Pfizer Vaccine Road Map Shows Logistical, Financial Obstacles

[Ensure you have all the info you need in these unprecedented times. Subscribe now.]

When Pfizer Inc. and BioNTech SE’s COVID-19 vaccine rolls off production lines, Shanghai Fosun Pharmaceutical Group Co. will be waiting to distribute it through a complex and costly system of deep-freeze airport warehouses, refrigerated vehicles and inoculation points across China.

After they reach vaccination centers, the shots must be thawed from minus 70 degrees Celsius (minus 94 degrees Fahrenheit) and injected within five days. If not, they go bad.

Then the herculean journey from warehouse freezer to rolled-up sleeve must be undertaken all over again — to deliver the second booster shot a month later.

RELATED: Vaccine Cargo Cavalry Sizes Up Readiness of Historic Airlift

The road map sketched out by the company, which has licensed the vaccine for Greater China, offers a glimpse into the enormous and daunting logistical challenges faced by those looking to deliver Pfizer’s experimental vaccine after it showed “extraordinary” early results from final stage trials, raising hopes of a potential end to the nearly yearlong pandemic.

That euphoria now is being diluted by the realization that no currently used vaccine has ever been made from the messenger RNA technology deployed in Pfizer’s shot, which instructs the human body to produce proteins that then develop protective antibodies.

That means that countries will need to build from scratch the deep-freeze production, storage and transportation networks needed for the vaccine to survive. The massive investment and coordination required all but ensures that only rich nations are guaranteed access — and even then perhaps only their urban populations.

“Its production is costly, its component is unstable, it also requires cold-chain transportation and has a short shelf life,” said Ding Sheng, director of the Beijing-based Global Health Drug Discovery Institute, which has received funding from the Bill & Melinda Gates Foundation.

The expense of deploying the Pfizer shot likely will heighten existing fears that wealthier nations will get the best vaccines first, despite a World Health Organization-backed effort called Covax that aims to raise $18 billion to purchase vaccines for poorer countries.

It also presents a choice now faced across the developing world: to pay for the expensive construction of subzero cold-chain infrastructure for what seems like a sure bet, or wait for a slower, more conventional vaccine that brews batches of protein or inactivated viral particles in living cells, and can be delivered through existing health care networks.

RELATED: FedEx Vows to Avoid Transport Bottlenecks When Vaccines Are Ready

“If there is a protein-based vaccine that could achieve the same effect as an mRNA vaccine does and there’s the need to vaccinate billions of people every year, I’d go for the protein-based shots in the long run,” Ding said.

Even for rich countries that have pre-ordered doses, including Japan, the U.S. and the U.K., delivering Pfizer’s vaccine will involve considerable hurdles as long as trucks break down, electricity cuts out, essential workers get sick and ice melts.

Safe Delivery

To safely deliver shots in mainland China and Hong Kong, Fosun will partner with the state-owned Sinopharm Group Co., a pharmaceutical distributor with well-established networks across the country. One of Sinopharm’s subsidiaries also has been developing COVID-19 vaccines.

Packed into cold storage trucks, those vials will arrive at inoculation sites where they can thaw and be stacked in fridges at 2 to 8 degrees Celsius for a maximum five days before going bad.

“The requirement for extremely cold temperatures is likely to cause spoilage of a lot of vaccine,” said Michael Kinch, a vaccine specialist at Washington University in St. Louis.

It also is likely to cost Fosun tens of millions yuan, according to company Chairman Wu Yifang. Fosun is considering importing the vaccine in bulk and filling it into vials at a local plant. That also will require further investment in production and storage.

The resulting price tag may be too hefty for many developing nations, including neighboring India, which has struggled to contain the world’s second-largest coronavirus outbreak and currently has no agreement to purchase the Pfizer vaccine.

‘Forget It’

Many working in the country’s public health and the pharmaceutical industry already have voiced concern that India lacks the necessary capacity and capability to deliver a vaccine across its vast rural hinterland and population of more than 1.3 billion people at the breakneck speed now expected.

“Most of these vaccines need minus 70 degrees [Celsius], which we just can’t do in India, just forget it,” said T. Sundararaman, a New Delhi-based global coordinator of the People’s Health Movement, an organization that brings together local activists, academics and civil society groups working on public health.

In this episode, host Michael Freeze takes a look at the surprising ways trucking companies are building strong, resilient cultures and attracting talent that stays. Hear a snippet, above, and get the full program by going to RoadSigns.TTNews.com.

“Our current cold chains are not able to cope with some districts’ need for measles vaccines, and that’s only for children below the age of 3,” he said. “That’s a really trivial number of people compared to the numbers that will need a COVID-19 vaccine.”

When asked at a Nov. 10 briefing if India’s government would look to buy any of the Pfizer vaccine, Rajesh Bhushan, the secretary at the health ministry, said New Delhi is in talks with all vaccine manufacturers. He added that India was in a position to “augment and strengthen” its existing cold-chain capacity but declined to release purchase details.

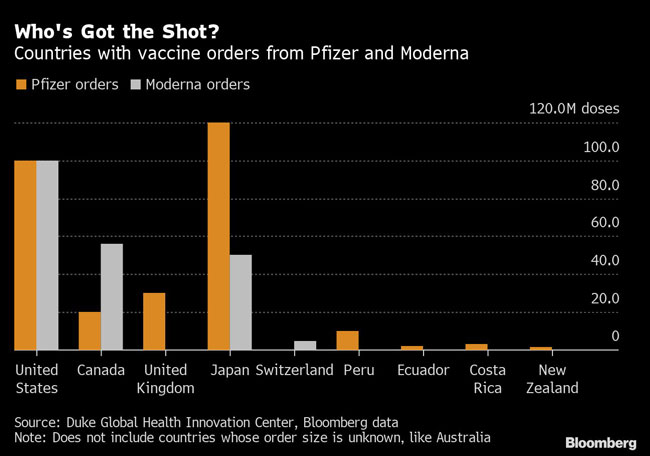

Pfizer already has orders from some developing countries such as Peru, Ecuador and Costa Rica. It’s unclear how widely those nations plan to distribute the shots, but their small orders of less than 10 million doses suggest limited deployment.

‘Last Mile’

Even without the subzero issue, rolling out a vaccine in a short space of time will be a “major challenge” requiring mass paramedical training to administer two-shot doses, said Pankaj Patel, chairman of Indian drug maker Cadila Healthcare Ltd., which is developing its own experimental plasmid DNA COVID-19 shot.

This is especially so in areas where people are not easily contactable or have to travel long distances to reach vaccination centers. Past vaccination campaigns show that many simply never show up for the second shot, public health experts said.

RELATED: UPS Readies Freezer Farms to Store Virus Vaccine When Approved

The mounting obstacles mean that some developing countries may pass on the Pfizer vaccine, despite early signs of its exceptional efficacy.

“If we were to wait an extra year and have something that’s feasible for us to deliver to as many people as possible in this country, would that be a bad trade-off?” asked Gagandeep Kang, professor of microbiology at the Vellore, India-based Christian Medical College and a member of the WHO’s Global Advisory Committee on Vaccine Safety.

“Based on the cost of the Pfizer vaccine, the logistics of an ultra-cold storage — I don’t think we are ready,” she said, “and I think this is something that we need to weigh the benefits and the costs very, very carefully.”

Want more news? Listen to today's daily briefing:

Subscribe: Apple Podcasts | Spotify | Amazon Alexa | Google Assistant | More