Tonnage Rises 5.2% in December

This story appears in the Jan. 26 print edition of Transport Topics.

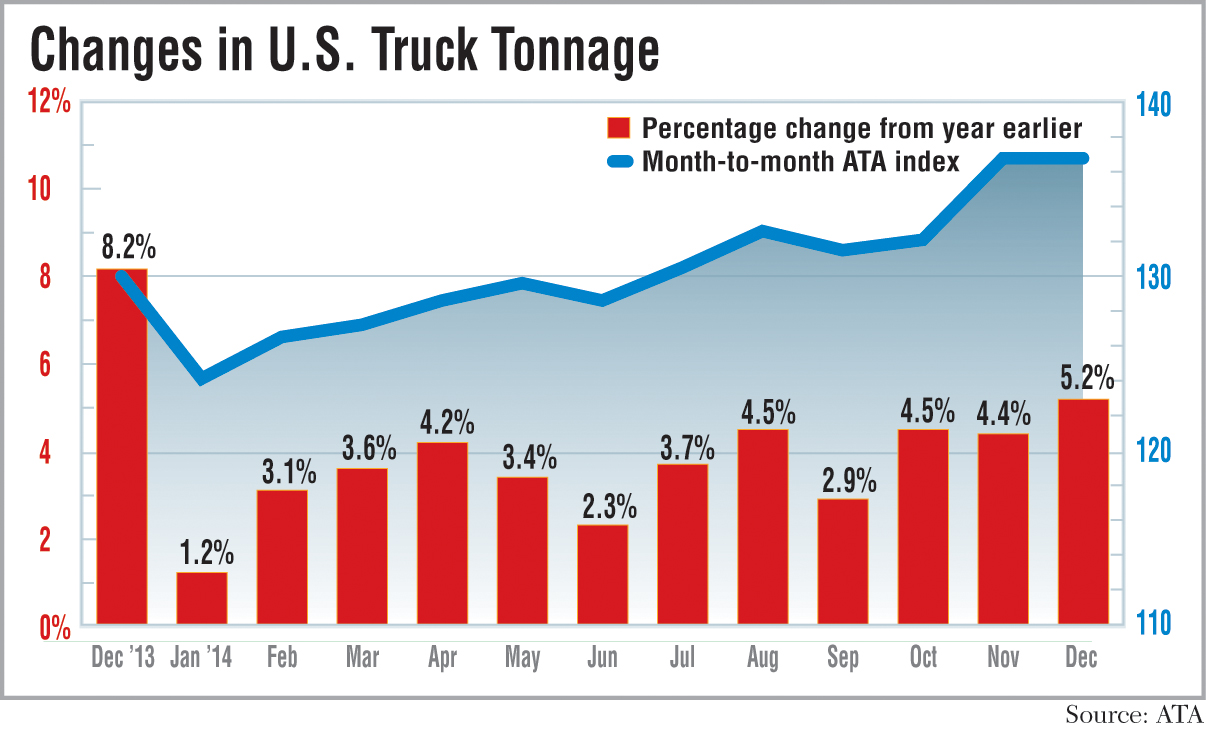

Growing factory activity helped truck tonnage end the year on a strong note, with American Trucking Associations’ index rising 5.2% in December over the year earlier.

The 136.8 reading matched November’s all-time high for the advanced seasonally adjusted for-hire index, ATA said in a Jan. 20 report.

The 5.2% increase was the highest for a single month of 2014. Tonnage rose 3.5% for the full year, ATA said.

ATA’s chief economist Bob Costello linked tonnage growth to the 5.2% year-over-year rise in December factory output, measured by the Federal Reserve, with a smaller contribution from less severe weather compared with 2013.

Sequentially, factory output rose 0.3% on top of a 1.3% rise from October to November.

“Overall, 2014 was a good year for truck tonnage with significant gains throughout the year after falling 4.5% in January alone,” Costello said.

A 4.4% rise in housing starts last month provided economic impetus as well, including new single-family home construction at its highest since early 2008, a Jan. 21 Commerce Department report said.

From a spot market perspective, DAT analyst Mark Montague told Transport Topics on Jan. 21 that “the foot never came off the accelerator” last year as its 2014 load board postings rose 20% to about 120 million, pushing rates to a record in December.

ATA’s non-seasonally adjusted index, based on actual freight hauled, rose last month to 133.5. That’s 6.1% higher than November and 8.5% above December 2013.

“Freight volumes look good going into 2015,” Costello said. “Expect an acceleration in consumer spending and factory output to offset the weakness in hydraulic fracking this year.”

Fracking uses water, sand and chemicals to drill for oil and gas. That heavyweight freight buoyed tonnage in recent years, when lighter-weight dry van freight was lagging. But fracking activity has dwindled lately, along with falling oil prices. James Meil, principal industry analyst at ACT Research, agreed that 2015 looks bright.

“Manufacturing is solid, and consumers are spending money,” Meil told TT last week. “The historical trends have been good, and momentum is likely to continue in 2015.”

Increased consumer spending and manufacturing will spark more trucking activity and outweigh tonnage reductions, should lower crude prices drive down U.S. energy production, said Meil, formerly the top economist at trucking supplier Eaton Corp.

Lower fuel prices will boost trucking activity and tonnage by about a 0.5 percentage point this year if fuel prices remain at current levels, Meil said. His forecast is for 3.5% tonnage growth this year.

An Energy Information Administration report from early January estimated savings on average would be $750 annually per household if current gasoline prices continue throughout 2015.

Costello has gauged tonnage growth at 3% to 3.5%, as U.S. economic expansion continues to generate more jobs and more manufacturing at the same time fuel prices are falling. Early 2015 spot market activity also illustrates economic growth, said Montague.

He told TT that flatbed freight has been unusually strong in the Great Lakes area, reflecting more production of steel and autos. Gulf Coast chemical shipments also have been strong this month, he added.

The Trans4Cast report last week from Internet Truckstop, another load board operator, also showed strength in those areas. However, overall loads available slipped in mid-January, Internet Truckstop’s report said.

Montague cited another sign of continued 2015 economic strength, even though load activity has dropped slightly because the weather so far this month has been more moderate than in 2014.

He said rates are keeping pace with record highs set in December, if the effect of lower diesel prices is included.

Costello expects another tonnage benefit this month.

“I think the bigger weather impact will be with the year-over-year comparisons in January, when tonnage fell 4.5% month-over-month in January 2014 from winter storms,” he said.

Montague also cited 2014 winter weather as a factor in the spot market strength.

Initially, load board activity surged last year because severe weather disruptions forced shippers to turn to load boards when fleets couldn’t cover contract loads.

For the balance of the year, the economic growth fueled increased load board activity, he said.

Not all the indicators were positive, the two economists said.

Retail sales dropped 0.4% last month, excluding lower fuel prices, Costello noted, even after the effect of lower fuel prices was excluded. Meil said the stronger U.S. dollar is hurting exports.

Meil cautioned that the December number frequently is revised and said a more encouraging note was the 4% rise in holiday sales reported by the National Retail Federation.