Truck Tonnage Rises 3.7%

This story appears in the Aug. 24 print edition of Transport Topics.

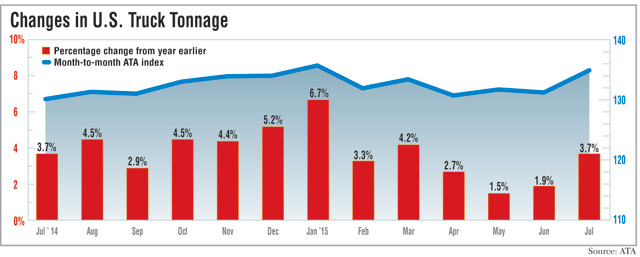

This story appears in the Aug. 24 print edition of Transport Topics. Truck tonnage rose 3.7% in July over the same month last year, jumping to the second-highest level ever as factory output rebounded and the consumer as well as housing markets continued to improve, American Trucking Associations reported.

The federation’s advanced seasonally adjusted index rose to 135.0 from 131.3, the revised reading for June, ATA announced Aug. 18. That 2.8% increase on a month-to-month basis was the largest since November 2013 and pushed tonnage close to the record 135.8 set in January.

“After several soft months starting in February, tonnage really snapped back in July,” ATA Chief Economist Bob Costello said.

Last month’s performance represented a sharp shift from May and June, when weak industrial activity depressed tonnage growth to an average of 1.7%. That was the slowest growth pace in more than two years.

One factor, according to another economic report from ATA on Aug. 14, was the 0.8% increase in factory output, which was tied to stronger car and light truck sales.

Arun Raha, chief economist at trucking supplier Eaton Corp., told Transport Topics on Aug. 18 that increasing July car and light truck sales, which reached an annualized pace of 17.55 million, could continue but at a slower pace. The reason, he said, is that replacement demand has been satisfied.

Housing markets should continue to be strong, he also said, because significant pent-up demand remains after slow and steady growth since 2009.

In fact, housing starts in July rose at the fastest pace since October 2007, the Commerce Department reported.

“I do believe the housing recovery is sustainable,” Raha said. “Population has been growing — more households are being formed.”

Jon Starks, director of transportation analysis for Bloomington, Indiana-based consultant FTR told TT that industrial products such as chemicals and other manufactured products are boosting demand and fueling tonnage growth. Lower fuel prices also have helped that sector, he said, by reducing production costs.

In the consumer-retail market, trucking was helped by a rise of 0.6% in retail sales last month, Costello said.

DAT Solutions analyst Mark Montague last week said “increased consumer spending is raising overall freight levels.”

Truck tonnage is being helped particularly by heavier freight such as bottled water shipments, which have risen during a hotter-than-usual summer, he said. Increased medical products shipments also have helped tonnage, he added.

ATA also reported freight on a not seasonally adjusted basis, which shows actual tonnage moved, fell 0.8% sequentially to 137.3 in July, but rose 2.8% year-over-year.

Costello and others voiced some concerns to temper expectations.

“I remain concerned in the near term about the high level of inventories throughout the supply chain. This could have a negative impact on truck freight volumes over the next few months,” the ATA official said.

Inventories over the past two months are at the highest level in more than six years, the Census Bureau reported.

“This is disappointing as it is likely to suppress truck freight volumes until inventories retreat some,” according to the Aug. 14 economic report by ATA. “Inventories remain elevated because some of the buildup results from shippers’ decisions to pad their stocks to protect against possible supply chain disruptions.”

Starks said the strong dollar that has crimped exports of manufactured products is a further drag on truck freight.

Still another factor is the drop-off in hydraulic fracking, Raha said, explaining that movements of heavy products such as sand boosted tonnage in 2014 and before.

And yet, tonnage growth that reached 3.4% in the first seven months of 2015 despite the possibility that several months of weakness could continue, several analysts told TT.

Starks said FTR expects that both manufacturing and tonnage will grow in the second half of 2015, but not at the same pace as 2014. Last year, tonnage rose 4.2% in the second half over the comparable 2013 period.

“The question is whether manufacturing is growing fast enough to help out the trucking industry,” he said, assigning a low probability to that outcome.

Raha was more optimistic.

“Tonnage in the second half should be better than the first half,” he said, with freight levels outpacing GDP growth that is expected to be in the 2%-2.5% growth range.

“Things that drive truck tonnage such as housing will improve in the second half,” Raha said. “Industrial production at the very least will remain steady.”

“We expect truck tonnage to grow in the second half given growth in housing and increased automotive production,” Deutsche Bank analyst Robert Salmon said, though inventories and industrial production are “potential headwinds.”

Montague also said that current strong markets include the Northeast and truck freight through East Coast ports that have gained some market share from West Coast rivals. West Coast trucking also has been hurt by weaker produce shipments from California, he said.