Staff Reporter

Medium-Duty Truck Sales Spike 13% in August

[Stay on top of transportation news: Get TTNews in your inbox.]

U.S. retail sales for medium-duty trucks grew 13.6% in August compared with the year-ago period, according to data from Wards Intelligence.

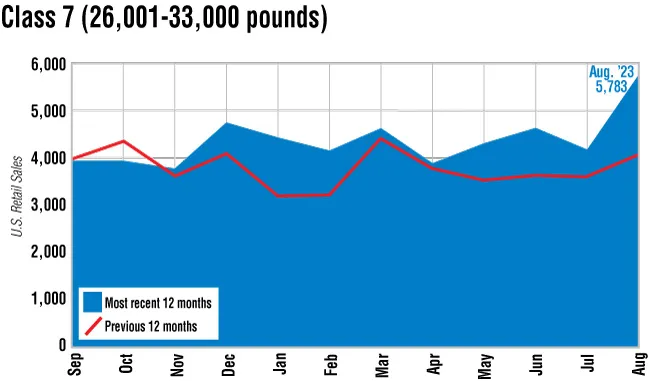

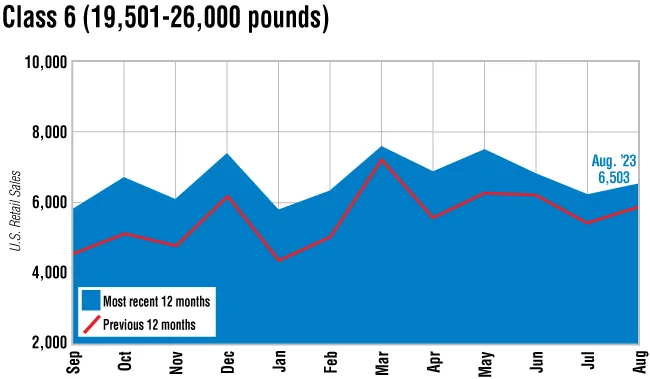

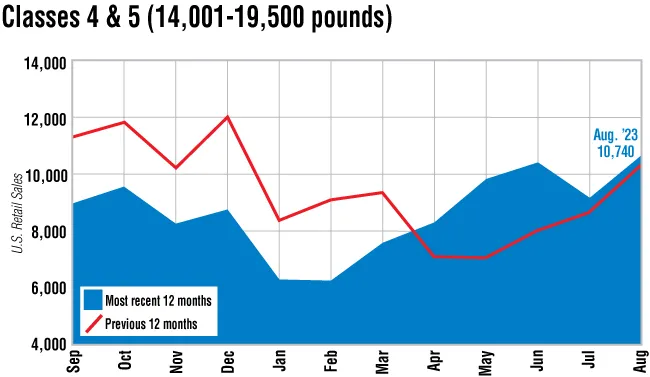

Classes 4-7 saw total retail truck sales increase to 23,026 from 20,261 units, marking the fifth consecutive month of year-over-year gains and the sixth month for the year to date. The year-ago period also marked the only increase for all of 2022. The latest results, too, were up 17.4% sequentially from the 19,618 units sold in July.

“In the short term, we had some really strong sequential comparisons looking at August versus July,” ACT Research Vice President Steve Tam said. “July is always kind of a funny month. We get holiday issues both from the dealer side as well as from the buyer side, so things get a little bit crazy. It’s not completely out of the box to see some of those increases, although some of them were quite sizable.”

Every class saw an increase in sales from the prior-year period. Class 7 experienced the biggest percentage increase at 44%, to 5,783 units from 4,016. Class 6 showed a 10.3% increase to 6,503 from 5,897 units. Classes 4-5 collectively saw sales increase 3.8% year-over-year to 10,740 from 10,348 units.

Freightliner, a brand of Daimler Truck North America, sold the most Class 7 trucks at 2,407 units. It also sold the most in Class 6 at 1,870. Ford sold the most in Class 5 at 4,343 units, as well as Class 4 at 987.

“Near-term noise notwithstanding, I think that the market is performing very much in line with what our expectations are,” Tam said. “We’re looking for a similar kind of growth number for sales for this year for the U.S. market. We focus predominantly on [Classes] 5 to 7, but you can throw 4 in there and the comment still stands.”

Tam noted that the numbers appear to be trending a bit above expectations. He added that could be because the forecast is on the light side, but whether that is the case isn’t clear yet.

“I think we get up against some relatively tough comparisons when we get in the latter parts of this year,” Tam said. “We were on our way up as we were exiting the year last year, so the tough comparisons will probably trend some of the in-hand growth that we’ve got right now.

“But generally speaking, the challenge of the medium-duty market is just availability of equipment.”

Tam also pointed out that the truck manufacturers continue to favor heavier trucks over their lighter counterparts. They have been forced to carefully allocate scarce resources between their different model units. But that has tended to mean prioritizing heavier classes since they’re more profitable per unit.

But there has been growing demand among the lower classes as some carriers have sought to gain vehicles that don’t require a commercial driver license.

“We’re still slugging that battle out, unfortunately,” Tam said. “Thankfully, not nearly to the degree that we had previously. But we, as an industry, are not able to supply all the equipment that our customers want and are demanding, and certainly not as quickly as they want.”

Want more news? Listen to today's daily briefing below or go here for more info: