Caterpillar Tops Estimates, but Investors See ‘Cracks’ in Other Businesses

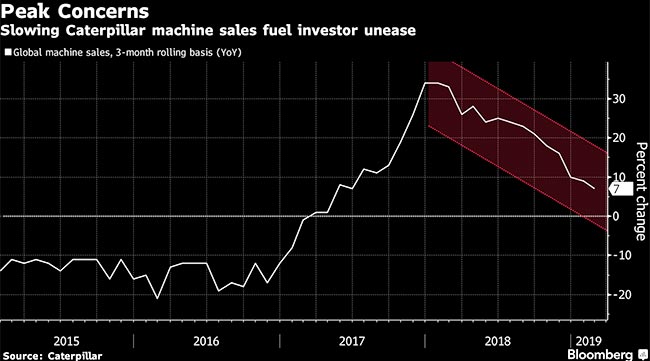

Impressive results in Caterpillar Inc.’s mining business weren’t enough to assuage investor concerns about the outlook for its other businesses for the rest of the year.

The company reported first-quarter profit and sales that beat estimates, driven by a boost from mining orders. At the same time, inventories grew, and Caterpillar flagged declining market share and “aggressive pricing” from competitors in China. The company, which got pummeled a year ago after warning results may be “the high-water mark for the year,” again was punished by investors concerned about its future.

Chief Financial Officer Andrew Bonfield said China’s demand for construction equipment will grow this year, though the company’s sales are expected to be flat.

“[Caterpillar] will lose a little bit of market share for this year; there’s bits of aggressive pricing by some of our competitors who are pricing very strongly over there to try and get market share,” he said.

The prospects from Caterpillar, considered an economic bellwether, come after economists including those at the IMF and OECD cut their outlooks for major economies in 2019 amid geopolitical and trade tensions. The outlook dims investor hopes that demand from mining and energy customers would help the company weather an expected slowdown in construction industries.

“Some cracks in the story for first time in several years,” Bloomberg analyst Karen Ubelhart said. “Construction machinery outside U.S. is petering out. Asia is flattening, and CAT mentioned “aggressive pricing” in China. They cited Asia pricing and market share losses in China at a recent conference, but maybe the word didn’t spread.”

Dealer machine and engine inventories increased about $1.3 billion in the quarter, compared with an increase of about $1.2 billion a year earlier.

“Investors don’t like when big machinery companies like Caterpillar report in-line quarters during periods when dealers are adding all that inventory and they’re supposed to be getting ready for the spring selling season,” William Blair & Co. analyst Larry De Maria said. “It implies things are as good as it gets and that end markets are softer due to backlog, and therefore the upside to numbers just won’t be there.”