App-Enabled Freight Platforms Help Small Carriers Find Loads, Boost Efficiency

Large fleets typically have been the first to benefit from the spread of technology in trucking, but digital freight brokers are working to extend some of the same advantages to smaller carriers and independent drivers.

Companies such as Convoy, Uber Freight and Transfix have introduced app-based freight platforms designed to make it easier and faster for small carriers to find and book loads and handle much of their business on their smartphones.

These digital freight networks still are relatively new to the industry, but they have attracted significant support from investors.

Armstrong & Associates estimates that freight load-matching startups have drawn about $455 million in funding since 2011, said Haley O’Donnell, an analyst at the research firm.

The investment comes at a time when small carriers and owner-operators are in high demand as the transportation industry contends with tight freight capacity.

“They have a lot of leverage right now. I think digital freight-matching companies are taking note and really trying to cater to a solid, consistent driver base,” O’Donnell said, adding that the technology can streamline communication and drivers can benefit from quick, intuitive, user-friendly interfaces. “The companies that have been listening to drivers and testing out driver-friendly services are on the right track.”

Bob Chappuis, senior operations manager for Uber Freight, said that as the market tightens, connecting shippers with drivers becomes even more valuable.

“We’re building a liquid marketplace where a driver can push a button and they’re on the load,” he said, adding that drivers utilizing a load board may have to make five to 10 calls before securing a load.

Uber Freight also provides drivers with upfront information on a load’s rate.

“Most brokerage firms would refuse to provide a known or transparent rate to the driver,” Chappuis said, adding that Uber Freight sets the price for a load based on supply dynamics.

Amir Shaw, an owner-operator based in Cameron, Texas, started using Uber Freight about a year ago and now uses it to book 90% of his loads.

“I like that the app is 24 hours,” Shaw said. “We don’t want to not be able to make money on a Saturday or Sunday because the broker isn’t answering the phone.”

Digital freight brokers such as Uber Freight have designed their technology primarily for small carriers and owner-operators. (Uber Freight)

Shaw said he appreciates the upfront information the app provides, as opposed to negotiating with a broker for freight listed on a load board.

“The broker wants you to call him, and his job is to get you to move that load for the least amount of money,” he said. “That means you’re leaving money on the table.”

Besides rates, freight-matching apps typically provide detailed information on each load.

“Before I book a load, I know what the load is and if it’s loaded on a pallet or if it is floor-loaded,” Shaw said of Uber Freight. “Knowing the information gives you an opportunity to look at a load on a case-by-case basis and know if it is a good load or a bad load.”

Uber Freight aims to pay drivers in less than seven days with no fee. Chappuis said carriers and brokers can take 30 to 50 days to pay drivers.

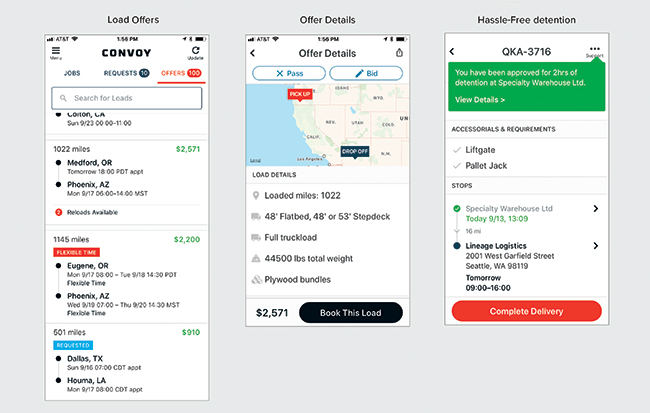

Convoy, another digital freight broker, also calculates the price of a load based on the shipment and industry conditions, said Kristen Forecki, vice president of carrier engagement for the company.

“We are able to take less than a traditional broker because so much of it is automated,” she said, adding that the app provides information on pickup and drop-off locations, weight, commodity and carrier-specific instructions about the shipment.

Once drivers deliver a load and upload the information in the Convoy app, the company submits information to the driver’s bank account in one business day, Forecki said.

Convoy can help drivers reduce deadhead miles and increase efficiency, she added.

“It lets them know as they are taking a load, what other freight will be available,” Forecki said. “It makes it easier to plan and make sure they’re using their truck really efficiently.”

Ira Lawrence, owner of Lawrence Express Lines in Oak Harbor, Wash., has used Convoy to book loads since obtaining his commercial driver license in 2017.

Lawrence said the app enables him to keep a higher percentage of the revenue on a load compared with a traditional broker or load board, plus he gets paid faster.

“Convoy doesn’t take as much, and they pay a lot more than anybody else does out there,” he said.

If drivers are interested in a load but need a higher price, they can enter that request into the Convoy app.

Convoy's mobile app enables drivers to browse and examine available loads and automates detention pay. (Convoy)

“Sometimes you get it, and sometimes you don’t,” Lawrence said.

Transfix, another digital freight broker, has designed its app to create a better experience for shippers and drivers, CEO Drew McElroy said.

The app also allows smaller companies to take advantage of a much larger pool of freight to better utilize their equipment.

“The more density we ourselves have, the more value we can deliver to the people in our ecosystem,” McElroy said. “Our system is looking at available trucks and loads, and providing matches in aggregate.”

McElroy said Transfix is focusing on independent owner-operators and fleets with 50 trucks or fewer.

“Small companies have trouble with scale,” he said. “Ultimately, what we’re creating is a fully transparent commodity marketplace where everybody can play.”

Through Transfix, drivers can receive load offers through their phone or their dispatcher’s phone or e-mail.

“They can see where they are picking up, where it is going and what it pays. If the driver or dispatcher chooses to accept a load, it takes a touch of a button,” McElroy said, adding that directions, track and trace functions and paperwork are automated. “We invoice ourselves on the driver’s behalf and pay them in 48 hours.”

Despite the benefits, some developers of app-enabled freight networks have struggled.

In our fourth episode of RoadSigns, we ask: What does trucking's rush toward blockchain mean for an industry that relies so much on trust among business partners? Hear a snippet from Ken Craig, vice president of special projects for McLeod Software and co-founder of the Blockchain in Transport Alliance (BiTA), and get the full program by going to RoadSigns.TTNews.com.

“Cargomatic almost went bankrupt. Having a lot of smart people doesn’t build a business model,” said Satish Jindel, president of SJ Consulting Group.

Cargomatic, which recently received an additional $35 million in funding, didn’t return calls seeking comment.

“From my perspective, there is an unjustified craze by investors to put money into companies that label themselves or get viewed by others as Uber for freight,” Jindel said.“There is definitely an opportunity in the market to leverage the smartphone technology to enhance business processes that are required to connect the guy with capacity to the guy with the demand, but that doesn’t mean that someone can just build a business by having a smartphone.”

Armstrong & Associates’ O’Donnell said several barriers have kept the early players from completely disrupting the market.

“There are equipment breakdowns. Shipments can be immensely valuable and time-sensitive,” she said. “Brokers offer numerous services to address this. Stand-alone apps don’t.”

What’s more, direct freight-matching companies need ample and consistent demand and supply to work well, plus there are several parameters these companies have to consider, such as the type of equipment, weight, accessorials and hazardous materials, O’Donnell said. “This dilutes the density of available loads.”

However, new technologies don’t necessarily need to disrupt to succeed.

“Instead, digital freight-matching principles that have been tried and tested in the past few years can enhance traditional brokerage and carrier operations,” O’Donnell said.

There is massive opportunity for the application of technology in the trucking and logistics industry, but “it’s not going to simply be a stand-alone app where shippers and carriers post and accept loads, at least not anytime soon,” she said.

Larger, more traditional freight brokers also have been leveraging new technology to improve transportation efficiency.

C.H. Robinson offers Navisphere, which combines digital transactions, digital connectivity and web and mobile technologies, said Mike Neill, the company’s chief technology officer.

“Carriers can find and accept loads, book loads, set up tracking for themselves or a driver, scan the paperwork and monitor the payment,” Neill said. “It is a self-service model for those who want a more streamlined process.”

Navisphere handles more than 11 million total truckload, less-than-truckload and intermodal shipments within C.H. Robinson’s North American surface transportation division each year, and half of the shipments on the platform are fully automated.

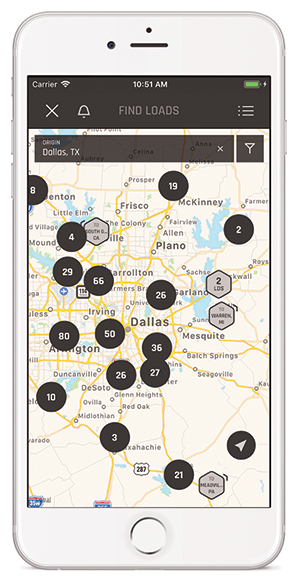

Through Navisphere, owner-operators and dispatchers can find loads that are a match based on position or future location. The technology also can provide tracking and help streamline paperwork.

Although the entire process can be done without the need to talk to a person, Navisphere also pushes information to internal capacity representatives who facilitate carrier load matches and also leverage patterns to help align loads.

Neill said this mix of technology, data science and C.H. Robinson’s expertise and relationships separate the company from pure technology players.

C.H. Robinson's Navisphere mobile app is designed to help drivers and carriers stay connected to booked and available loads. (C.H. Robinson Worldwide)

He added that there are many variables that can unexpectedly disrupt the delivery process, so it is essential to have a support system in place so carriers can connect with people who are experts when they need it.

C.H. Robinson, based in Eden Prairie, Minn., ranks No. 4 on the Transport Topics Top 50 list of the largest logistics firms in North America.

Other players have introduced their own digital freight networks.

Trucker Path offers Truckloads, an app that connects drivers to freight via brokers that establish the rate and post the loads. Truckloads differs from a traditional load board in that there is no monthly fee.

“The greatest benefit is the quality of the freight that is posted on Truckloads,” said Chris Oliver, chief business officer for Trucker Path.

Carriers can use Truckloads to search for loads by location and sort them by best rate, time posted and distance. Drivers also can activate truck tracking, which allows a broker or shipper to track their load from point A to point B.

“Technology advances have allowed a carrier to run his or her business out of the cab of their truck,” Oliver said. “With a smartphone or tablet and maybe a printer, a carrier can run a very successful and profitable business right from the truck.” ³