Staff Reporter

October Medium-Duty Sales Post First Decline Since March

[Stay on top of transportation news: Get TTNews in your inbox.]

U.S. retail sales for medium-duty trucks declined 4.2% year-over-year in October, ending six consecutive months of year-over-year increases, according to data from Wards Intelligence.

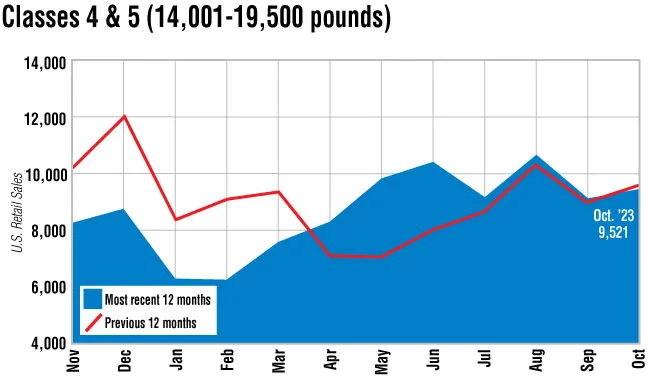

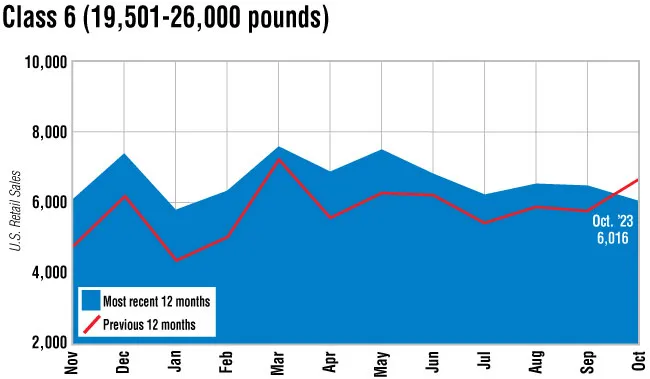

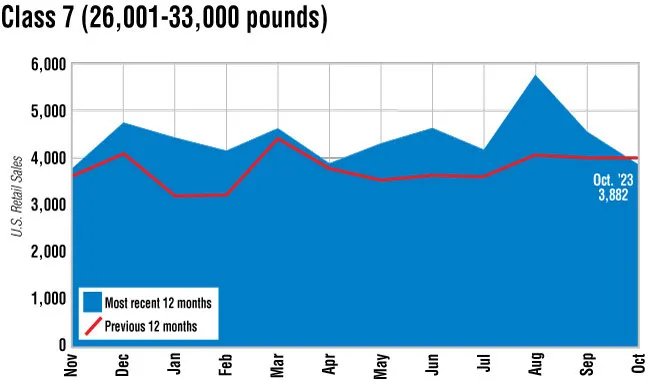

Classes 4-7 saw total retail truck sales decrease to 19,419 from 20,261 units, the first year-over-year decline in medium-duty sales since March. The latest results were also 3.9% lower sequentially from the 20,216 units sold in September.

“Both Class 4 and 5 actually increased this month, at least sequentially, to the detriment of 6 and 7,” said ACT Research Vice President Steve Tam. “If my hypothesis is right, we could see a pullback and we could see it as soon as the November sales activity.”

Tam said truck manufacturers continue to favor heavier trucks over lighter models, a trend that began amid parts and labor shortages in recent years that compelled them to carefully allocate scarce resources. That tended to mean prioritizing heavier trucks since they’re generally more profitable per unit.

“We really haven’t made a whole lot of progress,” Tam said. “In fact, my guess is, when we get the midmonth numbers for October [shortly], we’ll probably see backlogs moving the wrong direction in the medium-duty space, which means we’re going to have a greater percentage of unfulfilled demand on the medium-duty side.”

Every class saw a decline in sales from the prior-year period. Class 6 experienced the biggest percentage drop at 9.9%, to 6,016 from 6,678 units. Class 7 showed a 1.9% decline to 3,882 from 3,958 units. And despite the sequential gains compared with September, Classes 4-5 collectively saw sales decrease 1.1% year-over-year to 9,521 from 9,625 units.

Tam noted that an employee strike launched in October against Mack Trucks by workers represented by the United Auto Workers may have shifted some market dynamics.

“We’ve got some plants that are in there that were affected by the UAW strike,” he said. “While sales, per se, weren’t a direct target, production would be. I wonder if there might have been folks who were concerned that the strike was going to linger on, and so maybe they pulled up their purchases a little bit to try to make sure that they got the units that they wanted.”

Union members on Oct. 8 voted against ratification of a five-year collective bargaining agreement, and resumed strikes at several plants the next day. Tam called the situation disconcerting. A second round of voting was set for Nov. 15-16.

Freightliner, a brand of Daimler Truck North America, sold the most Class 7 trucks in October at 1,636 units. Ford sold the most in Class 6 at 1,547, as well as Class 5 at 3,161 units. Isuzu sold the most in the Class 4 category at 1,088 units.

“Even ahead of the strike, we were still running at nearly twice our normal backlogs in the Classes 5 to 7 space, whereas on the Class 8 side, tractors pretty much have fulfilled demand. Vocational trucks are still a little bit behind,” Tam said. “So, on balance, Class 8 is maybe 10% higher than its traditional backlog. Not anywhere near the double factor that we see on medium duty.”

Want more news? Listen to today's daily briefing below or go here for more info: