Caterpillar Sales Drop Highlights Worry of ‘Catatonic’ Recovery

[Ensure you have all the info you need in these unprecedented times. Subscribe now.]

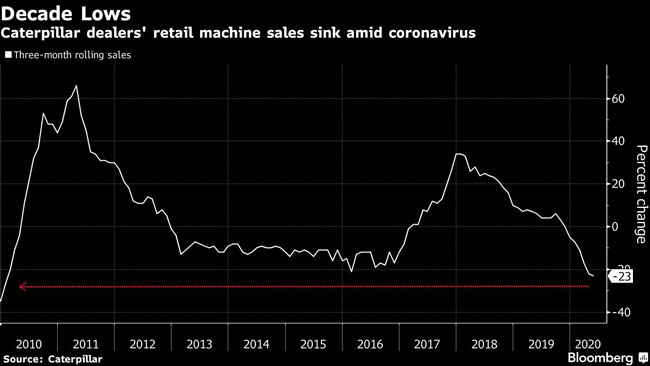

Caterpillar Inc.’s machinery sales dropped by the most in 10 years last month in a sign of a deepening slump in its Americas businesses, where the company has extended plant shutdowns.

Retail receipts in North America fell 36% on a rolling three-month basis, the most since January 2010, the company said in a government filing June 12. Sales in Latin America had the biggest decline since December 2016. Overall global sales dropped by the most since early 2010.

The figures underscore concerns over prospects for a halting recovery at the heavy-equipment maker after coronavirus shutdowns dented the profit outlooks for miners and construction companies. The data comes on the heels of a report that the Deerfield, Ill.-based company is keeping some of its plants across North and South America shut for longer than expected.

BMO Capital Markets analyst Joel Tiss earlier downgraded Caterpillar’s stock to the equivalent of a hold, citing a “catatonic recovery.” Near-term recovery of the company’s end markets will be challenged by customers’ budgetary constraints and stretched government finances, Tiss said.

“These factors will likely overwhelm the myriad internal improvements occurring at the company, at least for the next few years,” Tiss said in the note.

CEO Jim Umpleby took the helm at the start of 2017 with a focus on boosting efficiency and profit margins, and expanding services to help offset the traditionally cyclical nature of the bellwether producer’s markets. In an earnings call in April, Umpleby departed from his normally staid commentary to warn analysts of a “severe and chaotic” impact from the crisis.

Caterpillar’s stock is down about 16% this year. Shares rose more than 2% in New York on the morning of June 12 as the broader equity markets advanced.

Want more news? Listen to today's daily briefing:

Subscribe: Apple Podcasts | Spotify | Amazon Alexa | Google Assistant | More