Drivers Would Pay Tax on Miles Traveled Under Lawmaker’s Plan

Drivers could pay a tax based on how many miles their vehicles travel under a plan being pushed by Missouri Rep. Sam Graves, who’s vying to become the powerful new chairman of the House Transportation Committee.

While exact plans for such a tax remain vague, the fees could be calculated based on odometer checks, GPS devices, cellular technology or radio-frequency identification devices that would track how far a vehicle travels and charge drivers accordingly.

Graves, (R-Mo.), is promoting the per-mile tax as an alternative to raising the gasoline tax, a long-discussed way of providing more money for highway construction and repair.

RELATED: Business groups say time is now to increase gas tax for roads

RELATED: Anchorage’s first-ever tax on gas and diesel fuel takes effect

Some states have been experimenting with a tax on miles traveled. A four-month pilot program last year in Colorado included 150 participants from 27 counties. The program let drivers choose how they reported their mileage and compare what they paid to the gas tax.

“Participants reported high satisfaction with all aspects of the pilot program and 91% said they would participate in a future pilot,” according Michael Lewis, executive director of the Colorado Department of Transportation.

Lewis cautioned lawmakers, however, that the miles traveled tax is “probably 10 years off before it can be fully implemented.”

Currently, drivers across the country pay an 18.4 cent-per-gallon federal gas tax that is not indexed for inflation and has not been increased for 25 years.

Missouri Rep. Sam Graves ( Andrew Harrer/Bloomberg News)

Over the years, anti-tax attitudes among conservatives have hardened, and Republicans who vote for higher taxes often find themselves with primary opposition.

But most in Congress agree money is badly needed to fix the nation’s ailing, aging infrastructure. Without additional revenue sources, the federal government’s Highway Trust Fund will see a shortfall of $80 billion by 2026, according to the nonpartisan Congressional Budget Office.

Graves is so pessimistic about Congress raising the gas tax to fund the nation’s highways that he likened colleagues’ efforts to do so to “beating our heads against the wall.”

“There are a lot of members out there who are just philosophically opposed to increasing the tax,” Graves told reporters on March 7. “That’s all there is to it.”

RELATED: Spend gas tax money ASAP, new Caltrans leader says of directive from California Gov. Jerry Brown

RELATED: Conservative Koch-backed groups ramp up pressure on Texas GOPers to oppose gas tax hike

Plus, he pointed out, the gas tax will bring in less revenue over the years as more drivers turn to fuel-efficient or alternatively fueled vehicles such as electric cars.

That’s why Graves said he’s “a believer” in implementing a fee on vehicle miles traveled, or VMT, as a long-term solution.

“We could implement it in the commercial sector almost immediately,” he said. “In the commercial sector they’re already logging in miles … It might be a little farther away in the private sector, and that comes with acceptance and the technology.”

He doesn’t buy critics’ arguments that such a tax would penalize drivers in rural areas.

“They’re already driving farther so they already have to pay more gas tax than somebody who is driving, you know, two miles across town,” Graves said. “Equity is already built into that argument so that doesn’t necessarily worry me.”

Graves’ embrace of the tax on miles traveled separates him from the current chairman of the House Transportation Committee, Bill Shuster, (R-Pa.), who March 7 called on President Donald Trump to back a gas tax increase.

“I, for one, think it’s time to do it,” said Shuster, who is retiring this year.

The U.S. Chamber of Commerce has proposed raising the gas tax by 25 cents per gallon, a plan the group says would raise $394 billion for infrastructure investments over the next decade.

Ed Mortimer, the chamber’s executive director, said he’s open to other alternatives, but said the federal government is far from being able to implement a tax on drivers based on miles traveled.

“Our view is we can’t wait for some other funding mechanism to come out of the woodwork,” Mortimer said. “We need to raise revenue this year, and in our view, the only one that is ready to go that we know works is the fuel tax.”

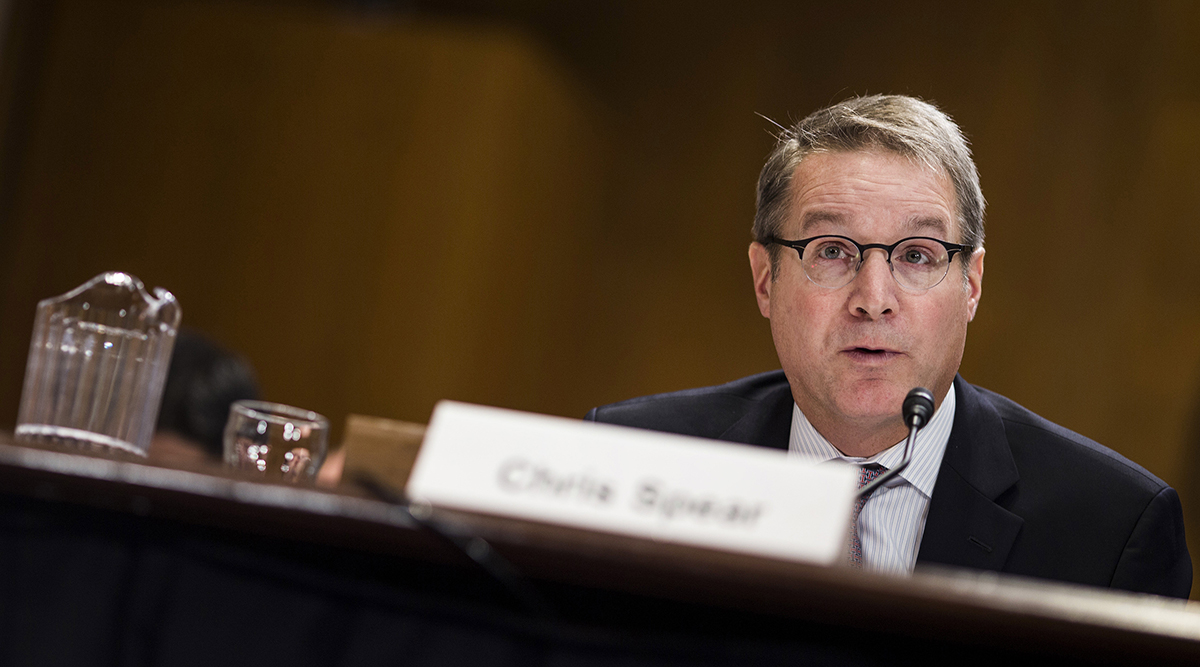

Chris Spear, President and CEO, American Trucking Associations (Zach Gibson/Bloomberg News)

Chris Spear, president and CEO of American Trucking Associations, said it’s unclear why a known user fee — the gas tax — would be less politically feasible than the miles traveled tax, an untested fee with significant privacy concerns.

Spear said the trucking industry is still years away from a feasible program to charge drivers based on miles traveled.

It isn’t clear that Republican members of the House would be any more likely to support a new tax on miles traveled than they would be to increase an old one on fuel.

Graves thinks they might. He said March 7 that Speaker Paul Ryan, (R-Wis.), “likes the idea” of a miles traveled fee. Ryan’s office did not immediately respond to request for comment.

Conservative groups that have lobbied hard against the gas tax hike signaled March 7 that they aren’t likely to support an entirely new tax in its place.

“Lawmakers can, and should, focus on smarter spending and breaking down burdensome regulatory barriers that delay projects and drive up costs, rather than turning back to hardworking taxpayers to further bear the cost of their own inefficient spending,” said Nathan Nascimento, vice president of Freedom Partners, a conservative nonprofit.

Distributed by Tribune Content Agency, LLC