Senior Reporter

Increase of 4.6¢ Halts Diesel’s Seven-Week Decline Streak

[Stay on top of transportation news: Get TTNews in your inbox.]

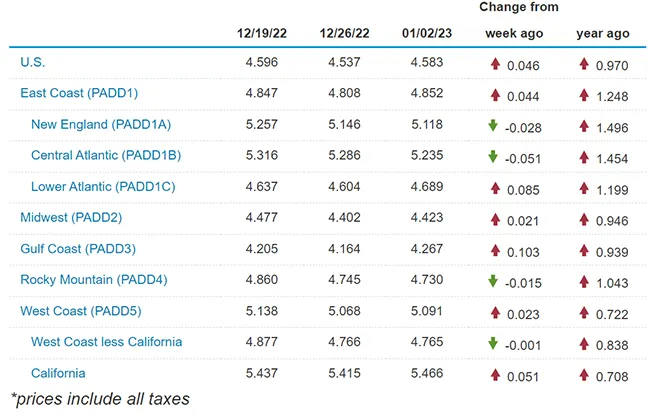

The national average price of diesel increased after seven straight weeks of declines, rising 4.6 cents to $4.583 according to Energy Information Administration data on Jan. 2.

The price had dropped 79.6 cents, from $5.333 on Nov. 7 to $4.537 on Dec. 26.

The average price for a gallon of diesel now costs 97 cents more than it did at this time in 2022.

Of the 10 regions in EIA’s weekly survey, diesel’s cost went up in six and down in four. The biggest increase was 10.3 cents in the Gulf Coast; the biggest drop was 5.1 cents in the Central Atlantic.

U.S. On-Highway Diesel Fuel Prices

EIA.gov

Gasoline, meanwhile, climbed 13.2 cents on average to reach $3.223 a gallon. The Lower Atlantic and Gulf Coast each saw spikes of more than 20 cents. Still, a gallon costs 5.8 cents less than at this time a year ago.

EIA noted rising U.S. retail gasoline prices in the summer were linked to increasing crude oil prices and increased gasoline demand early in 2022, but gasoline prices ended 2022 lower than at the start of the year because of more refinery production and less demand during the second half of the year.

In related news, New York state’s fuel-tax suspension ended Jan. 1 and Washington state’s clean-fuel program aimed to cut greenhouse gas emissions took effect — steps some see as adding cost at the pump.

Meanwhile, the Environmental Protection Agency issued in late December the final rule for a new heavy-duty engine and vehicle standard that “establishes many new challenges for manufacturers and suppliers but also ensures diesel’s place in the future for trucking,” said Allen Schaeffer, executive director of the Diesel Technology Forum.

Schaeffer

“Just under half of registered commercial trucks operating today are an older generation; pre-2011 model year vehicles with relatively higher emissions without the benefit of particulate traps and/or selective catalytic reduction technology,” Schaeffer said. “The relative benefit of accelerating the turnover of these older trucks on the road today to newer technology will be enormous.”

EPA reported the final rule includes emissions standards to further reduce air pollution, including pollutants that create ozone and particulate matter, from heavy-duty vehicles and engines starting in model year 2027. The final program includes new, more stringent emissions standards that cover a wider range of heavy-duty engine operating conditions compared with today’s standards, and it requires these more stringent emissions standards to be met for a longer period of time when the engines operate on the road.

“In 2045, this final rule will reduce nitrogen oxides emissions from the in-use fleet of heavy-duty trucks by almost 50% and would result in widespread air quality improvements across the U.S., especially in areas already overburdened by air pollution and diesel emissions,” EPA noted.

EIA reported the crude oil futures price for West Texas Intermediate on Jan. 4 was $72.84 per barrel. That was down $6.12 compared with a week earlier and down $4.15 compared with a year earlier.

According to Bloomberg News, crude is off to a gloomy start to the year with futures curves continuing to signal a market that is oversupplied. At the same time, the oil market is also grappling with lower levels of participation. Open interest remains near multiyear lows, leaving prices susceptible to large intraday swings.

Bloomberg on Jan. 4 added that state-controlled Saudi Aramco cut crude prices to its main market Asia and Europe, a signal that demand remains sluggish as coronavirus cases in China surge. Crude also was restrained as equities fell and the dollar strengthened after a strong U.S. labor report fueled speculation that interest rates have more room to rise.

EIA reported for the week ending Dec. 30, its latest data, that total products supplied — a measure of demand —over the last four-week period averaged 20.5 million barrels a day, down by 4.3% from the same period last year. Over the past four weeks, motor gasoline product supplied averaged 8.5 million barrels a day, down by 7% from the same period last year. Distillate fuel product supplied averaged 3.6 million barrels a day over the past four weeks, down by 12.4% from the same period last year. Jet fuel product supplied was up 5.1% compared with the same four-week period last year.

Want more news? Listen to today's daily briefing below or go here for more info: