Staff Reporter

Diesel Prices Drop 3.4¢ to $3.767 a Gallon

[Stay on top of transportation news: Get TTNews in your inbox.]

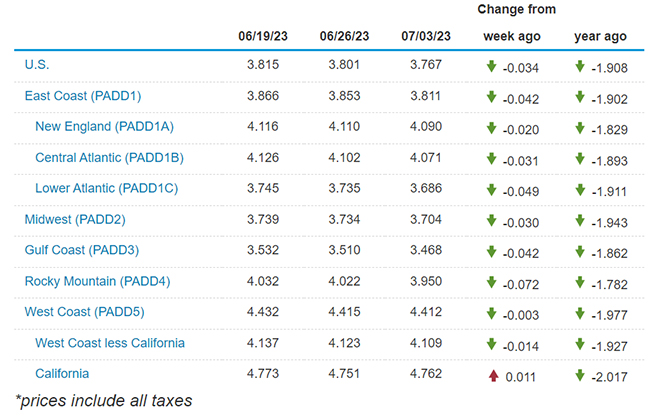

Diesel prices dropped another 3.4 cents to a national average of $3.767 per gallon, according to weekly data released by the Energy Information Administration July 3.

The national average price for diesel is now $1.908 a gallon cheaper than a year ago.

This week’s average price is the lowest reported by EIA since Jan. 17, 2022, when it was $3.725 per gallon.

Prices fell in every region except for California, where they rose by 1.1 cents a gallon.

The average price of diesel has fallen three straight weeks and 20 of the last 22 weeks. The national average price for a gallon of on-highway gasoline also fell in the most recent week, by 4.4 cents a gallon to $3.527.

U.S. average retail prices for July 3, 2023:

⛽️ Regular grade #gasoline: $3.53/gal

⛽️ On-highway #diesel: $3.77/gal #GasPriceshttps://t.co/dsfxiPA8Wj — EIA (@EIAgov) July 3, 2023

However, retail diesel prices are likely to find support from events in wholesale diesel and crude futures markets in the first few days of July, analysts say.

Front-month WTI crude prices jumped more than $2 a barrel July 5 as U.S. traders returned to their desks from the Independence Day federal holiday on the back of Saudi Arabia promising to maintain a production cut through August and Russia adding to the bullishness by promising a 500,000-barrels-a-day reduction of its own.

Saudi Arabia and Russia are the world’s two largest oil exporters. They were joined in the August production cuts by fellow OPEC+ member Algeria.

Uncertainty over whether the Saudis would extend their 1 million-barrels-per-day output reduction beyond an initial month weighed on prices following the initial June 4 announcement, sapping strength from the wider energy complex. Price Futures Group oil trader Phil Flynn quipped July 5 in his daily commentary: “Oh, so they were serious about that.”

As crude prices rose, so did the new front-month CME Group ultra-low-sulfur diesel futures contract for August, indicating a likely rise in on-highway retail prices down the line. Flynn said July 5 that diesel futures were surging on signs of tightening supplies.

Guy Broderick of Kriska shares how he successfully combined data reports and a simple understanding of human nature to become one of the best driver coaches in North America. Tune in above or by going to RoadSigns.ttnews.com.

If the front-month contract remains above $2.40 per gallon, bullish psychology is still in place, said David Thompson, an executive vice president at Powerhouse, a brokerage based in Washington.

Fundamental support is building for higher prices too, observers say, with the supply side of the equation the key. Tom Kloza, global head of energy analysis at price reporting agency OPIS, said in an email he expected prices to be 5 cents to 20 cents a gallon higher in the second half of the year.

Kloza

“I think the theme in July that may set the stage for the rest of the year is Great Expectations … It’s mostly tied to diminished supply and not to an increase in demand,” Kloza said.

U.S. refineries operated at 92.2% of capacity in the week that ended June 23, EIA data shows, compared with around 95% a year earlier. The EIA has yet to release data for the most recent week because of the holiday. Distillate output fell 300,000 barrels week-on-week to 4.7 million barrels a day, its lowest level since the start of May, according to the EIA data.

Supply-side support may boost crude prices later this summer too, Flynn said. “I don’t believe that I’ve ever seen a market more complacent about the risk to supply than we’ve seen in the last couple of weeks,” he said, adding, “Maybe that complacency is well founded, but history suggests that it may not be.”

On-Highway Diesel Fuel Prices

Want more news? Listen to today's daily briefing below or go here for more info: