Product Integration Among Competitors A Growing Trend in Technology Sector

By Seth Clevenger, Staff Reporter

This story appears in the April 6 print edition of Transport Topics.

Trucking technology companies said they will continue to offer product integrations with outside vendors, even as mergers and acquisitions increasingly bring their partners under the same corporate ownership as their direct competitors.

Those partnerships across company lines will remain in place because joint customers will demand it, suppliers said.

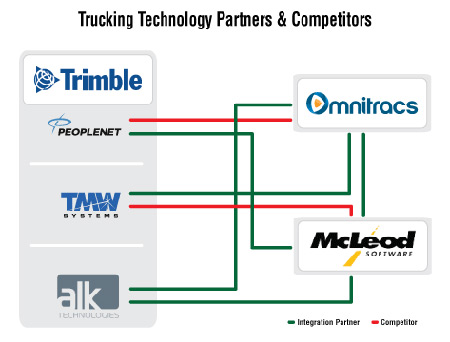

A prime example of this type of “coopetition” is the relationship between Omnitracs and Trimble.

In recent years, Trimble has purchased PeopleNet, TMW Systems and ALK Technologies, while Omnitracs has acquired Roadnet Technologies and XRS Corp.

Those acquisitions have positioned Trimble and Omnitracs as both rivals and partners.

While Omnitracs competes directly with PeopleNet in the mobile communications space, it also continues to partner with software providers TMW and ALK on integrations for shared customers.

Meanwhile, PeopleNet said it will continue to work with McLeod Software and other transportation-management software firms.

“At the end of the day, our customers in the market tell us what solutions they’d like to be able to assemble to differentiate their businesses,” TMW Systems CEO David Wangler said. “We’ve worked hard to strengthen existing partnerships.”

TMW has about 230 partnerships, he said. “That number has grown since the acquisition, not shrunk.”

Wangler said TMW will continue to work with Omnitracs and other providers that its customers identify as key partners.

“We’re also interested in getting to know new providers coming into the market and working with them as well,” he added. “We’re pretty sure we don’t have a monopoly on good ideas.”

Brian McLaughlin, president of PeopleNet, said cross-company integrations will endure because the market will demand that their systems work together.

PeopleNet has as good a relationship with McLeod as it has ever had, he said.

“We have customers we care very dearly about that need us to maintain that level of integration [with McLeod],” McLaughlin said.

PeopleNet also integrates with some Omnitracs properties, such as Sylectus, he added.

Although PeopleNet will continue collaborating with outside companies, it aims to develop a deeper level of integration with TMW, its sister company, he said.

“We want to continue to serve the market any way we can, but let’s differentiate with TMW — not by tearing down things from the past but by building something new,” McLaughlin said.

Jim Veneziano, the Trimble vice president responsible for its mobile solutions segment, said the industry’s model of integration across company lines remains intact.

“The customers are going to drive a lot of that,” he said.

However, if the Trimble companies do a “phenomenal” job of providing technologies that transform the industry, that can change what the customers want and move that model, Veneziano said.

Omnitracs CEO John Graham said partnerships with other technology providers will remain an important part of his company’s strategy.

“Our customers are going to want to work with certain technologies that they like, and we’re going to offer that flexibility,” he said. “We can’t operate in a world by ourselves, and I don’t think our partners can, so we need to be able to work together.”

At the same time, Omnitracs will set a “high bar” when selecting its partners to ensure that its customers will receive strong levels of support, Graham said.

Omnitracs’ top priority will be ensuring that its own products work together seamlessly, but that’s not to say that the company won’t work with other providers in the marketplace, said David Post, the company’s chief operating officer.

“We want customers to have the choice to work with other products, if they so choose,” he said.

McLeod Software has long enjoyed working relationships with companies such as Omnitracs, PeopleNet and ALK and expects those relationships to continue, CEO Tom McLeod said.

In fact, those suppliers have gone out of their way to assure McLeod that they want those partnerships to continue, he said.

“We’ve suddenly become everyone’s best friend,” McLeod said.

He added that he has a “high level of confidence” that technology firms will continue to offer integrations with outside companies, even after many of the major players have become part of a larger corporation.

“At this point, it would appear that if any vendor in the technology stack closed their products to a vertical integration offering, they would close themselves off to a significant portion of the market, and I don’t see anyone who appears to be interested in doing that any time soon,” he said.

Clem Driscoll, founder of research and consulting firm C.J. Driscoll & Associates, also said he expects technology suppliers to continue their existing partnerships and integrations across company lines.

“I think it’s hard for them not to,” he said.

In the case of Omnitracs, TMW is simply too big, Driscoll said.

“Too many Omnitracs customers use TMW. They used it before it was bought by Trimble,” he said. “They have to remain open to that. They’d be shooting themselves in the foot if they didn’t. I don’t think that’s going to change.”

At the same time, PeopleNet will need to continue working with its customers who are also McLeod users, or they’d be hurting themselves if they didn’t, Driscoll said.

“When they approach customers, they’ll try to sell their complete solution, including TMW, but where they’re working with McLeod customers, they have to be able to integrate with McLeod and make that happen,” he said.

Tom Benusa, chief information officer at Eagan, Minnesota-based truckload carrier Transport America, said it will be imperative for technology firms to work with other vendors — even when they’re in a competitor’s camp — because they will need those revenue streams.

“They’re all saying the right things, so if they follow up on their words we shouldn’t have a problem,” he said. “I think it would be really hard for them to cut off a large segment of the industry, especially given the ongoing consolidation in the TMS space. They just can’t afford not to work with them.”