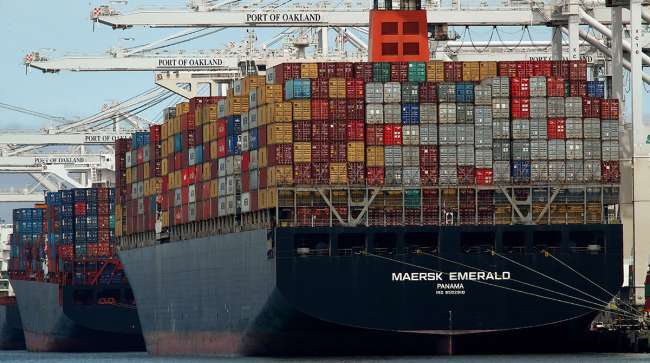

Maersk Sees Fuel Bill Soaring by $2 Billion From 2020 Rules

The world’s largest container shipping line said adhering to stricter environmental standards could add at least $2 billion to its annual fuel bill from 2020, one of the clearest examples yet of how vessel owners will be affected by rules to curb sulfur emissions that take effect in 16 months’ time.

High crude prices, tight availability of compliant fuel, and investment in research and development are among issues that will combine to drive up the cost of complying with IMO 2020, said Simon Bergulf, director for regulatory affairs at A.P. Moller-Maersk A/S, the Copenhagen, Denmark-based operator of hundreds of containerships and smaller craft such as tugboats.

“I wouldn’t call it a perfect storm, but it’s close,” Bergulf said, adding that marine fuel suppliers that Maersk is in contact with aren’t concerned about a ship-fuel shortage.

In our third episode of RoadSigns, we ask: Will your next truck be a plug-in? Hear a snippet from Mike Roeth, executive director of the North American Council for Freight Efficiency, above, and get the full program by going to RoadSigns.TTNews.com.

While there’s a growing consensus that the new rules to limit sulfur emissions will have far-reaching consequences for oil refiners, shippers and even trade, few large companies have attempted to quantify that impact publicly. Maersk, which spent $3.37 billion on fuel last year, said the increase could exceed $2 billion — and that’s before taking into account further spending on things such as research and development.

Currently, there isn’t a single, widely traded contract that captures the price of the new fuel vessels will have to use. ICE Gasoil, lower in sulfur than would be necessary, is more than double the price of high-sulfur fuel in January 2020, when the new rules start, according to data compiled by Bloomberg.

Large increases to expenses could tempt some companies to cheat by using fuel that doesn’t meet the regulations set out two years ago by the International Maritime Organization.

Rule Breaking

A large containership hauling goods to Europe from Asia might save in the region of $700,000 just for one delivery if it broke the rules, Bergulf said, adding that Maersk is committed to full compliance.

The new limit will be 0.5% sulfur content, down from 3.5% in most parts of the world today. Vessels also can have onboard equipment called scrubbers, which cost several million dollars apiece in big ships but allow owners to keep using higher-sulfur fuels. The pollutant is blamed for human health conditions such as asthma.

RELATED: World’s Biggest Shipping Firm Maersk to Test Russian Arctic Route

Maersk CEO Soren Skou shunned both liquefied natural gas — a fuel being touted as an alternative option — and scrubbers as potential solutions for complying with the 2020 cap in the company’s second-quarter earnings call earlier this month. Instead, Maersk has committed to burning low-sulfur fuels.

The company last week announced the creation of a 0.5% fuel-supply facility in Rotterdam, Netherlands, with storage company Vopak that will cater to around 20% of Maersk’s global demand. Maersk also is looking into the potential of similar facilities in other locations.

“Everyone that we’re talking to in our dialogues in the refineries, in the bunker suppliers, they’re not fearing any shortage,” Bergulf said. “That’s not something that they’re fearing at all. They believe they’re well-equipped to handle that transition.”

— With assistance by Christian Wienberg