Auto Plants Approach Reopenings, Putting Pressure on Detroit

[Ensure you have all the info you need in these unprecedented times. Subscribe now.]

Automakers are cautiously coalescing around plans to reopen North American assembly plants early next month following what will be a roughly six-week shutdown for virtually the entire industry.

Toyota Motor Corp., Tesla Inc., Hyundai Motor Co. and Volkswagen AG are among the major automakers that have said they intend to resume production in the first week of May. Even if they stick to that schedule, many won’t restart all their factories at once, and the facilities that do restore output will run assembly lines at slower rates than they did pre-shutdown.

The non-unionized carmakers’ intentions add to the urgency of talks General Motors Co., Ford Motor Co. and Fiat Chrysler Automobiles NV are having with the United Auto Workers that weigh the need to get back to business against the possibility that reopening will sicken employees. Of the three, only Fiat Chrysler is confirming plans to progressively restart beginning May 4, pending approval from governments and unions.

“A lot of automakers are looking at some point in May starting production for at least half or a majority” of their plants, prioritizing those making lucrative pickups and SUVs, said Jeff Aznavorian, president of Clips & Clamps Industries, a supplier to Fiat Chrysler and other manufacturers. “All of them are planning on staggering those openings to make sure their processes are in place so they can go back to work safely.”

Less-Dire Sales

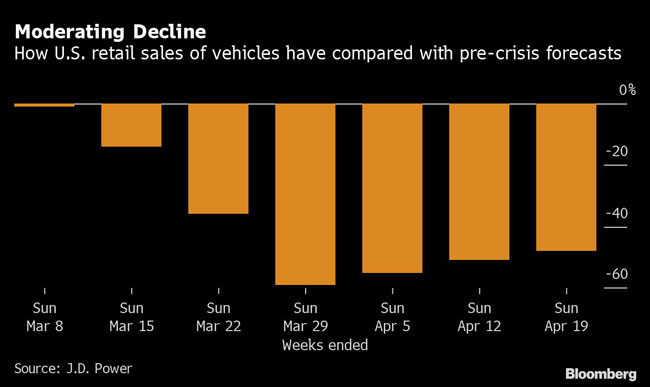

Weeks ago, analysts assumed there would be little reason for the industry to rush its restart. Sales in China plummeted almost 80% in the wake of the country’s coronavirus outbreak early this year, and some were expecting a decline of similar magnitude for the U.S. Yet demand has held up better than expected, with researchers LMC Automotive and J.D. Power predicting a roughly 50% decline this month.

“We’re confident, we’re ready to go with the proper safety protocols in place,” Gerald Johnson, GM’s executive vice president of global manufacturing, said in an interview April 23. “We surveyed our supply base. They are as committed as we are. They’re as ready to start as we are.”

While the UAW likely won’t want to put its companies at a competitive disadvantage or keep its members from earning bigger paychecks again, the union also is leery of reopening plants too soon after two dozen union workers at Ford, GM and Fiat Chrysler have died of COVID-19 complications.

“The one thing that is a priority of all parties is the health and safety of UAW Ford, General Motors and FCA employees, their families and their communities,” Rory Gamble, the union’s president, said in a late April 22 statement.

Speaking at GM’s shuttered transmission plant north of Detroit that’s now making face masks, Johnson said the company is figuring out what timing is right without compromising on safety. “It’s not either-or,” he said. “It’s our responsibility to be safe and bring the economy back.”

Slow Ramp-Up

Because many factories were running at full speed prior to the shutdown, automakers were carrying plenty of inventory. The process of restarting production will unfold in stages and it could take months for certain products to return to full capacity.

“We do expect to see a slow ramp-up of volumes over the coming weeks” starting the first week of May, said Julie Fream, CEO of the Original Equipment Suppliers Association, an auto parts industry trade group. “That doesn’t mean that all plants will be back online and certainly not that all shifts will be working.”

Not all companies in the supply chain will resume output at the same time, nor are all states in alignment on policy. Michigan’s Gov. Gretchen Whitmer on April 22 cautioned automakers in her state to “slowly engage in a safe manner,” while southern governors are pushing hard to become the first to lift shelter-in-place orders.

“Even if the stay-at-home gets extended, there may be some exceptions,” said Jeff Schuster, senior vice president of forecasting for researcher LMC Automotive. “I have no doubt that the industry is lobbying hard for that.”

Schuster expects the industry to produce at 50% of normal production levels or lower at least through May, if not through the remainder of the second quarter. “Following the model they used in China, it’s probably one shift initially, heavy-duty disinfecting and cleaning, slower line rates because of social distancing, staggered entrance and exits, temperature monitoring and, if they can get them, those quick self-administered test kits,” he said.

Pre-Paying for Parts

Cash-strapped smaller suppliers need detailed timelines — and sometimes prepaid orders — before bringing workers back, sourcing new materials and investing in equipment to promote social distancing on their shop floors, said Alan Baum, an independent auto analyst based near Detroit.

It’s typical for suppliers to take in receivable payments on a 45-day delay, so they’re still getting paid for work they were doing before production was halted. By late May and early June, that money will dry up and cause a cash crunch for some companies.

To help bridge the gap, some automakers are considering front-loaded payments to avoid any cash-flow issues. The approach, referred to in the industry as “factoring programs,” generally involves suppliers surrendering a few percentage points of profit in exchange for early payment, OESA’s Fream said.

“Most of the first tier is ramping up in a very organized way, but my clients are often frustrated they’re not getting enough guidance to make specific plans for restarting,” Baum said.

Chester Dawson, Gabrielle Coppola, Keith Naughton and David Welch were the primary contributors on this report.

Want more news? Listen to today's daily briefing: