Senior Reporter

Oil Price Turns Negative in Historic First; Diesel’s Decline Continues

[Stay on top of transportation news: Get TTNews in your inbox.]

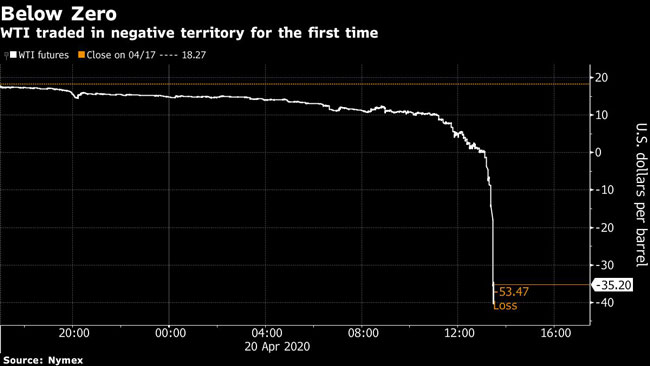

The price of oil dropped to its lowest level in history April 20, sinking into negative pricing as oil supplies are beginning to overwhelm the globe’s storage capacity.

During trading on the New York Mercantile Exchange, West Texas Intermediate crude for May delivery fell more than 100% to settle at negative $37.63 per barrel, meaning oil producers would pay traders to take the oil off their hands.

Meanwhile, diesel fuel prices continued their steady slide, according to the Energy Information Administration.

RELATED: Oil Plunges Below Zero for First Time in Unprecedented Fall

Trucking’s main fuel fell 2.7 cents to $2.48 a gallon, and now is 66.7 cents below what it cost one year ago ($3.147).

Prices fell in all 10 regions of the country that EIA monitors in its weekly diesel and gasoline report.

The least expensive diesel is in the Gulf Coast region at $2.272 a gallon, where prices slipped 1.7 cents in the past week. There, prices are 64.5 cents less than a year ago.

The most expensive diesel is in California at $3.248, but prices in that state fell 5.4 cents and diesel there is 75.5 cents a gallon cheaper than it was a year ago, when it cost slightly more than $4 a gallon.

Meanwhile, the national average of a price of gasoline fell 4.1 cents to $1.812 and is now $1.029 cheaper than a year ago. In the Midwest, the average price is down to $1.51.

Professor Bud Weinstein, associate director of the Maguire Energy Institute at Southern Methodist University in Dallas, told Transport Topics the collapse in energy prices is unprecedented.

“I don’t think anyone has seen what we’ve seen in the last couple of days,” he said. “There has never been a period in recorded history when oil prices turned negative. Even in the 1930s, when we had overproduction in Texas and Louisiana, oil got down to 10 cents a barrel, but it never turned negative.”

Weinstein said the problem is that daily world oil consumption has fallen by almost 30% from 100 million barrels a day to slightly more than 70 million barrels, and oil-producing giants such as Saudi Arabia and Russia are continuing to produce oil at pre-coronavirus levels.

(Bloomberg News)

Earlier this month, Saudi Arabia, Russia and 23 other oil-producing nations indicated they are willing to reduce world oil production by as much as 9.7 million barrels a day to bring supply and demand into balance.

If the deal holds, that would result in a cut of oil on the world’s markets by 13%.

But Weinstein said that cut won’t be enough to stop the price of diesel and gasoline from plunging, especially as demand remains extremely weak.

“Even if they could immediately reduce production by as much as 10 million barrels a day, that’s not enough,” he said. “Where’s the other 19 million going to come from?”

Veteran oil industry analyst Tom Kloza, founder of the Oil Price Information Service, told TT that he expects diesel prices to continue their steady downward trend, even as some trucking companies have been exceptionally busy restocking grocery stores and transporting critical supplies to hospitals and clinics.

“I believe we are going to see gasoline prices fare a little bit better than diesel prices, because we’re starting to get more of that demand destruction on the diesel side than on the gasoline side,” Kloza said. “Consider this: There are 480,000 school buses in this country. How much diesel have they used in the last 30 days? And that’s not even counting the 35,000 motor coaches that are sitting idle. Transit has 96,000 buses, most aren’t running.”

Kloza also said the drop-off in diesel is being felt in trucking as the West Texas oil market has been decimated by the lower prices and the oil tanker business is slumping.

Plus, demand for jet fuel has plummeted as airlines have cut their schedules by as much as 90% because of the coronavirus. In terms of chemical make-up, diesel and jet fuel are very close.

“I mean jet fuel is horrible, and it’s going to be horrible for a long time,” he said. “Now we are seeing it shift from gasoline price destruction into the diesel side, and I think refineries are going to have to get a handle on this. I think they are producing too much.

Want more news? Listen to today's daily briefing: