Diesel Issues Could Worsen Due to Lack of Crude From OPEC+

[Stay on top of transportation news: Get TTNews in your inbox.]

The diesel market is pricing in a crisis, one that soon could get even worse because of a lack of the type of crude that’s good for making the fuel.

Output curbs from countries including Saudi Arabia and Russia are limiting supply of medium and heavy crudes and pushing refiners toward using others. That’s helping to cut production of diesel fuels — which include heating oil — in an already tight market as winter approaches.

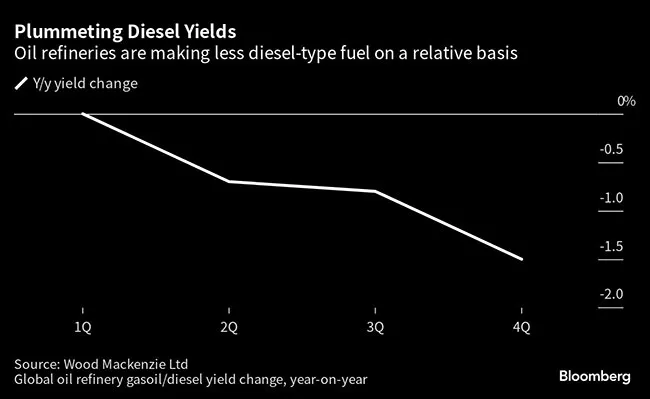

With refiners using different crudes, Wood Mackenzie Ltd. expects the proportion, or yield, of diesel they make to drop 1.5% next quarter from a year earlier. That equals a loss of 1.2 million barrels a day — roughly the combined output of Germany and the U.K. — something that higher overall processing rates won’t fully compensate for.

The diesel market has been flashing signs of scarcity for months, with the fuel’s price relative to crude well above seasonal norms in northwest Europe, the U.S. and Asia, according to fair value data compiled by Bloomberg. Lower refining yields have been an important bullish factor, with supply also curbed by plant outages.

Just as OPEC+ cuts have spurred refiners to process crude with a lower density — resulting in proportionally less output of diesel-type fuel — plants have also been focusing production on other products, said Mark Williams, a research director at London-based Woodmac.

For example, more demand for jet fuel during the summer has been a major driver of lower diesel yields. A tight Atlantic basin gasoline market also pushed output toward that product.

Want more news? Listen to today's daily briefing above or go here for more info

The predicted fourth-quarter drop in diesel yield is particularly steep because it’s a time of year when plants typically raise their relative output of the fuel to meet winter heating demand. That will be harder to do this year due to the OPEC+ crude cuts and a stronger focus on jet fuel output.

While refineries are expected to process an extra 2.4 million barrels a day of crude next quarter compared with a year earlier, that won’t be enough to make up for the hit to diesel supplies from a lower yield, Woodmac says.

Overall, the supply of diesel-type fuel is seen falling by 400,000 barrels a day, an amount larger than France’s total output.