Senior Reporter

April Class 8 Sales Lift All Truck Makers

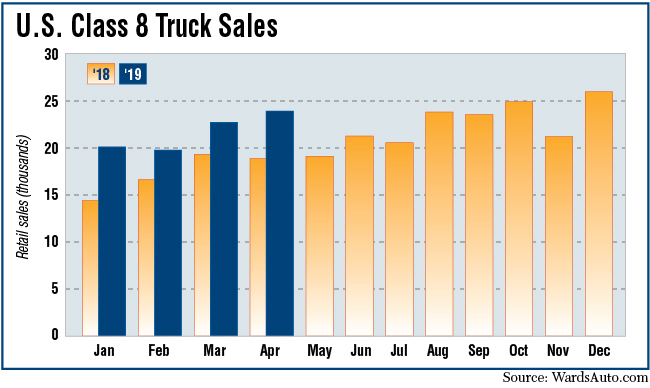

U.S. retail sales of Class 8 trucks in April continued to climb and were the highest of the year, edging past 24,000, WardsAuto.com reported May 10.

Sales rose 26.8% to 24,024 compared with 18,950 a year earlier.

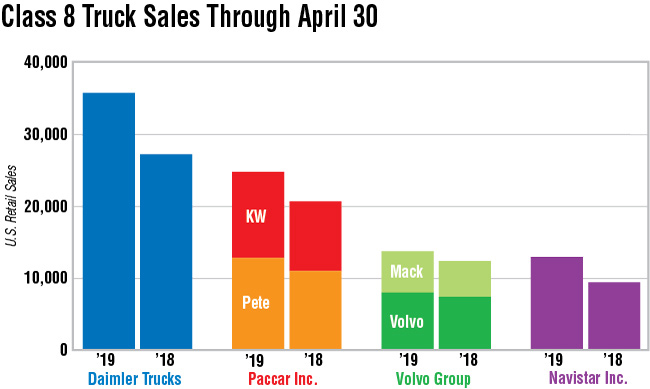

Year-to-date sales climbed 25.1% to 86,908, according to Ward’s.

ACT Research is expecting a 4% increase in Class 8 sales in 2019 compared with 2018, Vice President Steve Tam said. “Things will slow, we presume.”

In the meantime, all truck makers posted double-digit gains in April.

“Truck makers are still building a lot of trucks. You have to have strong sales to keep inventories from going up,” said Don Ake, vice president of commercial vehicles for FTR. “Now, inventories did go up in March [as reported in April], but they are still pretty well matched with the sales. The market looks like it is operating normally, but at a very high rate of demand.”

He added the backlog has dropped by 35,000 trucks since December but remains “huge” at about 256,000.

April’s Class 8 sales, seasonally adjusted, were at an annual rate of 296,217. That implies linehaul capacity, in particular, continues to expand faster than freight volumes, “resulting in a downward trend in fleet-capacity utilization,” said Chris Brady, principal at Commercial Motor Vehicle Consulting.

But that has not resulted in large adjustments to fleets’ truck investment plans in the near term, he said.

“Fleet-capacity utilization began to trend downward from very high levels, and fleets have put a lot of energy and money in driver recruitment and retention programs that are paying off.”

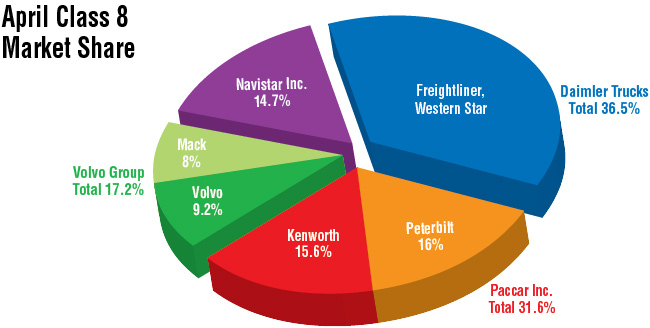

Freightliner, a brand of Daimler Trucks North America, claimed the leading market share, 34.2%, on sales of 8,209 trucks, up 28.3% compared with a year earlier.

Western Star, also a DTNA brand, earned a 2.3% share on sales of 558 trucks, or 11.4% more compared with April 2018.

“We’re focused on developing next-level safety and efficiency with new advanced technologies, while making no compromises on our core competencies,” said Richard Howard, DTNA’s senior vice president of sales and marketing. “We look forward to continuing to deliver electric vehicles to our Freightliner Electric Innovation Fleet partners in the coming months, and we’re working diligently to prepare for the first deliveries of the Freightliner Cascadia with Detroit Assurance 5.0 in the fall.

DTNA relies on listening to customers, co-creating with them and using innovative working models to deliver the best trucks for their businesses, he said.

Mack Trucks showed the greatest year-over-year improvement, soaring 62.8% to 1,924 units, earning an 8% share.

“We anticipated a positive 2019 both for the trucking industry in general as well as Mack in particular, and April’s retail sales figures continue to bear that out,” said John Walsh, Mack Trucks vice president of marketing. “Thanks to a substantial order backlog and a steady overall economy helping keep retail sales strong, we expect this trend to continue throughout the year.”

Mack is a unit of Volvo Group, as is Volvo Trucks North America.

VTNA notched sales of 2,199, a 13.2% improvement compared with a year earlier, and good for a 9.2% share.

“The North American Class 8 truck market remains strong, and the demand for the Volvo VNR, VNL and VNX series continues to drive our positive performance,” VTNA Vice President of Marketing Magnus Koeck said.

Active safety technology and connectivity systems for remote diagnostics and over-the-air remote programing are increasing safety and uptime for VTNA’s customers, he said.

“The driver shortage is also increasing interest in the premium comfort and productivity features in our truck models,” Koeck said.

“Business is there,” said Jarit Cornelius, vice president, asset maintenance and compliance, at Sharp Transport Inc., which operates 135 Class 8s for dry van and flatbed hauls. “There’s just a lot of variables. What’s your capacity? How much freight do you accept or pass on? It all goes back to the driver pool. How consistent can you be with bringing on X number of drivers per month to be able to look at that magic 8 ball as far as what your capacity is going to be later. That has a lot to do with what kind of new business you go after on what lanes.”

In July, Sharp took delivery of 20 LT model trucks from International as replacements. It has no plans to buy more this year, but did expand its fleet with used trucks when it added a flatbed division in 2018.

International, a brand of Navistar Inc., sold 3,537 units, up 25.2% compared with a year earlier, which earned it a 14.7% share.

Peterbilt Motors Co. earned a 16% share on 3,842 sales, up 23.3% compared with a year earlier.

Kenworth Truck Co. had sales of 3,755, earning a 15.6% share, as sales rose 25.9% compared with April of last year.

Peterbilt and Kenworth are the North American brands of Paccar Inc., which noted it is selling every one of its MX engines it can produce.

“We need additional capacity in our factories, and we need the additional capacity with our suppliers,” Paccar CEO Ron Armstrong said in a first-quarter earnings call.

In related news, a Paccar spokesman declined to comment on “rumors” it was discussing the sale of its European truck brand, DAF.

One analyst thought such a sale was unlikely.

“I doubt Paccar would sell its DAF brand given its importance to Paccar’s position as a leading global truck manufacturer. Paccar is better able to leverage its R&D and sourcing with the DAF business as part of Paccar. Additionally, Paccar continues to gain market share in Europe, so I do not think the company will want to walk away from the success it has had in the region,” said Neil Frohnapple with The Buckingham Research Group.