Carmakers Sell More to Rental Companies as Retail Demand Weakens

Stronger-than-expected new car sales last month belied a dirty little secret: Automakers have been selling more vehicles to rental fleets in recent months to prop up volume.

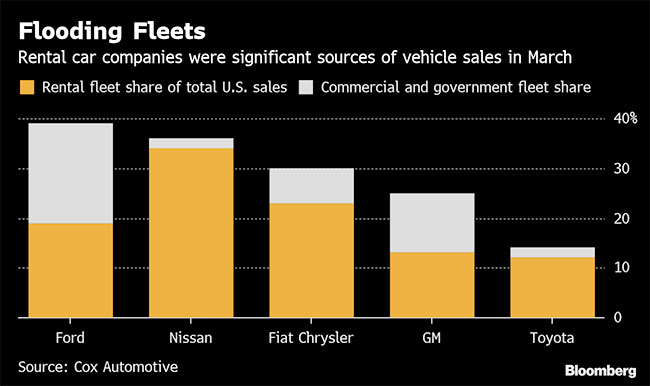

Deliveries to rental-car companies and other nonretail buyers accounted for more than a third of total sales last month for Ford Motor Co. and Nissan Motor Co., according to data from researcher Cox Automotive. Deliveries to rental companies alone in March and in the first quarter were the highest in two years, Cox said.

Rental-car sales tend to have lower profit margins and can erode used-vehicle prices once those models hit the resale market. Automakers appear to be using fleet deliveries to make up for showroom demand starting to sputter as U.S. economic growth slows.

“Any favorable view we have of the market is because of sales into fleets,” said Zohaib Rahim, manager of economics and industry insights at Cox. “The market peak of 2016 is behind us, and retail sales are softening more and more now.”

Automakers sold 550,000 vehicles to rental-car companies in the first quarter. That’s the most since the first quarter of 2016 and up 6% so far this year, Rahim said. The increase comes on top of a 7% gain in 2018 to 2.7 million.

The surge helps explain the surprising resilience of the auto market. Sales have been down every month this year, but the annualized selling rate improved to 17.45 million in March, helped by favorable seasonal factor adjustments.

The rental push comes as companies such as Avis Budget Group Inc. and Hertz Global Holdings Inc. have been upgrading their lineups with newer vehicles as they seek to match their fleets with customer demand.

Ford was especially reliant on fleets in March, with those deliveries accounting 39% of sales, including 19% from rental-car companies, according to Cox data. Nissan’s total fleet share was 36%. Most of that volume went to rental lots, the data showed.

Representatives for Ford, which officially releases its March numbers April 4, declined to comment. A Nissan spokesman said the company doesn’t break out its monthly sales.