Senior Reporter

Congestion Easing at Ports, Along Southern Border, TRB Speakers Say

[Stay on top of transportation news: Get TTNews in your inbox.]

WASHINGTON — Nearly three years after the beginning of the COVID-19 pandemic, global supply chains and international ocean carriers have seen cargo volumes return to pre-pandemic levels.

Now, many manufacturers are considering reshoring and nearshoring their operations to lower costs and make their companies less vulnerable to shipping interruptions, such as those they experienced in 2020 and 2021.

That was one of the conclusions from Maria Boile, a former Rutgers University professor now with the Department of Maritime Studies at the University of Piraeus in Greece.

She presented her findings Jan. 10 at the Transportation Research Board’s annual meeting.

Maria Boile is with the Department of Maritime Studies at the University of Piraeus in Greece. (Dan Ronan/Transport Topics)

“I don’t think it’s something that can happen overnight. It’s not something that can happen quickly. It will take time. But I think that we see that,” Boile said. “We’re seeing all of the supply chain patterns being changed. So this creates a totally different environment. And if you consider also the nearshoring and reshoring tendencies, this creates a totally new environment.”

Boile said companies are finding it makes sense to relocate some manufacturing closer to home, and she points to the decision by leaders in the semiconductor industry to shift production of computer chips from Asia back to the U.S.

Boile broke the disruptions caused by the pandemic into four different stages, with one being a rapid decrease in demand beginning in the spring of 2020.

That was followed with the second phase (June 2020-December 2020) with a rapid restoration in demand, as consumers worldwide shifted their consumption rates and global shipping rates soared to keep up with surging demand. The third period (January 2021-March 2022) showed a continued increase in consumer demand and ongoing supply chain disruptions as Asian export volumes surged by 16.6% compared with the same period in 2020. Boile said Phase 4 began last March and is characterized by what she called a “severe gradual decrease in transport container demand along with a huge decrease in freight rates.”

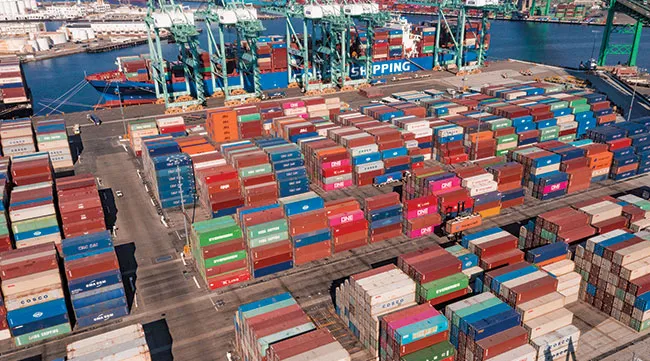

The Port of Los Angeles faced a massive container bottleneck last summer. (Jorge Villalba/Getty Images)

“We expect to see an overcapacity on the shipping side,” Boile said. “And if that trend continues in the near-term, then the demand is not going to follow pace.”

During the last quarter of 2022, several ports on the East and West coasts have seen monthly container volume numbers decline by double digits, as was the case at the Port of Los Angeles. Meanwhile, the Port of Savannah, Ga., saw its numbers drop 6.2% year-over-year in November.

Another presenter at TRB did a detailed analysis of Texas Gov. Greg Abbott’s April 2021 decision to close the U.S.-Mexico border by deputizing state troopers to inspect commercial vehicles crossing the border at selected ports — an initiative that caused extensive delays and threatened the country’s pandemic-stressed supply chains.

Eighty percent of the 450 billion in annual trade between the U.S. and Mexico moves by truck, says Daniel Escoto of the Texas A&M Transportation Institute. (Dan Ronan/Transport Topics)

Texas A&M Transportation Institute researcher Daniel Escoto said that 80% of the $450 billion in annual trade between the U.S. and Mexico is carried out by truck, and thousands of trucks were delayed, often for hours at the 13 truck ports of entry.

“From March 23 all the way to April 19, during this time there was no movement at all,” Escoto said. “Millions of dollars were lost during that time.”

Escoto said that at the Laredo World Trade port of entry, the volume of trucks crossing the border declined 31% during the three-plus weeks the order was in place.

Abbott eventually reached agreements with Mexican leaders in Chihuahua, Coahuila, Nuevo León and Tamaulipas on security measures along the 1,200-mile border.

What is the outlook for trucking in 2023? How will the industry change with the current government, economic and business trends? Join host Michael Freeze and TT reporters Eugene Mulero and Connor Wolf. Hear the program above and at RoadSigns.TTNews.com.

During the standoff, automakers and other types of vehicle manufacturers said many of their facilities were severely impacted by a shortage of parts to build the cars and trucks.

Escoto said his research showed that electrical components and other critical parts were among the most heavily impacted.

At the 3.2-mile Pharr-Reynosa International Bridge, which crosses the Rio Grande, Escoto said vegetable and fruit imports were dramatically impacted, causing prices at the grocery store to increase.

“I wouldn’t say it’s back to normal, but things are catching up,” Escoto said. “Some of them are already going better. But if we look back to 2020, before the pandemic, the expectations were for it to be higher than this. They’re in a recovery, and things are getting back to normal.”

Want more news? Listen to today's daily briefing below or go here for more info: