Trailer Orders Hit Record

This story appears in the Feb. 2 print edition of Transport Topics.

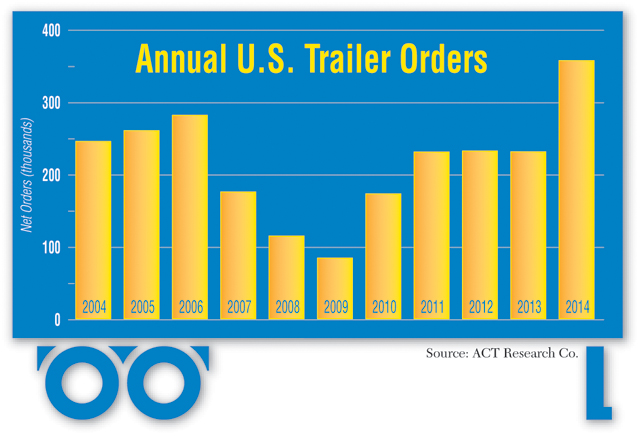

New trailer orders jumped in December to the second-highest monthly level on record, rounding out the industry’s best year ever for orders, ACT Research reported.

A late-year surge boosted the 2014 total to 359,085, supplanting the 327,000 orders in 1994 as the all-time high, ACT said. Last year’s order intake jumped 55% from the 232,159 placed in 2013.

December’s tally of 43,840 was second only to October, when manufacturers received 47,844 orders. The December figure represented a 51% jump from the same month in 2013 and a 21% increase from November.

ACT President Kenny Vieth said the record demand in 2014 reflects fleets’ continued replacement needs, combined with their improved profitability.

“The fleet is really old, and truckers are finally starting to make money,” he said. “It’s not enough that there’s freight to haul. Truckers have to make money hauling that freight, as well.”

Research firm FTR reported an even higher total for December, pegged at 45,500 units. It also said 2014 orders surpassed 360,000, making it “by far” the best order year ever.

“The trailer market is blazing hot as fleets continue to lock up future build slots in anticipation of a strong freight environment this year,” said FTR Vice President Don Ake.

Manufacturers cited the age of the trailer fleet as a key factor supporting demand.

“The pent-up demand finally turned into orders over the past couple of years and will likely peak over the next 18 to 24 months,” said Chris Hammond, vice president of dealer and international sales at Great Dane Trailers. “We still expect the market to stay at a healthy level over the next few years.”

Larry Roland, director of marketing at Utility Trailer Manufacturing Co., said the continued economic stability in 2014 “gave many of our customers confidence to move forward with a more aggressive replacement cycle.”

ACT’s Vieth pointed to the Compliance, Safety, Accountability ratings program as another factor supporting purchases. Shippers, lawyers, insurance companies and even drivers are paying attention to carriers’ CSA scores, he said.

“One way to clean up those safety and maintenance scores is to buy new equipment,” he said.

Even though the trailer industry is building at “near capacity,” manufacturers and their suppliers generally seem to be keeping up with the high demand, Vieth said.

However, there are concerns that delays at the West Coast ports related to labor contract talks could put a strain on supplies, he added.

Glenn Harney, chief sales officer at Hyundai Translead, said his company is experiencing some supply challenges due to the port delays and expects those issues to continue even if the contract is settled.

“The backlog is very big and will take months to clear,” he said.

Utility’s Roland said suppliers’ lead times “have certainly pushed out with the increased demand but have not affected build schedules too much at this point.”

Stoughton Trailers does not expect to run into any major supply shortages, in part because the extended backlog enables it to order parts and materials further in advance, said David Giesen, vice president of sales and marketing.

“That should offset the delays at the ports,” he said.

Harney, of Hyundai Translead, said a variety of factors are contributing to the dramatic order intake, including some fleet expansion and stronger freight rates.

Stoughton’s Giesen said the “steady” economy and lower fuel prices have put buyers in a good position to order equipment.

Wabash National Corp., the only publicly traded trailer manufacturer, is scheduled to report its fourth-quarter and year-end results this week.

During January, Wabash raised its outlook for 2014 trailer shipments and projected record sales for the year. The company said its full-year shipments surpassed 57,300 units, up from its previous guidance of 54,500 to 56,000 trailers.

ACT’s Vieth said the average trailer age stood at about eight years at the end of 2014. That’s down from the peak of 8.3 years in 2010-2012 but still well above the historical average of about seven years.

Trailer age has remained stubbornly high in part because some trucking companies trimmed their trailer fleets about a decade ago as they improved utilization through tracking technology, Vieth said. Then the recession hit, causing incoming orders to plummet to just 84,200 units in 2009.

Trailer production also rose in 2014 but not as strongly as orders. Manufacturers built 270,757 trailers last year, up 14% from 2013, Vieth said.

Last year’s record order levels put the industry in position to build even more trailers in 2015. ACT projects that production will rise to 304,600 units this year.

The industrywide order backlog expanded to 180,400 units by the end of 2014, up from 158,600 a month earlier and nearly double the 91,000-unit backlog at the end of 2013, Vieth said.

Dry van production rose 14% to 155,100 units last year, while refrigerated trailers increased 9% to 38,800, and flatbeds jumped 20% to 26,500, he said.