Managing Editor, Features and Multimedia

Tonnage Growth Still Tepid

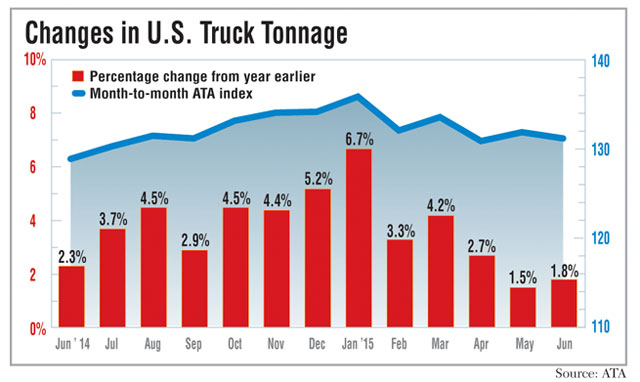

Last month’s gain narrowly outpaced May’s 1.5% year-over-year growth, which was the lowest since February 2013, when it fell 4.3%.

“With flat factory output and falling retail sales, I’m not surprised tonnage was soft in June,” said ATA Chief Economist Bob Costello, who also expressed concern about elevated inventories at retailers, wholesalers and manufacturers.

ATA’s advanced seasonally adjusted index stood at 131.1 in June, down 0.5% from May’s level. The index has been trending downward since hitting a record 135.8 reading in January.

Costello said many shippers made a conscious effort to boost inventories while the freight market was particularly tight. By holding more goods, shippers don’t need to order as much, which in turn suppresses freight volumes, he said.

Although the capacity crunch has eased recently, it will take higher consumer spending to bring inventories back down, Costello said, adding that he remains hopeful that such an inventory correction will occur this summer.

“When the correction ends, truck freight — helped by better personal consumption — will accelerate,” he said.

James Meil, an economist with ACT Research Co., also pointed to slowness this summer in some of the key components of the economy.

The manufacturing sector is flat, the energy sector continues to struggle with low oil prices and consumer spending and confidence are “OK, but not great,” he said. “It’s just sort of lackluster and slow-going.”

Despite questions about the strength of the overall economy, large truckload carriers recently expressed optimism about the freight market.

“While the pace of domestic economic growth remains uncertain, we believe the trucking economy’s freight demand and capacity remain closely in balance as the driver market remains tight,” David Parker, CEO of Covenant Transportation Group Inc., said in the Chattanooga, Tennessee-based company’s July 22 earnings report.

Richard Cribbs, chief financial officer at Covenant, added: “Discussions thus far with major peak-season shippers make us optimistic regarding the demand for our service offerings for the remainder of this fiscal year, although pricing and volume negotiations for peak shipments are not yet complete.”

Werner Enterprises said freight demand in the second quarter and into July continued to be stronger than the previous five years, “with the exception of the same period in 2014, which was rebounding from severe winter weather in [the] first quarter [of] 2014 that temporarily backed up the freight network.”

“Constrained truck capacity combined with a gradually improving economy in the retail, consumer products and grocery products markets primarily served by us are contributing to strong freight demand,” the Omaha, Nebraska-based carrier said in its July 20 earnings statement.

Werner and Covenant rank No. 16 and No. 46, respectively, in the Transport Topics Top 100 list of the largest for-hire carriers in the United States and Canada.

During the first half of 2015, tonnage increased 3.4% from the same timeframe last year. In the second quarter, the index rose 2% compared with the same period last year but fell 1.7% from the first quarter.

ATA also said the non-seasonally adjusted index, which represents the change in freight actually hauled, was 138.2 last month, up 4.2% from May.

Costello said gross domestic product likely grew at a 2% to 2.5% rate in the second quarter after a 0.2% contraction in the first quarter. He also predicted that GDP will expand by closer to 3% than 2% in the final two quarters of the year.

Although the manufacturing sector remains somewhat suppressed, Costello said he expects spending on goods to pick up steam and housing starts to remain strong in the months ahead.

“Therefore, I do expect tonnage to pick back up and grow better in the second half of the year than it did in the first half,” he said.

Deutsche Bank analyst Robert Salmon also anticipates growth in the freight market, moving forward.

“We expect truck tonnage to grow in 2015, given growth in housing, a stronger consumer, expected growth in U.S. imports and higher automotive production, though industrial production remains a headwind,” he said in a July 21 investor note.

ACT’s Meil agreed that freight capacity has loosened up recently. He cited the growth in production and sales of new Class 8 trucks over the past two years.

“You are seeing a lot of equipment flow into the marketplace, and that’s relieving capacity constraints,” Meil said.

Costello, however, said he believes the “vast majority” of new truck sales are replacement purchases rather than fleet expansion.