Senior Reporter

US Sales of Class 8 Trucks Fall 29.5% in February

This story appears in the March 20 print edition of Transport Topics.

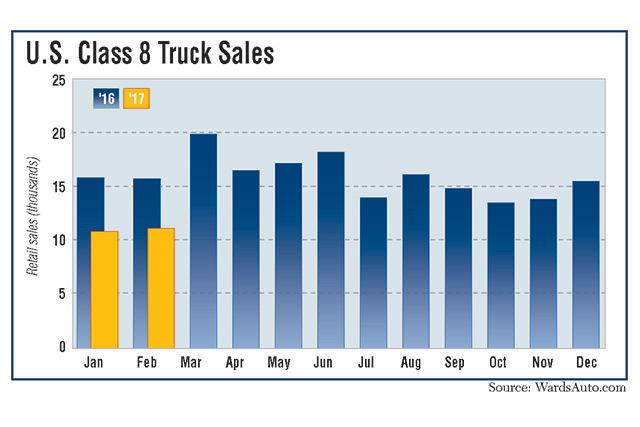

U.S. retail sales of Class 8 trucks in February fell 29.5% to just more than 11,000 units, as each truck maker experienced a double-digit decline. But analysts said the market, nonetheless, was showing signs of improvement.

Sales reached 11,200, compared with 15,876 in the 2016 period, WardsAuto.com reported. The last time sales rose year-over-year was in November 2015.

“Our models show tightening of capacity as the year goes on, freight growth resumes some, rates are getting better. So fleets are expecting to need more trucks in the future. They don’t need more trucks now. And that is reflected in the retail sales numbers, which are not impressive,” said Don Ake, vice president, commercial vehicles, at the research company FTR.

However, orders are climbing and production is expected to improve, Ake told Transport Topics. “Retail sales will be the last thing to go. This is like a reset; not a snapback.”

Year-to-date, retail sales reached 22,144, down 30.4% compared with 31,826 in the 2016 period, according to Ward’s.

“We fully expect to see continued improvement in the vocational segment as we roll through this year, but that is going to be offset by contractions in the over-the-road sales. There is still too much capacity out there,” said Steve Tam, vice president at ACT Research Co.

“That having been said, here we are in March and we have already raised our forecast twice this year,” he added.

ACT forecasts North American Class 8 production will be 217,000 this year, or about 5% below about where the industry ended in 2016 — about 228,000 trucks.

Freightliner, a unit of Daimler Trucks North America, slid 33.6% compared with February 2016, but led in sales with 4,310, good for a 38.5% monthly market share.

Western Star, also a unit of DTNA, dropped 24.3% as it sold 90 fewer trucks, but its 281 trucks gave it a 2.5% share.

Mack Trucks, a unit of Volvo Group, had the smallest year-over-year decline, down 11.9% to 1,105 units, which earned it a 9.9% market share.

“While manufacturing levels are expected to improve moving through 2017, the overall market is still experiencing the effects of truck overcapacity and weak used-truck prices,” said John Walsh, Mack Trucks vice president of global marketing and brand management.

“That being said, there is positive momentum for Mack. We were one of only a handful of heavy-duty truck manufacturers to grow market share in 2016, a trend that has continued for the first two months of 2017,” he said, citing Mack’s durability, support services and reliability.

Volvo Trucks North America, also a unit of Volvo Group, posted the steepest decline, 44.5%, as sales fell to 1,048, giving VTNA a 9.4% share.

Peterbilt Motors Co., a unit of Paccar Inc., dropped 16.3% to 1,816 trucks and earned a 16.2% share — the second-highest among the truck makers.

Kenworth Truck Co., also a unit of Paccar Inc., declined 39.7% to 1,331 units, good for an 11.9% share.

Meanwhile, International Trucks, a unit of Navistar Inc., saw sales decline 12.9% to 1,306 trucks, and achieve an 11.7% share.

One analyst expected International to begin a slow rebound, saying its market share “has bottomed.”

“We believe the new LT series — a significant improvement, in our opinion, from its predecessor, the ProStar — is the most important piece in that recovery,” Michael Baudendistel with Stifel, Nicolaus & Co. said in a note to investors.

“We also believe the just- announced A26 engine — the company’s re-entry into the 13-liter engine market — may be just as important as the new model tractor, as roughly 50% of the market now uses 13-liter engines,” he wrote.

Gary Haas, president of Haas Transport, a division of Haas Sons Inc., is adding 10 of International’s HX severe-service trucks to replace older models and expand his business, he said.

“I bought my first HX Series trucks in August of 2016 and since then have expanded our fleet to what will be a total of 10 trucks by May 2017,” Haas said. “When you’re driving large trucks, such as our heavy haulers or dump trucks, the turning radius is a major selling point. The HX Series gives our drivers a great turning radius with increased visibility.”

Haas predicts 2017 will be a busy year for trucking services.

“We have already locked down 50% of our work scheduled for the year. This is certainly abnormal. Although we don’t suspect the winter weather is the main contributing factor to this high demand, the mild winter has allowed us to work on some additional, smaller projects that we otherwise may not have done,” he said.

By May, Haas will have 54 dump trucks, he said, up from 40.

Other truck makers did not respond to a request for comments.