Class 8 Truck Orders Decline for First Time in 26 Months

This story appears in the April 13 print edition of Transport Topics.

New orders for Class 8 trucks declined in March for the first time in 26 months, but manufacturers remain busy filling previously placed orders, ACT Research said.

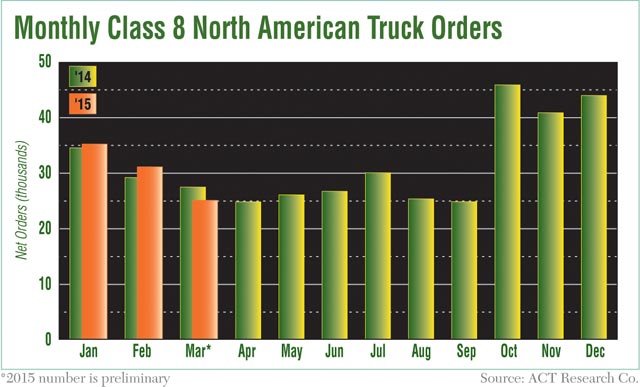

North American truck makers received about 25,100 net orders last month, down 9% from 27,487 a year earlier and the lowest level since September, ACT’s figures showed. Sequentially, incoming orders fell 19% from February’s total of 31,158.

Nonetheless, ACT Vice President Steve Tam said the March order total was still “a good number,” and he likened the current situation to filling a swimming pool that is almost full.

“Rather than signaling weakness in the market, March’s lower intake is more akin to turning the tap down as the pool nears the full mark,” he said.

By the end of March, the industry was probably down to about 80,000 open production slots for 2015, and that remaining capacity likely will be nearly filled by the end of June, Tam predicted.

Many fleets have been placing orders faster than usual to secure preferred timing for delivery of new trucks in light of manufacturers’ extended backlogs, Tam said.

As a result, some of the orders that might normally have been placed in March already had come in during earlier months, he said.

Year-to-date, Class 8 orders are up 0.3% to 91,541 units, according to ACT’s data.

Tam said most original equipment manufacturers will be working hard this year to build the trucks that have been ordered already.

“We’re going to be using some muscles that we haven’t used in a while,” he said.

Nevertheless, demand for heavy-duty trucks could be approaching the high point of the current cycle.

ACT has projected that Class 8 production will peak in 2015 at 340,000 units, which would be the second-most on record after 2006 and represent a 14% gain from 2013.

From there, ACT expects production to decline gradually, beginning in 2016, as the industry further satisfies its high demand for replacement vehicles.

Looking ahead, ACT expects order activity to slow during the summer months, in line with seasonal patterns, but still anticipates a “strong” order season in the fourth quarter so long as economic growth accelerates after a slowdown in retail sales and manufacturing early this year.

Research firm FTR’s net order figure for March was slightly lower, at 24,780 units.

FTR Vice President Don Ake said the decline in order activity was not a surprise.

“Many fleets already had their requirements in for 2015, and there is no advantage at this point to begin ordering for next year,” he said. “The market has cooled down from the torrid pace of [the fourth quarter] and is trying to find its equilibrium point. We could see orders dip below 20,000 in the summer, but this will still be a great production year.”

Industry analysts remained generally upbeat about Class 8 demand.

“Despite the weaker orders, investors should continue to have confidence that production will remain elevated in 2015,” said J.P. Morgan & Co. analyst Ann Duignan. “We continue to believe demand will remain above normal for longer this cycle as these orders are now filling [second-half] production slots.”

David Leiker of Baird Equity Research said solid growth in gross domestic product, freight rates and used truck values should support continued strong demand.

He said his firm expects truck production to surpass 300,000 units for several years.

“Unlike past cycles that have seen significant production fluctuations driven by emissions regulations, we believe stable mid-cycle demand supports a continued strong truck market,” Leiker said.

Rhem Wood of BB&T Capital Markets said a major reason for the March order slowdown is the majority of 2015 production slots are full and it’s still early to book into 2016.

He predicted that order levels could drop below 20,000 during the summer months but then exceed 40,000 once again by October if slots for 2016 are filling up at that point.

Michael Baudendistel, of Stifel, Nicolaus & Co., said the downturn “should not be interpreted as a softening in demand but rather a filling of available 2015 build slots in a period before 2016 pricing has been established.”

He also noted that Cummins’ share of diesel engines installed in Class 8 trucks slipped to 35% in February, citing figures from WardsAuto.com.

While many truck makers have continued to push their own vertically integrated engines, Cummins’ business will continue to be supported by its strength in the 15-liter engine market, where it maintains a market share of about 70% to 75%, he said.

Baudendistel said a large portion of the trucking industry will continue to opt for the larger engine because it is ideal for heavier applications and offers enhanced resale value.