Senior Reporter

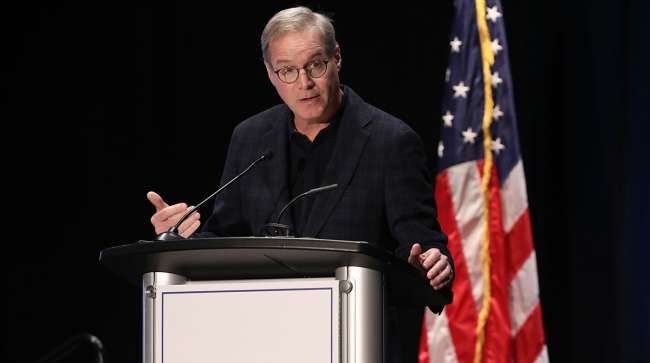

ATA’s Chris Spear Proposes Excise Tax Repeal

[Stay on top of transportation news: Get TTNews in your inbox.]

ORLANDO, Fla. — American Trucking Associations leader Chris Spear took direct aim at a World War I-era tax he argued presents an obstacle for the industry.

At American Trucking Associations’ Moving & Storage Conference Annual Meeting, Spear told attendees he had recently urged federal lawmakers to revisit their efforts on the repeal of the long-standing excise tax on new trucks.

He maintained that the tax has long since outlived its purpose. “A century-old [tax], created in World War I, just after the Titanic sank, to fund World War I trench warfare — it’s the only of that era that still exists. And it’s costing $25,000 a tractor,” Spear said Feb. 27.

He noted that freight connectivity and environmental benefits could spring from undoing the 12% tax on new truck and trailer purchases, as motor carriers could invest the savings in newer technologies for their trucks.

At American Trucking Associations’ Moving & Storage Conference Annual Meeting in Orlando, ATA President Chris Spear calls for repeal excise tax on new trucks: "If you want to put the newest, safest, most environmentally friendly equipment on the roads, get rid of this tax” pic.twitter.com/myEO8211sD — Eugene Mulero (@eugenemulero) February 27, 2023

“This is crazy, folks,” he said. “If you want to put the newest, safest, most environmentally friendly equipment on the roads, get rid of this tax.”

Over the years, the trucking federation has joined industry stakeholders in urging Congress to act on the tax. Cleaner or alternative-fuel vehicles are looked to for meeting regulations and mandates from government agencies on emissions reduction as well as decarbonization, but tend to cost more than diesel-fueled trucks.

At a February congressional hearing, Spear reminded lawmakers of the industry’s long-standing critique of the tax. “Mandates for emissions reduction and decarbonization will require the widespread deployment of new, cleaner or alternative-fuel vehicles that are significantly more expensive, and which are not yet widely available. The antiquated federal excise tax on heavy-duty vehicles, created by Congress to fund America’s participation in World War I, adds an additional 12% to the cost of every new truck,” Spear said in a statement to the Senate Environment and Public Works Committee Feb. 15. “If Congress is serious about reducing emissions from trucking and the supply chain, then the first step is to remove this onerous tax and immediately make new, clean equipment more affordable.”

During the last session of Congress, policymakers of the House and Senate transportation and infrastructure panels unveiled measures that would have repealed the 12% tax on new trucks and trailers. However, the legislation stopped short of reaching the president’s desk due to lack of support.

Want more news? Listen to today's daily briefing above or go here for more info

Opponents of the federal excise tax continue to note it is considered among the highest on any product. “Our tax policy is one of the most effective ways Congress can encourage cleaner and greener technology. The current federal excise tax has become a barrier to the progress,” Sen. Ben Cardin (D-Md.), a member of the committee on highway policy, said during his bill’s introduction in the previous Congress. The Modern, Clean and Safe Trucks Act of 2021 had gained bipartisan support.

Cardin went on, “I am proud to support Maryland manufacturers in their efforts to innovate and deploy cleaner and safer technologies in our trucking industry. Our legislation will spur growth and competitiveness while making our roads safer and less polluted.”

&uuid=(email))