China Agrees to Resume Purchasing US Soybeans

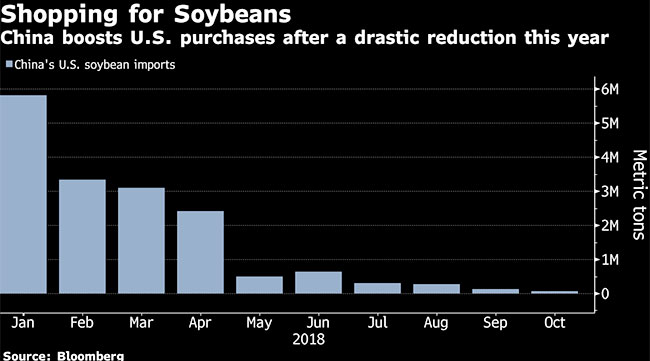

China resumed buying U.S. soybeans, bringing some relief to farmers in President Donald Trump’s heartland as President Xi Jinping works toward a trade deal with his American counterpart.

The giant Asian commodity importer bought 1.5 million to 2 million metric tons of American supply over the past 24 hours, with shipments expected to occur sometime during the first quarter, the U.S. Soybean Export Council said, citing unidentified industry sources. On Dec. 13, the U.S. Department of Agriculture disclosed sales of 1.13 million tons for delivery to China.

The purchases represent a major gesture by China toward easing tensions between the world’s largest economies. Soybeans have become the poster child of the trade dispute, with the Asian nation shunning imports from farms in rural communities that voted for Trump in 2016. Futures in Chicago tumbled as a result, while the 2018 harvest had been piling up, unsold, in silos, bins and bags across the Midwest.

“The shipments, mainly from the Pacific Northwest, will help reduce stockpile pressures for U.S. soybean farmers,” said Li Qiang, chief analyst with Shanghai JC Intelligence Co. “These shipments can ease China’s own shortage of supplies in the first quarter of the year.”

This is the first significant purchase since the countries began imposing tit-for-tat tariffs, with China slapping a 25% retaliatory levy on the American oilseed after Trump imposed duties on billions of dollars worth of goods from the Asian country.

‘Farmers, I Love You’

Soybean futures had stayed relatively quiet in the past few days as traders awaited confirmation deals were happening. Trump had hailed a breakthrough on agriculture as part of the trade truce agreed in his meeting with Xi earlier this month, and tweeted “Farmers, I LOVE YOU!” Prices in Chicago slid 0.2% on Dec. 13, and still are down about 14% since their peak in March.

The export council “is encouraged by the news that buyers from China have made purchases of U.S. soybeans,” the American group said in an e-mail. “This is obviously positive news for our growers.”

“China officially echoed President Donald Trump’s optimism over bilateral trade talks. Chinese officials have begun preparing to restart imports of U.S. Soybeans & Liquified Natural Gas, the first sign confirming the claims of President Donald Trump and the White House that...... — Donald J. Trump (@realDonaldTrump) December 5, 2018

The Skeptics

Still, while the purchases represent some relief to farmers, the three-month nature of the import agreements is leaving some traders concerned. Cargill Inc. said earlier this month that the United States probably has missed the best chance to sell beans to China because of approaching South American harvests.

Skepticism also remains over the impact on the soybean markets as the imports are likely to be made by state-owned enterprises while Chinese commercial buyers that typically buy more are still hampered by tariffs.

The purchases may help refill China’s supplies, but it won’t do a lot to empty the huge stockpiles that have built up in America, said Darin Friedrichs, risk management consultant at INTL FCStone Inc.’s Shanghai office.

“The problem is it’s so late in the season for the U.S.,” Friedrichs said. “The stocks are huge.”

While the purchases may have a limited effect on soybean flows, the move is much more significant for sentiment in broader financial markets. Asian equities to rubber futures advanced on hopes that Xi and Trump will be able to reach an agreement within a 90-day truce period. It also raises prospects for further buying from China, according to JCI’s Li.

“We expect China to resume purchases of other farm products from the United States, including corn,” Li said.