s been a solid recovery in retail sales.

“Consumers also expressed greater optimism about their short-term financial prospects, which may help keep spending from slowing further in the months ahead,” Lynn Franco, senior director of economic indicators at the Conference Board, said in a statement.

Respondents indicated they were more likely to make big purchases in the months ahead. The share expecting to buy major appliances rose to a seven-month high of 49% from 44.9%. Those planning to buy a car increased to 11.8% from 10.1%, and more intended to buy a home.

The share of survey respondents who said they expected their incomes to increase rose to a six-month high of 17.5%, though that’s down from 22.7% who said so in February before the pandemic. Optimism in general was driven by higher-income individuals, the report showed.

Larger shares also expected more jobs and better business conditions in coming months.

Consumers that said business conditions are currently favorable increased to a five-month high of 18.3% from 16%. The percentage of consumers who said jobs are hard to come by decreased to 20%, the lowest since March, from 23.6%.

Want more news? Listen to today's daily briefing:

Subscribe: Apple Podcasts | Spotify | Amazon Alexa | Google Assistant | More