New EV Models Drive Up North American Factory Production

[Stay on top of transportation news: Get TTNews in your inbox.]

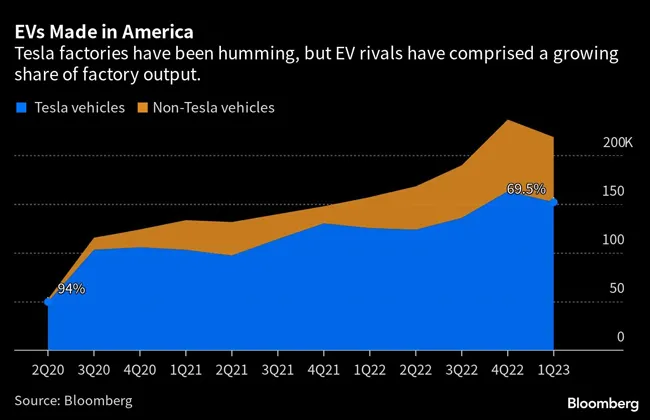

There’s one big reason EVs are getting slightly cheaper: More of them are rolling off production lines. North American factories cranked out 219,000 battery-powered cars and trucks in the first three months of the year, a 39% increase over the year-earlier period.

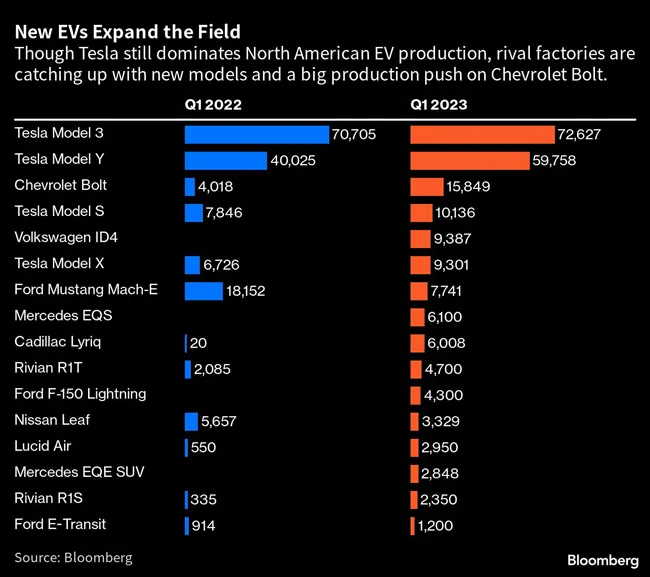

Tesla Inc., which has recently sparked a price war in the global EV market, continues to dominate it. The carmaker boosted North American production of each of its four vehicles in the first quarter, according to Bloomberg Intelligence, and bolted together more than 150,000 cars in total. But it’s a parade of entirely new cars and trucks that is starting to really move the needle on EVs in America.

In the first quarter, North American factories produced almost 29,000 cars that weren’t being manufactured a year ago, including the Ford F-150 Lightning, the Volkswagen ID.4, and two Mercedes vehicles, the EQS and EQE SUV. Those four models alone now comprise 13% of domestic EV production. General Motors also more than tripled production of its Chevrolet Bolt in the first three months of the year, filling a tide of orders a few months before it sunsets the car for good after a six-year run.

“We’re still production constrained, but it’s getting normalized and it’s getting better,” says Stephanie Brinley, associate director at S&P Global Mobility. “Ultimately, these companies want to build where they sell, so it’s going to happen. It needs to happen.”

While North American EV production is growing, it continues to lag demand. Some 7.2% of cars sold in the U.S. are now electric, while only 5.7% of the vehicles made on the continent are — a share that’s down slightly from the fourth quarter of 2022. In short, North American factories produced 219,000 EVs during a three-month period in which U.S. car buyers bought 259,000 EVs.

“It definitely looks like if you could build more EVs, you could sell more EVs,” Brinley said.

In a globalized economy, the disconnect between local production and local consumption is often trifling. After all, North American factories don’t make any iPhones. But in the U.S., where an electric car is made matters — at least to would-be buyers. Generous EV subsidies laid out in the Inflation Reduction Act kicked in last month, and only a short list of vehicles built domestically are eligible.

Old-guard automakers may not exactly be in a rush to catch Tesla: For many, the unit economics on EVs don’t yet add up. Last week, Ford Motor said its electric vehicle unit lost $722 million before taxes and interest in the quarter ended March 30. That number might have been higher if the company didn’t freeze its electric truck assembly line for five weeks after a battery fire. “Legacy automakers have the flexibility to ebb or flow EV production as profitability dictates,” Bloomberg Intelligence analyst Kevin Tynan wrote recently.

Ford CEO Jim Farley assured analysts last week that he is more focused on EV profitability than volume. “We are not going to price just to gain market share,” he said. “We will always balance a healthy profit road map.”

At the same time, Farley reiterated Ford’s thesis that EV profits come with scale. The company plans to be able to build 2 million battery-powered cars and trucks a year by the end of 2026, a volume that it expects to deliver an 8% profit margin. “We’re pulling every lever we can,” he said.

Want more news? Listen to today's daily briefing below or go here for more info: