US Diesel Climbs 3.2¢ to $2.571, Reversing Five Weeks of Declines

This story appears in the June 5 print edition of Transport Topics.

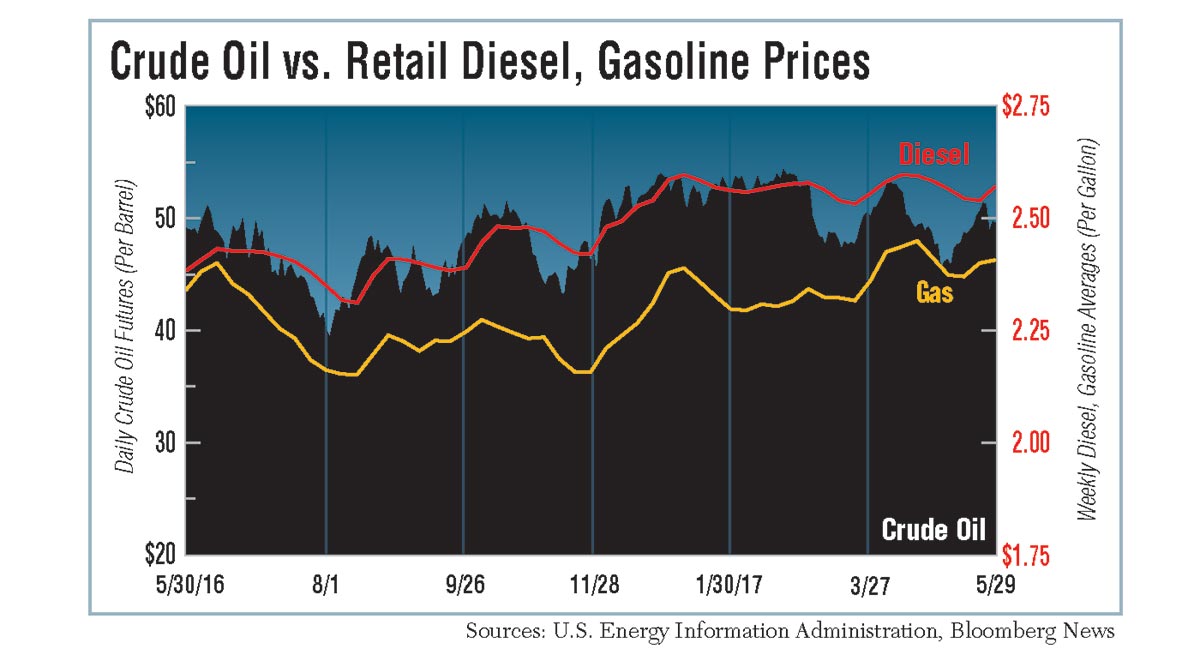

The U.S. diesel average reversed direction and rose 3.2 cents a gallon to $2.571 on May 29, taking back more than half of the decreases from the previous five weeks combined, the Department of Energy reported.

The retail average is just below its 12-month high of $2.597 in January and April, but that mark might not be broken quickly as crude oil last week returned below the $50-per-barrel threshold. On the New York Mercantile Exchange, crude futures closed at $48.32 on May 31, down from $51.47 on May 23.

Nymex traders also deal in wholesale diesel futures that rose sharply through May to $1.607 a gallon, also May 23, and then dropped to $1.515 on May 31.

The gasoline average inched up 0.7 cent a gallon to $2.406 on the Memorial Day holiday, May 29, the second weekly increase. DOE’s Energy Information Administration said the start of the summer driving season is marked by “weaker demand and high inventories” for gas.

Gasoline also is near its 12-month high of $2.449 recorded April 24.

While diesel is not near the historic highs above $4 a gallon during 2008, it is high enough to cause problems for small trucking companies.

“Fuel rates are way too high with the kind of [freight] rates we’re getting,” said Alton Palmer, owner of Alton Palmer Trucking of Rapid City, S.D., whose five flatbed rigs haul lumber, pipes and other building materials. Competition is so keen, he said. “We can’t get a rate to pay for the fuel.”

Palmer said he scouts for fuel deals, avoiding the center of Rapid City and heading for truck stops in rural areas. His trucks do a lot of longhaul work, anywhere from California to the East Coast, and they consume about 8,800 gallons a month, he said.

Robert Obrist, also a flatbedder and the owner of Fairview Trucking Co. in Tillamook, Ore., said he’d like to see prices drop about 15 cents a gallon. With a fleet of 20, he signed up for a discount program with a truck stop chain. Palmer said his fleet of five does not qualify for such deals.

Obrist, who has worked in trucking since 1974, said he trains his drivers to conserve fuel and looks for fuel-efficient engines to help him haul hay and lumber.

His tractors are Peterbilts powered by Paccar MX-13 engines, but he also is starting to experiment with Cummins X15 engines.

“You try to watch every detail, but it’s hard to keep up with all of the irons in the fire at once,” Obrist said in an interview.

For the five weeks through May 29, diesel dropped by 5.8 cents to $2.539.

Among the country’s regions, all parts of the nation had cheaper diesel a year ago, when the average was $2.382, or 18.9 cents lower. For the week, all areas saw rises except for New England, which dipped by 0.4 cent a gallon.

The gasoline average a year ago was $2.339, or 6.7 cents cheaper. Among the regions, Midwest drivers enjoyed a one-week decline of 1.4 cents and a year-over-year decline of 3.9 cents, but all other regions saw gains for the week and the year, the Energy Information Administration reported.

In May, OPEC members and other major oil-producing nations agreed to maintain production limits through March. But prices started declining last week because, according to Bloomberg News, oil traders are anticipating a surge in U.S. oil production that will largely nullify the OPEC efforts.

By the end of the year, U.S. output is seen reaching a record 10 million barrels a day, the wire service said May 31, citing consulting and data firm Rystad Energy. Production with oil at $50 a barrel has grown faster “than any analysts in the market predicted,” Bjornar Tonhaugen, a vice president for the Norwegian firm, told Bloomberg.

“There doesn’t seem to be an end to supply out there,” oil analyst Bob Yawger of Mizuho Securities USA told Bloomberg. “And demand is not exactly rip-roaring.”

The Energy Information Administration said in its June 1 Petroleum Status Report that domestic oil production was 9.34 million barrels per day during the week ended May 26.

The report also said U.S. refineries are busy, operating at 95% of capacity, up from 93.5% the previous week and from 89.8% a year ago.

Not only has the percentage increased, but so has the number of barrels that can be processed.

Currently, the refineries can crank out a maximum of 18.62 million barrels per day. Two years ago, the level was 17.87 million.

The production of ultra-low-sulfur distillates, including diesel, is on the rise. Refineries produced 4.96 million barrels per day during the week ended May 26, EIA said, up from 4.89 million the week before and from 4.48 million the year before.