September Freight Shipments, Expenditures Fall Year-Over-Year, Cass Report Shows

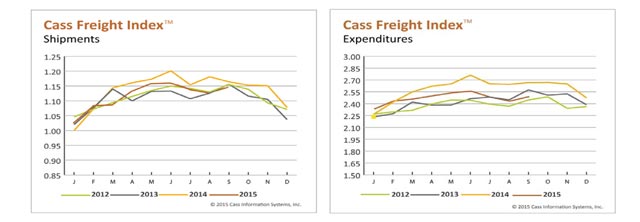

North American shipping activity declined 1.5% year-over-year in September, according to the Cass Freight Index, a measure of shipping activity in trucking and other modes of transportation.

Also, the St. Louis-based company said transportation spending year-over-year fell 6.6%.

The declines coincided with the fall in the Institute for Supply Management’s September PMI index, which slid lower for the third month in a row, the company said. For instance, the production sub-index slid 12.1% after a strong gain in August. The PMI’s 6.2 % drop was influenced by the steep decline in production and a 12% decrease in new orders.

However, freight shipments and expenditures rose last month compared with August, climbing 1.7% and 2.4%, respectively, according to the index.

September’s gain in shipments reversed a two-month decline, the company said. The month traditionally shows increases in shipments as retailers stock up for holiday sales.

Also, Cass attributed the rise in shipments to a strong U.S. dollar relative to other currencies and s sluggish global economy that “are continuing to make imports very attractive."

The company attributed much of the increase in the freight sector to railroad cargo, both carload and intermodal, that jumped 22.6% over August levels.

September’s rise in expenditures coincided with the gains in shipment volumes, it said.

“Spot prices have been lower because of adequate capacity during the slowdown in August. Trucking companies are holding rate increases down and offering capacity guarantees in exchange for higher rates. There has also been a steady growth in dedicated carriage agreements. We expect rate increases for the trucking sector to be modest through the end of the year.”

Also, Cass again noted that inventory levels — for retail, wholesale and manufacturing — are well above the high point prior to the inventory drawdown at the beginning of the Great Recession.

The company said, “All business inventories are continuing to grow, as are inventory-to-sales ratios, indicating that we are not at optimal levels given inventory turnover rates. In the first half of 2015, retail inventories rose 2.9% compared with only 2.3% for all of 2014; manufacturing inventories increased 3% compared to a decline of 0.25% in 2014. Wholesale inventories are up 2.3% in 2015 compared with 3.9% in all of 2014. ”