November Truck Turn Times Tumble at Ports of L.A., Long Beach

This story appears in the Dec. 19 & 26 print edition of Transport Topics.

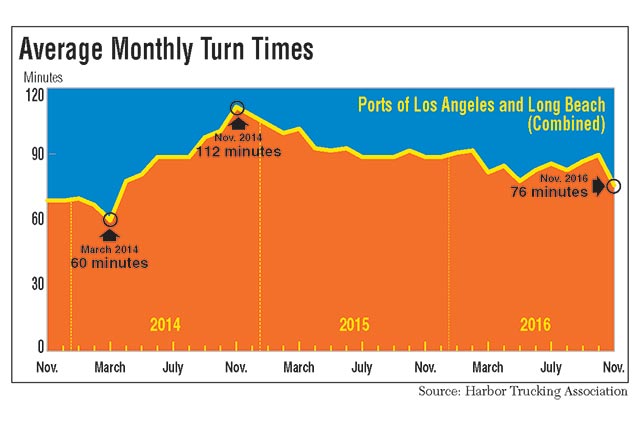

The average time it took trucks to enter and exit the two largest container ports in the United States dropped 15 minutes in November compared with October, according to data from the Harbor Trucking Association of Southern California.

On average, truck drivers spent 74 minutes in November at the Port of Los Angeles and 78 minutes at the Port of Long Beach. In October, it was 97 minutes in Los Angeles and 78 in Long Beach. The Port of Los Angeles is the largest in North America based on container volume; Long Beach ranks No. 2.

The Harbor Trucking Association uses GPS to track trucks from the moment they enter the line until they pass through the exit, also known as turn time.

Historically, according to the data, turn times increase in August, September and October, then drop in either November or December, the association said.

“Typically, when we see the turn times get longer, it’s because it’s a higher-volume month for container volume. When we see the times come down, it’s typically because there’s less cargo flowing through the terminals,” HTA Executive Director Weston LaBar said.

However, container volume increased in Los Angeles in November, according to port officials. Longshoremen handled 877,564 industry-standard 20-foot-equivalent units, or TEUs, up from 814,574 in October. Year-over-year, loaded imports increased 22% to 437,050, and exports jumped 25% to 177,359 last month.

Less cargo did flow through terminals in Long Beach on a sequential and year-over-year basis. In November, the port handled 534,308 TEUs, down 8.2% from October and 14% from one year ago. Imports fell 12% to 270,610, and exports declined 3.1% to 120,897.

The quickest terminals in November were TraPac in Los Angeles at 52 minutes and Matson in Long Beach at 38, on average. The slowest terminals were California United Terminals in Los Angeles at 117 minutes and Total Terminals International in Long Beach at 110, on average. More than 30% of truckers spent two hours or more conducting business at CUT and TTI compared with less than 10% at TraPac and Matson.

Truckers point to several causes, chiefly the chassis shortage.

Fred Johring, president of Golden State Express Inc., bought 33 private chassis for his fleet of 25 trucks to eliminate the headache. He said that, too often, no chassis are available when the truck driver arrives or there is a backup for chassis to be repaired.

“The same terminals tend to have the same problem day after day, so the frustration is how do I ever get the box out of the terminal?” Johring said. “Some terminals are more honest than others putting out data. Almost every day we get a chassis-shortage notice from TraPac. It’s well-known you don’t go into TraPac without your own chassis.”

However, he and Brian Griley, president of Southern Counties Express, don’t blame the terminal operators but rather the chassis pool of pools. Grand Alliance Chassis Pool, Los Angeles Basin Pool and Direct ChassisLink Pool are pooled a second time to form the pool of pools. The three main providers are Direct ChassisLink Inc., Flexi-Van Leasing Inc. and Trac Intermodal.

DCLI and Flexi-Van didn’t respond to requests for comment. Trac said a spokesman was unavailable to comment.

“You’ll have one terminal with zero chassis and others with 1,500 chassis on a particular day. I don’t know what the reasons are, but they [chassis providers] aren’t moving the equipment to where they need it,” Griley said.

Southern Counties Express owns 500 chassis for its 225-truck fleet.

To make matters worse, trucking companies will book appointment times but can’t pick up the containers because there aren’t available chassis, and still get charged a demurrage fee for not picking up the containers within the free time, according to Johring.

“We plead mercy to the terminals, and there are some terminals that hear my cry and extend the last free day, but many won’t,” he said.

Meanwhile, the PierPass Advisory Committee reviewed proposals Dec. 8 to ease congestion at the entrance gates in Los Angeles and Long Beach. One plan to fluctuate fees based on congestion was scrapped. The committee will study another idea to lower the fee but apply it at all times. Currently, it’s only charged during the day.

The committee also will explore a portwide peel-off plan, in which trucks would show up and pick up the next available container without foreknowledge of the final destination. The cargo owner or steamship line would sign up for a date and time for pickup and only learn later which trucking company took the container. If they wanted to use a specific carrier, the terminal would charge extra fees to place the container into a separate pile.

A draft report is expected to be presented in February.