A Year to Forget for Third-Party Logistics Providers

[Stay on top of transportation news: Get TTNews in your inbox.]

Logistics costs and third-party logistics revenues saw extraordinary increases during the 2020-2022 COVID-19 pandemic shutdown and post-shutdown periods. With inventories rebuilt and severe COVID-19 cases waning, demand for 3PL services became more stable and manageable in the second half of 2022. In turn, transportation rates began falling and carrier capacity was normalizing.

The second half of 2022 was highlighted by tightening monetary policy through central banks’ quantitative tightening and increased interest rates to reduce demand and stave off long-term higher structural inflation. These anti-inflationary policies are ongoing. When coupled with deflating transportation rates, the negative impact on logistics costs and 3PL revenues in 2023 was significant.

For the United States, the Federal Open Market Committee has done a commendable job and it looks like it has engineered a “soft landing” with most economists taking a recession off the table. But 2023 generally was a downtrodden year for 3PLs with plummeting transportation rates and shippers focused on right-sizing inventories and reducing logistics costs.

With COVID and ongoing geopolitical risks, 3PL customers realized that supply chains need to be more flexible, and being able to source products and components from multiple countries versus just one is beneficial. A bright spot for 3PLs has been cross-border trade with Mexico, now the largest U.S. trading partner, as companies look to nearshore manufacturing from Asia. This has created opportunities for 3PLs such as Ryder, C.H. Robinson and ProTrans with strong cross-border offerings.

International transportation management (ITM) 3PLs saw rapid declines in air and ocean demand and rates in 2023. Global air cargo freight rates decreased as much as 41% in the second quarter of 2023 versus the prior year. Air cargo capacity and revenues started to recover late last year after 17 months of consecutive decline. ITM has moderately bounced back from the first half of 2023 and has seen some rate benefit from shipping uncertainty in the Red Sea and reduced ocean traffic through the Suez Canal.

Armstrong

Domestic transportation management (DTM) 3PLs became hyperfocused on contractual transportation management business and managed transportation versus spot market freight brokerage as truckload demand waned and rates declined to under the five-year average, causing a freight recession. The impact was widespread and even included last-mile delivery providers, which benefited from strong e-commerce demand during the pandemic shutdowns. Domestic transportation managers will tell you that we are still in a freight recession, but there is muted optimism for good growth in the second half of the year.

For value-added warehousing and distribution (VAWD) 3PLs, inventories have stabilized and some space has freed up even with higher interest rates keeping a lid on new warehouse development. There has been increased focus on fine-tuning warehouse pricing and improved bid performance. Shippers see this as a good time to put out requests for proposal and work to mutualize some of the one-sided agreements entered into during the post-shutdown demand surge.

VAWD has seen increased automation and use of technology. This has included robots supporting humans for picking, automated storage and retrieval system cranes for picking and putaway, and increased use of conveyance in e-commerce operations. Regulatory compliance around product serialization for health care and food-safety certification are being worked out. Overall, VAWD 3PLs with strong customer verticalization strategies, operational excellence cultures, integrated warehousing and transportation management skills, and longer-term customer agreements have been winning out versus undifferentiated, short-term public warehousing 3PLs.

►Amazon Takes No. 1 Spot on Top 100 List

►When Will Freight Market Conditions Improve?

►Map: Where the Top 100 Are

►Armstrong: A Year to Forget for 3PLs

►Logistics Market Faces Challenges Across Segments

Sector Rankings

Freight Brokerage | Dedicated

Dry Storage Warehousing

Refrigerated Warehousing

Ocean Freight | Airfreight

Dedicated contract carriage (DCC) hung in there due to the contractual nature of its transportation agreements; however, pricing pressure persists. Of note is Ryder System Inc.’s recent acquisition of Cardinal Logistics adding significantly to its network scale and Knight-Swift’s 2023 acquisition of U.S. Xpress.

In all 3PL segments, automation to reduce head counts and increase efficiencies gained further momentum. Strategic growth initiatives to better position 3PLs in a changing environment took on new importance.

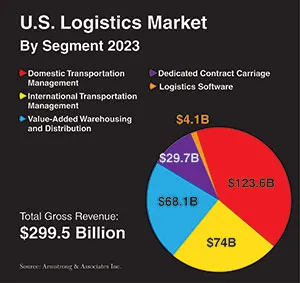

While many 3PLs still are providing us with 2023 financials, Armstrong & Associates’ current estimates show U.S. 3PL market net revenues (gross revenues minus purchased transportation) were down 12.8% to $129 billion and overall gross revenues fell 26.1%, bringing the total U.S. 3PL market to $299.5 billion in 2023. This was a level we haven’t seen since pre-2021, as 2021 saw 48.1% growth — the biggest year-over-year increase since we began developing 3PL market estimates in 1995. The second-best year-over-year growth occurred in 2000 at 22.9%, and 2010 was the third best at 19%.

Value-Added Warehousing And Distribution

Value-added warehousing and distribution was the best performing of the four 3PL market segments in 2023 with a mere 1.6% increase in gross revenue to $68 billion. This was on top of an extremely good 2022 with a gross revenue increase of 22.7%.

For 2023, VAWD also had the highest net revenue increase of all four 3PL segments, up 4.1% to $51.9 billion. By comparison, in 2022 VAWD had the third-highest net revenue growth of the segments with an increase of 21.1% to $49.8 billion. Most VAWD 3PLs had full warehouses in 2022 and during the first quarter of 2023 were scrambling to find more. Total U.S. warehousing inventory space increased an estimated 14% from 2021 to 2023 to 12.2 billion square feet. VAWD 3PL space grew 14.2% to 2.7 billion square feet over the same time frame.

A worker prepares orders to be loaded for shipment at a UPS distribution center in Atlanta. (Robin Nelson/Bloomberg News)

Primarily due to strong growth in e-commerce fulfillment, 2021 marked the first year that multiclient warehouse space — at 50.6% of total VAWD warehouse space in the U.S. — exceeded that of dedicated space. E-commerce fulfillment continues to be one of the fastest-growing domestic 3PL subsegments having a compound annual growth rate of 28.5% from 2016 to 2022.

Key value-added services provided in the VAWD segment include kitting, pick and pack, packaging, repair and refurbishment, sequencing and sub-assembly, merge in transit and shipment consolidation.

An ongoing headwind for VAWD 3PLs has been high warehouse labor demand, turnover and ongoing wage increases. This is driving significant interest from VAWD 3PLs to automate warehouses with robots from manufacturers such as Fetch, Locus and 6 River Systems. Many 3PLs invested in robotics last year to improve the efficiency, accuracy and speed of picking. By accessing real-time data and analytics from the cloud, robots can optimize their routes, reduce idle time, reduce human travel time and prioritize tasks based on demand. These autonomous mobile robots use sensors, cameras and mapping software to navigate the warehouse. Robots can be quickly deployed, in some cases as quickly as two weeks. Leasing robots also can offer 3PLs greater flexibility in terms of scaling their operations up or down as demand fluctuates.

In 2023, the VAWD 3PL segment fared better than its transportation management brethren, and even with shippers’ current inventory drawdowns, it will continue to do well given the general lack of warehousing space and growth in e-commerce fulfillment and last-mile delivery. Overall warehouse utilization should normalize with operations seeing increased efficiencies.

A lot of shippers we work with are examining their supply chain networks and providers to improve inventory management and on-time delivery performance.

The most noticeable change to the Transport Topics Top 100 logistics and dry warehousing lists is Amazon.com Inc. being listed for the first time, and at No. 1 no less. It has been left off due to limited visibility between merchandising and third-party logistics operations in its reporting. With an estimated 255 million square feet of 3PL warehousing space in 411 warehouses within North America, it’s the obvious elephant in the room and can no longer be ignored.

An Amazon fulfillment center in Robbinsville, N.J. (Michael Nagle/Bloomberg News)

Although the revenue shown is that of Amazon’s third-party seller services business segment, which includes its 3PL operations as well as commissions and any related fulfillment and shipping fees and other third-party seller services, Armstrong & Associates estimates most of this segment’s revenue is from 3PL services based on its warehousing footprint and e-commerce fulfillment focus. Even at 50% or $70 billion, Amazon still would be the largest 3PL, not only in North America but globally as well with an estimated 360 million square feet of 3PL warehousing space in 710 facilities worldwide.

Those 3PLs within the rest of the top 10 on the dry warehousing list remain fairly unchanged compared with last year except for UniGroup. Although it has 25 million square feet of warehousing space available to it via its agent network, it doesn’t directly own, lease or manage the space, and has therefore been removed.

Dedicated Contract Carriage

The other asset-heavy 3PL market segment, dedicated contract carriage (DCC), once again delivered the second-largest year-over-year net revenue growth of 1.4% to $29.6 billion. In stark contrast, the segment registered 27.4% growth in 2022 to $29.2 billion. Gross revenue ticked up 0.7% to $29.7 billion in 2023 after seeing an increase of 27.7% in 2022 to $29.5 billion.

DCC’s growth benefited from shippers wanting to lock in capacity after a turbulent 2021, an increased ability to attract drivers through wage increases and better recruiting, and having ample capital to invest in equipment. In addition, those 3PLs with freight brokerages that could handle overflow business from DCC operations as dedicated or spot truckload capacity tended to do well.

Traditional DCC contracts have one- to three-year terms with specific trucking assets dedicated to customers. This makes DCC contracts much stickier than standard shipper-carrier trucking contracts and less susceptible to declines in the truckload spot market, so DCC has an advantage when truckload capacity is increasing from softer demand and rates are declining.

DCC trailer types are 80% dry vans, refrigerated account for 11%, flatbeds comprise 5%, and tankers and other trailers tally 2% each. Sixty-four percent of the top 25 DCC providers have both dry vans and reefers; 60% also have flatbeds. More than a third of the top 25 have tankers. Other types of equipment include curtain sides, roller beds, end dumps, drop decks and dry van trailers with lift gates. Customer trailers and containers often are used, especially for retail operations such as Walmart.

J.B. Hunt’s Dedicated Contract Solutions segment had an organic increase of 353 power units and remained at No. 1 in the sector with 13,252 DCC power units total.

Ryder's dedicated contract trucking operations boasts a fleet of 11,700 power units. (Ryder System)

Ryder, bumping up to second place this year with 11,700 DCC power units, has dedicated contract trucking operations within its Dedicated Transportation Services and Supply Chain Solutions segments. Its increase of 2,670 power units over last year includes its February acquisition of dedicated contract carrier and transportation-specialized 3PL, Cardinal Logistics, which placed ninth on last year’s list.

Ryder’s purchase of Cardinal expands the gap between it and rival Penske Logistics to 2,489 power units this year versus the 39-power unit difference last year. However, Penske remains in the top three for the foreseeable future with Schneider remaining at fourth place with a difference of 2,878 power units between the two.

Lazer Logistics, with its reported 2,800 power units in DCC, rounds out the top 10.

Domestic Transportation Management

The non-asset-based domestic transportation management segment came in third in 2023 after leading all other 3PL segments with net revenue growth of 33.8% to $26.4 billion in 2022, while overall gross revenue increased a healthy 14.4% to $159 billion that year.

Although third place sounds pretty good, in 2023, the DTM 3PL market segment’s net revenues fell 25.8% to $19.6 billion and gross revenues decreased 22.3% to $123.6 billion. DTM gross profit margins fell by 0.7% to 15.9% on average.

The true leaders in DTM are those 3PLs with strong carrier management skills that have technologically innovated, allowing them to efficiently tap long-standing carrier relationships to cover shipper demand versus being overreliant on load boards to buy capacity at spot market rates.

The ongoing digitalization of transactional truckload freight brokerage continues at a rapid pace as more 3PLs have built interfaces to large shippers’ transportation management systems for truckload spot market rate quoting and automated load tendering and booking. A couple of dozen 3PLs are using these TMS interfaces to provide shippers with instant spot rate quotes and the ability to complete load tendering and booking systematically. This process automates part of the traditional spot market freight brokerage account management function and is increasing shippers’ use of more spot versus contract pricing.

Account management automation of spot market truckloads is happening in conjunction with the automation of carrier sales (procurement) functions within freight brokers using carrier capacity management systems to digitally match shippers’ loads to carriers based upon historical and real-time carrier capacity data analyzed via artificial intelligence and machine learning algorithms. This digital freight-matching capability has become a competitive differentiator within the DTM segment as these 3PLs look to increase the number of shipments they manage per person per day and revenue per person per year. It also can build carrier loyalty by reutilizing high-performing core carriers at rates that are below the spot market rates offered via load boards.

The top five freight brokers — C.H. Robinson, Total Quality Logistics, WWEX Group, Coyote Logistics and Echo Global Logistics — are some of the 3PLs driving industry automation along with the newer tech-first digital freight brokers such as Uber Freight. At this point, most of the top freight brokers are strategically digitalizing operations to add value through improved carrier management and customer and carrier experiences.

As a continuation from March 2022, the Federal Reserve has made nine rate hikes to curb inflation. In addition, many high-tech companies have laid off employees and contractors. This has led some consumers to spend less and when coupled with shippers striving to draw down warehouse inventories, imports have declined, and truckload rates and demand continued to decline into 2023. This has prompted an increase in shipper procurement events and requests for proposal, which put pressure on DTM gross margins and led to overall DTM margin compression in 2023. Some larger shippers transitioned from annual RFP events to six- and three-month RFP cycles to capitalize on the downward trend in truckload rates. Truckload pricing looks to have bottomed out, and these events have resulted in solidifying lower contractual rates as inventories began to be replenished.

The inclusion of Amazon on this year’s Top 100 Logistics Companies list bumped longtime front-runner C.H. Robinson to second place. However, going down the freight brokerage list, most reported negative revenue trends. Even the top three freight brokers — C.H. Robinson, Total Quality Logistics and WWEX Group — were negatively affected with gross revenue declines of 21.2%, 24.1% and 18%, respectively.

Freight brokers using C.H. Robinson logistics technology. (C.H. Robinson)

Most of the top 10 freight brokers are the same as those in last year’s list, just in different ranks, except for the two largest — C.H. Robinson and TQL. However, the gap between them and the rest of the top 10 continues to narrow.

The DTM 3PL segment is 83% freight brokerage with the remainder being made up by managed transportation services. In 2023, DTM became hyperfocused on contractual transportation management business and managed transportation versus spot market freight brokerage as truckload demand waned and rates declined to under the five-year average, causing a freight recession. The impact was widespread and even included last-mile delivery providers, which benefited from strong e-commerce demand during the pandemic shutdowns.

Looking to 2024, U.S. domestic truckload rates have stabilized to a new lower level, and spot market dry van demand is close to the five-year average; reefer is doing even better. Most industry participants hold muted optimism for good growth in the second half of the year.

International Transportation Management

In 2023, the international transportation management 3PL market segment continued to be the most underwhelming segment as net revenue dropped 34.2% to $28 billion. Gross revenue was nearly cut in half, plummeting 49.3% to $74 billion. It’s hard to believe when just two years ago the ITM market segment realized an unheard of 74.9% gross revenue gain and 44.6% net revenue jump from COVID-driven demand from shippers focused on replenishing inventories to meet strong consumer demand.

Volvo's Chayene de Souza and Magnus Gustafson discuss how new, connected trucks can boost business, enhance safety practices, and reinforce preventative maintenance plans. Tune in above or by going to RoadSigns.ttnews.com.

ITM includes air and ocean freight forwarding, associated inland transportation, shipment consolidation and deconsolidation, customs house brokerage and related warehousing services.

The ITM environment has dramatically changed since mid-2022 with ocean freight rates from Asia to the U.S. trending down to pre-pandemic levels. In the third quarter of 2022, ocean shipping rates and domestic transportation rates began to disinflate in the U.S. as consumer demand moderated and supply chain operations stabilized. China-to-U.S. and European ocean shipping rates have declined as much as 90% since the peak in early 2022.

ITM 3PLs saw rapid declines in air and ocean demand and rates. Global air cargo freight rates decreased as much as 41% in the second quarter of 2023 versus the prior year. Air cargo capacity and revenues started to recover late last year after 17 months of consecutive decline.

However, 2023 saw an increased willingness for ocean carriers to provide contracted capacity and good rates for targeted port-to-port pairs as import growth of furniture, consumer and retail products waned. Generally, outside of current labor disputes, ports are less congested and drayage capacity is readily available. Airfreight demand is down about 10% from 2022, while overall capacity has expanded with increases in passenger airline capacity globally. Airfreight capacity is generally available at lower rates.

ITM has moderately bounced back from the first half of 2023 and has seen some rate benefit from shipping uncertainty in the Red Sea and reduced ocean traffic through the Suez Canal.

In the second half of the year, ITM demand should start rebounding from China once shippers need to replenish inventories. This should stabilize ocean rates from Asia to North America.

Expeditors, the largest U.S.-based ITM 3PL based on revenue, was down 45.6% to $9.3 billion in 2023 revenues. Its freight forwarding volumes are based on the ebbs and flows in tonnage and containers handled as described in its annual report.

C.H. Robinson’s Global Forwarding saw revenue drop 56% to $3 billion, the largest revenue decline among the U.S.-based ITM 3PLs analyzed.

Want more news? Listen to today's daily briefing above or go here for more info

China’s largest 3PL, Sinotrans, saw its ITM revenue decrease 12.6% to $14.3 billion, while volumes were up 10.8% in ocean freight to 4.3 million 20-foot-equivalent units and up 15.5% in airfreight to 902,000 metric tons.

Chinese nonvessel operating common carrier and freight forwarder AWOT Global Logistics followed suit with revenues down 28.7% to $2.6 billion while ocean TEUs grew 2% to 260,000 TEUs and air metric tons jumped 19.2% to 590,000 handled in 2023.

In comparison to the above, the largest air and ocean freight forwarder, Kuehne + Nagel, saw its ocean freight revenues drop 51.8% while volumes declined a slight 1.1%. In airfreight, revenue was down 39.6% but tonnage only fell 11.2%.

Reflected by the change in its reporting, Nippon Express placed sixth with 1.7 million controlled and noncontrolled TEUs reported this year. In either case, Nippon Express sends the bill of lading information to the shipping company, and the shipment is made based on that information. Therefore, it is reporting those combined volumes going forward.

New to both freight forwarding lists this year is CIMC Wetrans Logistics Technology. CIMC is an integrated 3PL in China with freight forwarding as its core business. In 2023, it handled 884,734 ocean TEUs, placing it 13th on that list, and 94,000 air metrics tons, landing at 37th on the airfreight forwarders list.