Staff Reporter

Medium-Duty Truck Sales Rise 28.6% in May

[Stay on top of transportation news: Get TTNews in your inbox.]

U.S. retail sales for medium-duty trucks grew 28.6% in May compared with the year-ago period, according to data from Wards Intelligence.

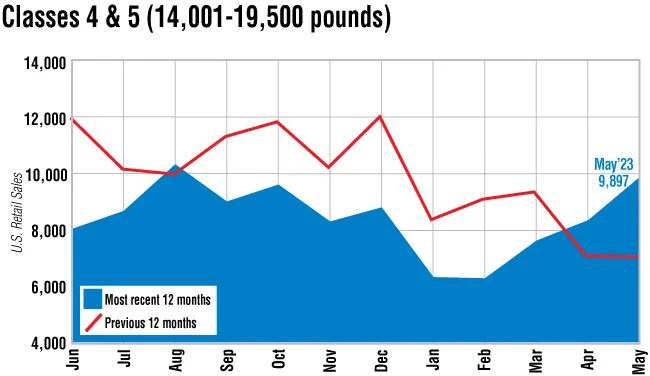

Total retail sales for Classes 4-7 trucks increased to 21,687 from 16,859. The results represent the second consecutive month showing a gain from the prior year. The only other year-over-year increase this year was in January. The only increase last year occurred in August. The latest results also were up 13.6% sequentially, with 19,098 units sold in April.

“It’s been interesting to see the differences between the different classes,” said ACT Research Vice President Steve Tam. “Class 5 for a while was just really getting kicked in the teeth, and here in the last two or three months it’s sort of resurfaced as a powerhouse.”

Tam suspects the change has to do with how the truck manufacturers are allocating scarce resources to maximize profit per unit. The bigger classes of trucks tend to be more profitable. But there has been growing demand among the lower classes as some carriers have sought to gain vehicles that don’t require a commercial driver license.

ACT Research Vice President Steve Tam. (ACT Research)

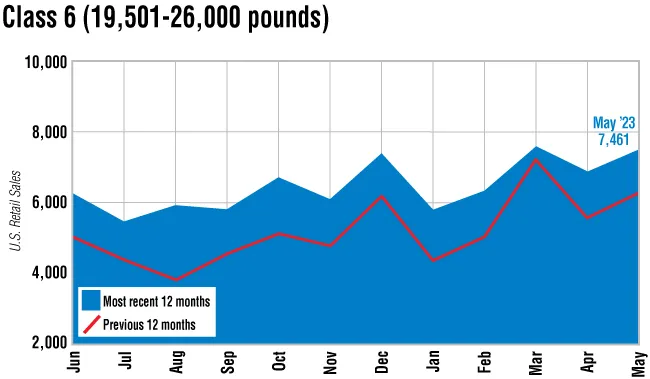

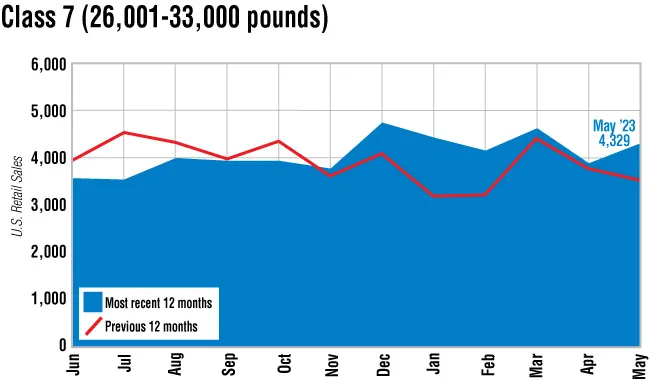

“You got some very solid demand in that 6 and 7 market,” Tam said. “The private fleets and the lease rental customers in that space that typically use that equipment are in exactly the same situation as a lot of the Class 8 fleets are. Not only have they had to extend trade cycles, but supplying capacity to those customers who couldn’t get it directly from the OEMs themselves. They’ve really consumed this equipment so they’re, I wouldn’t say desperate to get it replaced, but maybe verging on desperation.”

Every class saw an increase in sales from the prior-year period. Class 7 experienced a 24.1% gain to 4,329 units from 3,489. Class 6 reported an 18.6% increase to 7,461 units from 6,293. Classes 4-5 collectively experienced the biggest year-over-year increase at 39.8% to 9,897 units from 7,077.

“The medium-duty market tends to cycle at the same times as the heavy-duty market,” Tam said. “Though the volatility is not nearly as great, it’s just that diversification that you’ve got among all the different varied end markets that the medium-duty plays in; not only on the goods side, but also on the services side. So, as we’ve got pretty decent consumer activity in those spaces, we’re seeing, again, some pretty solid demand.”

Freightliner, a brand of Daimler Truck North America, sold the most in Class 7 at 1,987 units. Ford sold the most in Class 6 at 2,368, as well as in Class 5 at 4,270. Isuzu led the pack in Class 4 with 958 units sold.

“I was just looking earlier today at where the backlogs actually sit and, relative to history, the Class 8 backlog is about 1.5 times its normal level, where on the medium-duty side it’s like 2.2 times its normal,” Tam said. “So, a lot more pent-up demand in the medium space because of that preference, or deference, for the higher profit vehicles.”

Want more news? Listen to today's daily briefing below or go here for more info: