Senior Reporter

Congestion Cost Trucking a Record $94.6 Billion in 2021

[Stay on top of transportation news: Get TTNews in your inbox.]

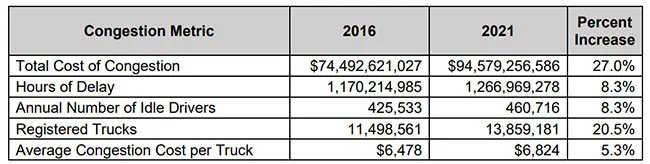

Snarled traffic on U.S. highways added $94.6 billion in costs to the trucking industry in 2021, up from $74.5 billion in 2016, according to a new Cost of Congestion study published by the American Transportation Research Institute.

“While year-over-year congestion costs decreased in 2020 due to the COVID-19 pandemic, they rose sharply in 2021 with a total of 1.27 billion hours of lost productivity,” the study reported. “This increase in costs reflects the dramatic post-COVID economic recovery, with high GDP growth and freight demand borne from record levels of consumer spending.

“This level of delay equates to more than 460,000 commercial truck drivers sitting idle for one work year, and the 2021 figure represents a 27% increase from the report’s baseline year of 2016 — an increase that is twice the rate of inflation.”

The study, made public on Oct. 25, recorded the highest level yet through ATRI’s ongoing research initiative.

The report provides a continuation of annual congestion cost results last published for 2016, now covering the years 2017 through 2021, ATRI said.

ATRI said 2021 congestion costs to date were fueled by high GDP growth, consumer spending, a jump in diesel prices, commuter traffic and trucking rate and volume increases.

ATRI’s analysis also found that the trucking industry wasted more than 6.7 billion gallons of diesel fuel in 2021 due to congestion, resulting in more than $22.3 billion in additional fuel costs. From an environmental perspective, the fuel that was wasted due to congestion delays resulted in the release of approximately 69 million metric tons of excess carbon dioxide in 2021.

In addition to the national findings, ATRI’s analysis documented state and metropolitan delays and related cost impacts. The top 10 states each experienced costs of more than $3 billion, led by California ($9 billion), Texas ($7.26 billion) and Florida ($7.16 billion). Combined, these 10 states ultimately account for more than half (53%) of trucking’s congestion costs nationwide. Additionally, the New York City metropolitan area ranked highest for cities, with costs approaching $5.5 billion annually, according to the study.

Cost of congestion national statistics for 2016 and 2021. (ATRI)

There were a small number of states that experienced a decrease in congestion, with Alaska and Wyoming experiencing the largest drop in congestion costs.

“Over the last several years, our industry has experienced some of the most dramatic increases in operating costs, including fuel, labor and equipment,” said Michael Lasko, vice president of EHS and Quality at Boyle Transportation. “Imagine how those costs are magnified by sitting still in traffic. We all should keep in mind that those costs are passed down directly to consumers resulting in higher prices for goods and services throughout the economy. Hopefully we can leverage the new infrastructure spending to get our supply chains moving again.”

When the total congestion costs of $94.6 billion are distributed across all registered tractor-trailers in the U.S., the average annual cost of congestion per truck is $6,824. This is equivalent to 3% of the average annual revenue generated per truck in the truckload sector in 2021, the report said.

Want more news? Listen to today's daily briefing above or go here for more info

ATRI said the November 2021 Infrastructure Investment and Jobs Act has provided approximately $1.2 trillion in infrastructure investments from 2022 through 2026 and includes approximately $350 billion dedicated to federal highway programs.

“This infrastructure funding is critical to addressing the congestion costs documented in this report,” ATRI said.

“According to a White House report, ‘one-in-five miles of our roadways and more than 45,000 bridges in the United States [are] rated as ‘in poor condition.’ Along with congestion issues, this type of infrastructure deficiency often creates safety hazards, road-related vehicle damage and repair costs, and road and bridge restrictions that negatively impact the supply chain.”