US Diesel Average Declines 2.7¢ to $2.917; Gasoline Dips as Crude Oil Hits 6-Year Low

U.S. Department of Energy

U.S. Department of EnergyThis story appears in the March 23 print edition of Transport Topics.

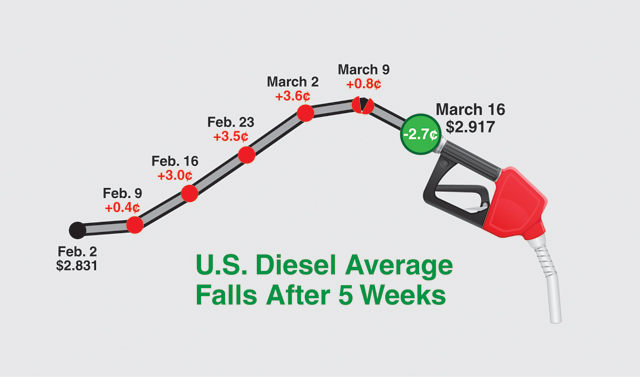

The U.S. retail diesel average declined 2.7 cents a gallon last week to $2.917, the Department of Energy reported, snapping a streak of five weekly increases.

Also last week, DOE said the retail gasoline average decreased 3.4 cents to $2.453, reversing a six-week gain, while crude oil prices briefly sank to a six-year low.

Before the downturn last week, diesel had risen a combined 11.3 cents since early February as cold weather boosted demand for heating oil, which comes from the same distillate stocks used for diesel.

Now that temperatures have risen, “that chapter is over,” allowing diesel to resume its downward trajectory driven by the low price of crude oil, said Tom Kloza, global head of energy analysis at Oil Price Information Service. “We have yet to catch up with these tremendous drops in crude.”

The national average price is more than a dollar cheaper than the same week last year, when diesel was $4.003, the Department of Energy said after its March 16 survey of fueling stations.

Retail gasoline had jumped 44.3 cents since late January before its downturn last week, but the fuel is still $1.094 below its year-ago level.

Crude futures fell on March 17 to $43.46 a barrel on the New York Mercantile Exchange, the lowest settlement price since March 2009, although it did edge up to near $44 two days later.

Oil prices have plummeted by more than $60 since July 1, when oil was just over $105 a barrel.

As a result, diesel prices plunged by nearly $1.09 a gallon from July through early February before its recent, five-week rebound.

The slide in diesel prices over the past several months has provided an unexpected benefit to trucking operations, said Ken Johnson, CEO at Leonard’s Express, a refrigerated and dry van carrier based in Farmington, New York.

“No one really anticipated this, certainly not a couple years ago,” he said.

At that point, average retail prices were hovering around the $4 mark.

“We pretty much anticipated that was going to be the new normal,” Johnson said.

A large portion of the 250-truck fleet’s operations are in the Northeast, where heating oil often has the largest influence on diesel prices, but that effect was much worse last winter, he said.

To help reduce its fuel expenses, Leonard’s Express has developed an internal program to track all of its purchases, so the company can help direct its drivers to fill up at the locations where they can get the best price on their particular routes.

The fleet also places an emphasis on providing its drivers with efficient vehicles.

“We try to rotate our equipment out on fairly short trade cycles, and we’re looking at always having the most fuel-efficient truck that works for our needs,” Johnson said. “The last couple years, the trucks have done much better than the prior model years.”

Meanwhile, OPIS’ Kloza said the United States is currently experiencing the greatest glut of crude oil that he has ever seen, going back to the 1970s.

“At some point in the near future, with refinery margins very high, that glut of crude oil should result in very comfortable, if not very unwieldy, supplies of diesel and gasoline,” he said. “I really struggle to come up with a catalyst that could move crude oil, and gasoline and diesel prices higher in the next three months.”

In fact, he predicted that diesel could drop 25 to 50 cents more in that timeframe.

“I think it’s going to be a steady decline lower,” Kloza said.

Earlier this month, DOE announced it is seeking to purchase up to 5 million barrels of crude to store in the Strategic Petroleum Reserve, Bloomberg News reported.

DOE announced its plan when commercial oil inventories in the United States have climbed to 459 million barrels, the highest level on record going back to 1982, according to DOE’s Energy Information Administration. The SPR currently has 691 million barrels.

“Commercial storage is filling up,” David Hackett, president of energy consulting firm Stillwater Associates, told Bloomberg. “If they buy domestic oil and put it in the SPR, that creates 5 million more barrels of space in commercial storage.”