Staff Reporter

IRS Reminds Truckers of Aug. 31 Tax Payment Deadline

[Stay on top of transportation news: Get TTNews in your inbox.]

For truckers who first used their vehicles in July on a public highway, the Internal Revenue Service is reminding them of an Aug. 31 payment deadline to electronically file their heavy highway vehicle use tax return.

“Vehicles first used on a public highway during the month of July 2023 must file Form 2290 and pay the appropriate tax between July 1, 2023, and Aug. 31, 2023. For additional taxable vehicles placed on the road during any month other than July, the tax should be prorated for the months during which it was in service,” the IRS stated Aug. 17.

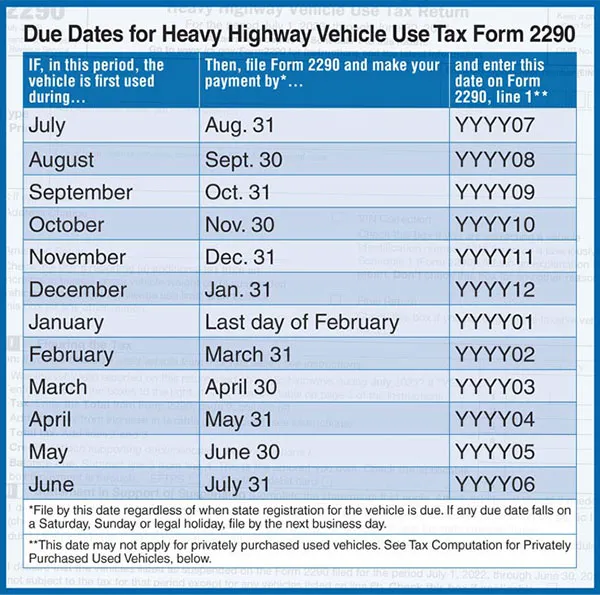

“You must file Form 2290 for these trucks by the last day of the month following the month the vehicle was first used on public highways. These due date rules apply whether you are paying the tax or reporting the suspension of tax. It is important to file and pay all your Form 2290 taxes on time to avoid paying interest and penalties.”

The IRS cautioned that truckers should not confuse the federal tax filing deadline with being linked to a heavy truck’s registration date.

“Taxpayers must file Form 2290 by the last day of the month following the month in which the taxpayer first used the vehicle on a public highway during the taxable period, regardless of the vehicle’s registration renewal date,” the agency said.

The IRS explained that the annual federal excise tax is for heavy highway motor vehicles with a taxable gross weight of 55,000 pounds or more that operate on public highways.

Guidance was also given on how to handle heavy vehicles used in the agriculture industry as well as for people who own and have registered more than two dozen heavy trucks.

“Taxpayers that have 25 or more taxed vehicles registered in their name must e-file Form 2290 and pay the tax,” the IRS said. “However, on vehicles they expect to use for 5,000 miles or less (7,500 for farm vehicles), they’re required to file a return, but pay no tax. If the vehicle exceeds the mileage use limit during the tax period, the tax becomes due.”

Graphic by Transport Topics

The IRS has a timetable to help taxpayers determine filing deadlines and a special webpage called the Trucking Tax Center. Various information is available, such as trucking industry tax publications, common questions asked by truckers who e-file and a short interactive interview called, “Do I Need to Pay the Heavy Highway Vehicle Use Tax?”

Want more news? Listen to today's daily briefing below or go here for more info: