Shippers to Pay More as Rates Rise on Equipment, Infrastructure Costs, Execs Say

SAN ANTONIO — Shippers can expect to pay more to secure freight-hauling capacity as truck and rail carriers raise rates to cover rising costs and fund investments in equipment and infrastructure, according to transportation and logistics executives.

“2015 will be a tough environment for shippers,” said Tommy Barnes, president of Conway Multimodal, a unit of Con-way Inc. in Ann Arbor, Michigan. Barnes was speaking at the Council of Supply Chain Management Professionals annual conference here Sept. 22.

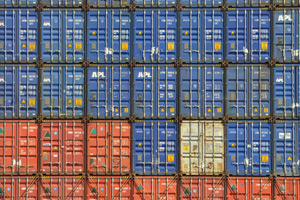

Craig Harper, chief operations officer at J.B. Hunt Transport Services, said his company is spending $700 million this year to “refresh” its fleet of containers and trailers to accommodate 7-10% growth in intermodal shipments and 10-12% growth in dedicated contract carriage.

Harper said a shortage of drivers is “real” and that congestion has slowed down rail service.

To attain more capacity, Harper said, shippers and carriers will have to work more closely to get better utilization of existing truck and rail equipment.

Michael Miller, chief commercial officer of Genessee & Wyoming Railroad Services, said rail carriers are spending about $24 billion a year on capital improvements, but rising demand for railcars to carry oil has “changed the flow of traffic” and slowed rail service in many parts of the country.

Rail carriers also are struggling to fill jobs, Miller said.

“We have had a corporate account position vacant for five months,” he noted.

Joe Carlier, senior vice president of sales for Penske Logistics, said he expects shippers to pay 3-5% more for freight transportation over the next year, although some shippers are seeing requests from carriers for rate increases of up to 10%.

J.B. Hunt Transport Services ranks No. 3 on the Transport Topics Top 100 list of for-hire carriers in the United States and Canada. Conway Inc. is No. 4, and Penske Logistics is No. 32.