Staff Reporter

Trucking LLCs Must File New Federal Report Under Law

[Stay on top of transportation news: Get TTNews in your inbox.]

Small trucking company owners may find themselves among the millions of limited liability company proprietors across the nation facing hefty fines and prison time if they fail to report information now required by an obscure new U.S. Treasury Department law that took effect Jan. 1 to thwart money laundering, tax fraud and financial crimes.

The new paperwork, called beneficial ownership information reports, for LLCs is now required by the Financial Crimes Enforcement Network, a bureau under the Treasury Department focused on safeguarding the nation’s financial system from illegal activities and collecting, analyzing and providing regulators with financial information to the agency.

The U.S. Small Business Administration notes 33 million small businesses are in the United States, many of which are LLCs, and among those are trucking companies.

LLC owners who do business in the United States now must report information about the people who ultimately own or control them, as mandated by the Corporate Transparency Act, enacted in 2021. The new reports are for an LLC’s beneficial owner (someone who owns/controls at least 25% of a company or has substantial control over the company) and a company applicant (the person who directly files/is mainly responsible for filing the document to create/register an LLC).

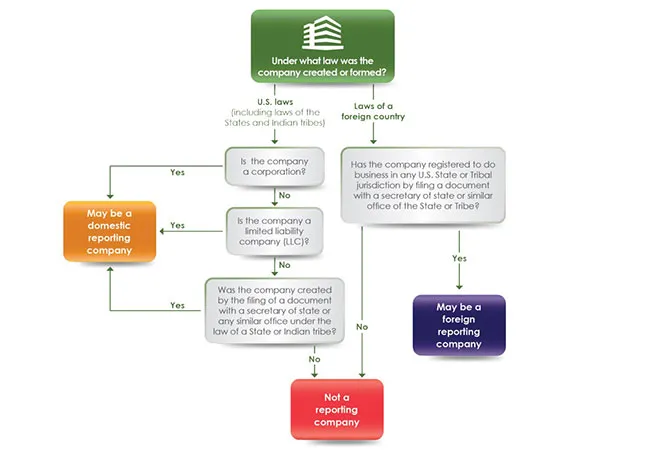

Is My Company a 'Reporting Company'?

(Financial Crimes Enforcement Network)

Failing to complete the report, neglecting to provide updated information or giving false information can lead to civil or criminal penalties, such as fines up to $500 for each day the violation continues, or criminal penalties including up to two years imprisonment and/or a fine of $10,000.

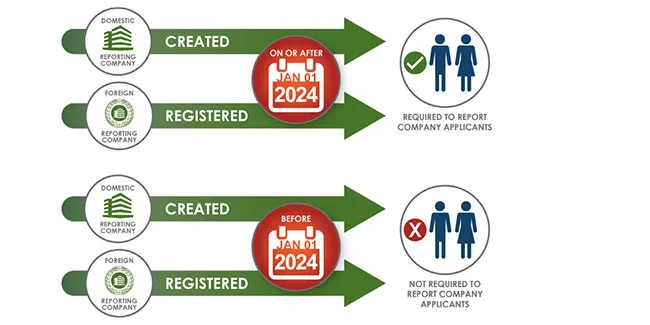

Two deadlines apply depending on when LLCs were formed:

- Existing companies created or registered before Jan. 1 to do business in the United States must file by Jan. 1, 2025.

- Newly created or registered companies created or registered to do business in the United States in 2024 have 90 calendar days to file from the date after receiving actual or public notice that the LLC’s creation or registration took effect. Also, LLCs created on/after Jan. 1 must submit information in the report about the people who formed the company as “company applicants.”

Is My Company Required to Report Its Company Applicants?

(Financial Crimes Enforcement Network)

Emphasizing that filing the required information “is simple, secure and free of charge,” FinCEN noted that reporting on beneficial ownership information is not an annual requirement and “only needs to be submitted once, unless the filer needs to update or correct information.”

According to FinCEN, LLCs generally must provide four pieces of information about each beneficial owner:

- Name

- Date of birth

- Address

- Identifying number and issuer from unexpired identification (an unexpired U.S. driver’s license or U.S. passport, or an unexpired state, local government or Indian tribe identification document). If none of those documents exist, an unexpired foreign passport can be used but an image of the document also must be submitted.

In addition, LLC information is required, such as its name(s) and address.

To help LLC owners understand the new beneficial ownership information reports requirement and how to complete the reporting, FinCEN has provided online resources in a brochure and videos on a special website: fincen.gov/boi. It also has created a 57-page “Small Entity Compliance Guide” (fincen.gov/boi/small-entity-compliance-guide).

Want more news? Listen to today's daily briefing below or go here for more info: