US June Manufacturing Index at Record High, Services Dip

[Ensure you have all the info you need in these unprecedented times. Subscribe now.]

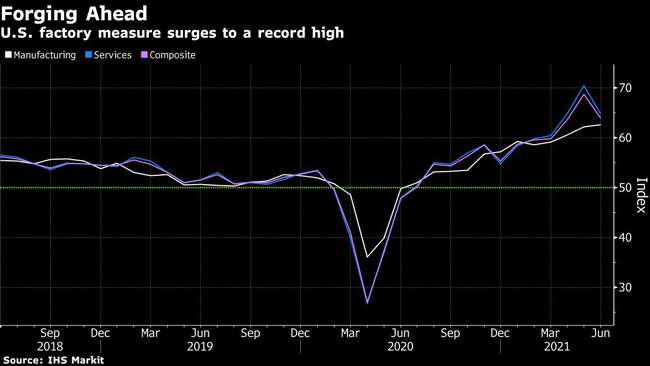

A measure of U.S. manufacturing activity expanded in June at the fastest pace in records dating back to 2007, fueled by easing pandemic restrictions and a strengthening domestic economy.

The IHS Markit flash index of purchasing managers at manufacturers increased for a fourth straight month to 62.6 from 62.1 a month earlier, the group reported June 23. The services measure fell to 64.8, though remains near record levels.

“The early PMI indicators point to further impressive growth of the U.S. economy in June, rounding off an unprecedented growth spurt over the second quarter as a whole,” Chris Williamson, chief business economist at IHS Markit, said in a statement.

Even so, factories are struggling to keep pace with demand amid supplier delays, record growth in input costs and hiring difficulties.

Price Pressures

A measure of manufacturers’ output prices rose to the highest in data back to 2007. Service providers also registered continued growth in costs and prices charged, providing further evidence of the inflationary pressures building across the economy.

The rapid increase in materials prices risks squeezing corporate profits, but the latest data show manufacturers have passed at least some of those costs onto consumers.

The report also showed that amount of time for supplier deliveries to reach factories lengthened by the most on record.

Factories expressed confidence that an end to restrictions and further increases in customer demand will boost output over the next year, according to the report. Optimism among service sector firms moderated.

Overall, the IHS Markit flash composite index of purchasing managers at manufacturers and service providers eased but continued to show robust growth.

Want more news? Listen to today's daily briefing below or go here for more info: