China Halts Crop Imports, Weakens Yuan

[Stay on top of transportation news: Get TTNews in your inbox.]

China responded to President Donald Trump’s tariff threat with another escalation of the trade war Aug. 5, letting the yuan tumble to the weakest level in more than a decade and asking state-owned companies to suspend imports of U.S. agricultural products.

The moves antagonized Trump, who used Twitter to accuse China of “currency manipulation” which “will greatly weaken China over time!” He has previously criticized Beijing for not keeping to promises to buy more U.S. crops.

China dropped the price of their currency to an almost a historic low. It’s called “currency manipulation.” Are you listening Federal Reserve? This is a major violation which will greatly weaken China over time!

— Donald J. Trump (@realDonaldTrump) August 5, 2019

Stocks and emerging-market currencies sank on concern a prolonged conflict between the superpowers will weigh on global economic growth, while haven assets including the Japanese yen, U.S. Treasuries and gold climbed. Investors increased bets on Federal Reserve interest rate cuts.

“It’s among the worst-case scenarios,” said Michael Every, head of Asia financial markets research at Rabobank in Hong Kong. “First markets sell off, then Trump wakes up and this all gets far, far worse.”

In a statement published Aug. 5 in Beijing, People’s Bank of China Governor Yi Gang said China won’t use the yuan as a tool to deal with trade disputes.

“I am fully confident that the yuan will remain a strong currency in spite of recent fluctuations amid external uncertainties,” Yi said, adding that the bank will work to ensure “reasonable and legal demand” by companies and the public for foreign exchange.

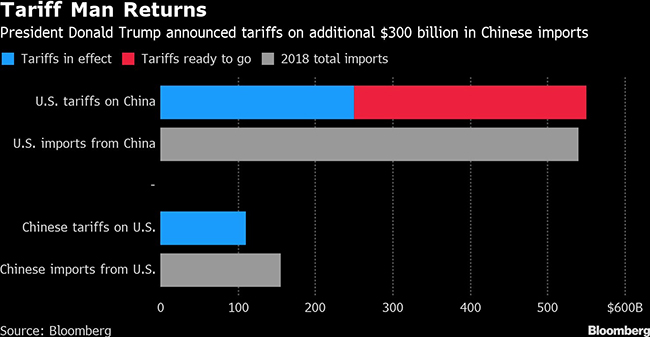

On Aug. 1, Trump proposed adding 10% tariffs on another $300 billion in Chinese imports from Sept. 1, abruptly ramping up the trade war between the world’s largest economies shortly after the two sides had restarted talks. Chinese bureaucrats were stunned by Trump’s announcement, according to officials who’ve been involved in the negotiations.

The threat of more tariffs came just as Chinese President Xi Jinping and other senior members of the Communist Party gathered for a secretive summer getaway in Beidaihe, a seaside town about a three-hour drive from Beijing. Xi had already faced pressure for weeks to take a harder stance on trade — particularly after the U.S. blacklisted telecom equipment giant Huawei Technologies Co.

The harder line underlines a growing feeling in Beijing that Trump can’t be trusted to cut a deal, and that China would be better off waiting to see if a Democratic presidential candidate — many of whom have criticized the use of tariffs — takes office. The halt in agricultural purchases could hurt Trump in politically sensitive states ahead of the 2020 election.

The MSCI Asia Pacific Index slid 2.1% on Aug. 5, the biggest drop since October 2018. European shares and S&P 500 index futures also retreated, while the yield on 10-year U.S. Treasuries declined about 8 basis points to 1.77%, the lowest level since 2016.

The onshore yuan weakened 1.4% to 7.0391 a dollar, falling sharply after the PBOC set its daily reference rate at a weaker level than 6.9 for the first time since December.

“Breaking 7 is due to a mix of factors: an escalation of trade war, the softening of China’s economy and a willingness for the PBOC to tolerate higher volatility for the yuan,” said Larry Hu, head of China economics at Macquarie Securities Ltd. in Hong Kong. “The PBOC has entered uncharted waters, so it has to manage expectations carefully.”

In an earlier statement, the central bank attributed the yuan move to protectionism and expectations of additional tariffs on Chinese goods.

By linking the devaluation with the renewed tariff threat, the PBOC “has effectively weaponized the exchange rate,” said Julian Evans-Pritchard at Capital Economics in Singapore. “The fact that they have now stopped defending 7 against the dollar suggests that they have all but abandoned hopes for a trade deal.”