Staff Reporter

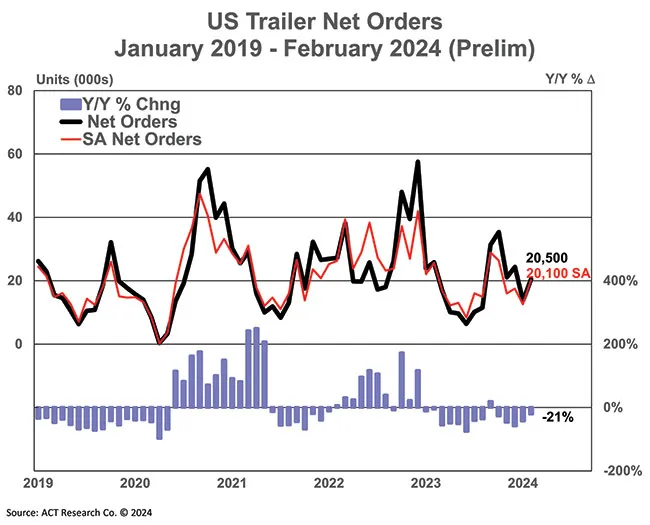

February Trailer Orders Fall 21% From Last Year

[Stay on top of transportation news: Get TTNews in your inbox.]

U.S. trailer orders in February declined from the prior year but rose sequentially, according to ACT Research.

Preliminary net data for the month showed orders fell 21% to 20,500 units from 25,800 in February 2023 but jumped 49.6% from the 13,700 units ordered in January.

“Against year-ago data still impacted by pent-up demand that is now gone, softer order intake activity continues to meet expectations,” said Jennifer McNealy, director of commercial vehicle market research at ACT. “Net orders remain challenged by a backdrop of weak profitability for for-hire truckers. Anecdotal commentary from trailer manufacturers and suppliers through the past several months have indicated this slowing, as they have shared that orders are coming, but at a more tepid pace when compared to the last few years.”

McNealy noted that the data continue to indicate that fleets have less of an ability or willingness to purchase equipment when they aren’t making as much money. However, she believes the weaker annual result doesn’t indicate a catastrophic year ahead with an economy that expanded at an above-trend rate in the first quarter. Plus, she notes that buyers are confronting some realities of the market.

McNealy

“Another indicator we’re watching closely is cancellations, which remained above comfortable levels for most segments in February,” McNealy said. “While the industry’s largest segments remain under pressure, some specialty segments have no available build slots until late in 2024 at the earliest, and cancellations remain low.”

Western Trailers is still burning through the backlog it had before the COVID-19 pandemic but is working down those orders. It’s also now fully employed for the first time since the pandemic.

“We’re a specialty manufacturer, so all the different markets we serve, our diversity, is what is helping us right now,” said Dan Taylor, sales manager at Western Trailers. “The traditional flatbed business is down, but the other things we do are up. So the flatbed business is still kind of fluttering around there. It’s OK — it’s not like [it’s] terrible — it’s just not like it was.”

Taylor recalled that during the pandemic, he saw a yearlong backup on orders. That has since eased, but he said a customer ordering a new flatbed trailer today could expect to secure an August build slot.

“We expected the market to cool down entering this year. and the comparable against last year is unsurprising,” said Chris Hammond, executive vice president of sales at Great Dane. “There are still new orders coming in for all products, although flatbeds seem to be the most sluggish right now. We don’t expect much cancellation activity going forward, as backlogs have come in somewhat and fleets normally are pretty sure on orders with these lead times, although some segments are out until later in the year.”

Great Dane expects March to be similar to February but believes the freight market forecast for later this year will again bolster orders for later in 2024 and into 2025.

Want more news? Listen to today's daily briefing below or go here for more info: