Bloomberg News

BP’s New CEO Needs to Steer Company Through World Wary of Oil

[Stay on top of transportation news: Get TTNews in your inbox.]

In a world that’s increasingly wary of fossil fuels, BP’s newly appointed CEO Bernard Looney will have to prove the company can keep up with the times.

BP has a highly profitable oil and gas business that pioneered exports from the Middle East, opened up giant fields in Alaska and the U.K. North Sea, and has paid billions of dollars to shareholders.

But Looney, 49, needs to decide how quickly he wants to pivot BP toward cleaner — typically less profitable — forms of energy. The company is already transitioning to cleaner fuels, and the timing will be essential as the new CEO tries to keep influential investors on his side, and also offer an attractive career to talented young engineers.

Looney has taken an unusual approach by asking a BP geophysicist in his 20s to “mentor” him on new innovations. During an interview earlier this year, the younger employee, Connor Tann, said he was somewhat in disbelief when he was picked to visit the office of the powerful executive.

The two meet regularly to discuss not just technology but the culture of the younger generation, which Looney hopes to lure to his company from the attractions of Big Tech. The tall and lanky Irish executive, who carries himself with the charm of a politician, often looks worried when he’s asked if he’s keeping up with society’s attitudes.

Looney has been “modernizing the upstream for BP and driving the digital agenda with a vision that the industry and the company are seen as cool, clean and low-carbon,” Barclays analysts wrote in a note. “It is likely that the appointment of Mr. Looney as CEO may accelerate the journey that BP is on regarding the energy transition.”

Looney already has some experience under his belt. As head of BP’s upstream business, he steered the company through a worst-in-a-generation price slump that led to project cancellations, staff reductions and the mandate to squeeze more out of every dollar spent.

He is credited with delivering projects on time and on budget. BP’s production is set to rival that of much larger Exxon Mobil Corp., including its stake in Rosneft PJSC, by the middle of the next decade.

He frequently holds town halls and runs an online discussion forum that looks a bit like a Facebook page. Looney sees these as key to keeping BP relevant in a world where students are marching on the streets demanding a move to a cleaner world and investors are questioning if it’s safe to keep their money in fossil fuels.

He helped drive the company toward digitizing its upstream operations and encouraging oil workers to wear devices to monitor their health. He also has helped push the company toward better detecting methane leaks, a key contributor to global warming.

“I am humbled by the responsibility that is being entrusted to me by the board,” Looney said in a statement that announced his appointment to the top job, “and am truly excited about both the role and BP’s future.”

In the past, he worked in the CEO’s office — a position his predecessor Bob Dudley also held — under the tumultuous reigns of former bosses John Browne and Tony Hayward. Those stints exposed him to major upheavals at BP including the company’s early, and eventually ill-timed, foray into solar. He was also in the thick of the action as the Deepwater Horizon accident resulted in the biggest U.S. oil spill, killed 11 people and which cost the company $70 billion in penalties.

Looney, who joined BP in 1991 as a drilling engineer, was running the company’s North Sea operations when the rig exploded in the Gulf of Mexico.

He flew out to Houston and worked for 60 days to try to stop crude gushing out of the well, he told an Irtish newspaper last year. At BP’s headquarters in London, employees were watching the company’s stock price plunge and U.S. President Barack Obama admonish their irresponsibility. People wondered if the company would survive the fallout. Looney called it the most challenging time of his career.

In February, he found himself on an all-male panel at a major London industry conference. He pointed out the practice, known as a manel, is not acceptable. Later at the company’s annual general meeting in May, a former engineer in his division took to the microphone to say people she speaks to in the upstream business are growing disillusioned because they don’t know what their purpose is amid the broader climate debate.

Afterward, as dozens of shareholders jostled for Looney’s attention, he stood speaking to her to better understand her concerns.

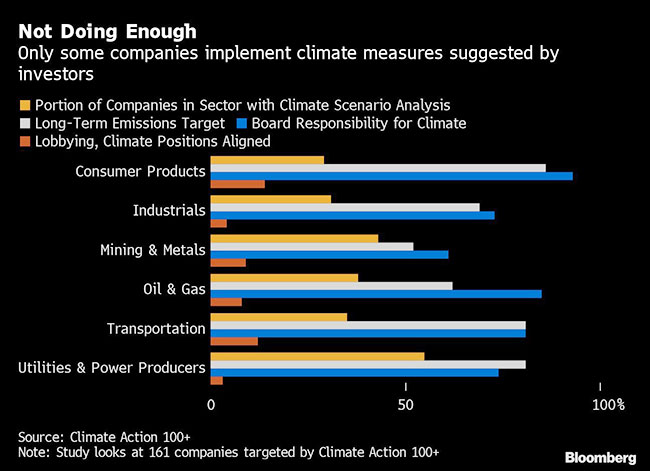

Looney will not be short of people wanting to have a say. An investor group overseeing $35 trillion called Climate Action 100+ said it wants BP, and 160 other companies, to be carbon neutral by 2050. That would drastically alter life at the oil major, which is aiming to keep its emissions from rising even as it increases production. The group has already bound BP to detail how each capital investment decision is aligned with the Paris climate accord, which Looney will be responsible for ushering through.

“An incoming CEO who understands his organization, diversity, shareholders, free cash flow and how to make BP investible amid the growing energy transition concerns,” said Oswald Clint, an analyst at Sanford C. Bernstein Ltd. “We see no radical change in strategy.”

Want more news? Listen to today's daily briefing: