Staff Reporter

Diesel Price Drops 9.5¢ to $4.498 a Gallon

[Stay on top of transportation news: Get TTNews in your inbox.]

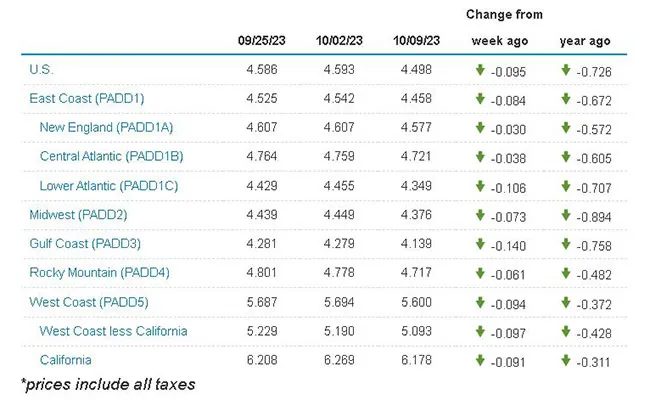

The national average diesel price swung back down after last week’s mild uptick, shedding 9.5 cents to reach $4.498 a gallon, according to Energy Information Administration data Oct. 9.

The average diesel price dropped for the second in time three weeks. The previous decrease was 4.7 cents Sept. 25, which was followed by an increase of seven-tenths of a cent. The price of diesel previously had risen each week since July 24, totaling 82.7 cents.

A gallon of trucking’s main fuel now costs 72.6 cents a gallon less than it did at this time in 2022.

The EIA reported that the price of diesel dropped in each of the 10 regions in its weekly survey. The Gulf Coast experienced the biggest drop at 14 cents to $4.139. New England reported the smallest decrease at 3 cents to 4.577.

The average cost of a gallon of gasoline fell 11.4 cents to $3.684, which is 22.8 cents less than at this time a year ago.

U.S. On-Highway Diesel Fuel Prices

“To understand fuel prices, you’ve got to understand crude oil prices,” Murray Mullen, chairman and president at Mullen Group, told Transport Topics. “Anybody that thinks they know where the price of crude oil is going to be is a fool. It’s beyond complicated. I don’t know which direction it goes, but I think it’s evident that fuel prices will follow crude oil prices.”

Mullen believes that crude oil inventories and prices could remain high. But he added that where prices actually end up will be dependent upon the strength of the economy and demand. He noted that there is a lot of emphasis on alternative fuels like battery-electric vehicles, but that transition will be slow, so demand for crude oil and its derivatives like diesel will stay.

Mullen

“We’re going to have crude oil for a bit,” Mullen said. “Demand is still pretty strong. And regardless of whether North America wants to move away from crude oil, in California or whatever, India and China are not. So, on balance, I would tell you I’m running this company as if crude oil prices will probably bump up. They’re not going to go down to zero. It’ll fluctuate depending upon economic activity.”

Mullen pointed out that the U.S. government used a lot of its Strategic Petroleum Reserve to control prices and help with inflation. But he warned that has made the country vulnerable in case something were to happen that disrupts the markets, such as what’s happening in the Middle East.

Mullen Group ranks No. 37 on the Transport Topics Top 100 list of the largest for-hire carriers in North America and No. 87 on the TT Logistics 100.

U.S. average retail prices for October 9, 2023:

⛽️ Regular grade #gasoline: $3.68/gallon

⛽️ On-highway #diesel: $4.50/gallon #gasprices https://t.co/dsfxiPA8Wj — EIA (@EIAgov) October 10, 2023

“I think we’re going to be very volatile on prices,” said Phil Flynn, senior energy analyst at The Price Futures Group. “We saw a big spike up because of the Hamas attack on Israel.”

Flynn is cautiously optimistic that the markets will see a pullback in diesel prices following another spike. But he added how things play out by the end of the year is going to depend on global conflicts and the weather.

“My big concern with California is there’s a lot of discourse going on, particularly the governor, where he’s claiming that it’s all profiteering by the oil companies,” said Jim Gillis, president of Pacific Drayage Services, a subsidiary of the IMC Cos. “I’m not saying that that’s not true. What worries me, though, is that if you look at what we paid [recently] in Long Beach, my supplier price was $4.50 per gallon. And then they added on $2.02, essentially for taxes and fees.”

Trimble CEO Rob Painter discusses the company’s continued investment in the freight transportation industry and its vision for a more connected supply chain. Tune in above or by going to RoadSigns.ttnews.com.

California remained the most expensive state for diesel in the latest weekly survey after experiencing a decline of 9.1 cents to $6.178 a gallon. Gillis believes it’s disingenuous for state leaders to say that this is an oil manufacturer problem when much of it is the taxes and fees.

“There’s been some calls by the Republican legislatures out here to put a moratorium on tax, and honestly, I just think that they need to look at something like that,” Gillis said. “Our fuel costs are passed on to the consumer, but to me, that’s an inflationary risk. But the bigger worry I have are the smaller trucking companies that are already being forced out of business due to the AB 5 regulations that are now in effect and then the [Advanced Clean Fleets Regulation].”

IMC Cos. ranks No. 40 on the for-hire TT 100.

Want more news? Listen to today's daily briefing below or go here for more info: