Senior Reporter

November Class 8 Sales Fall 27.5%

This story appears in the Dec. 19 & 26 print edition of Transport Topics.

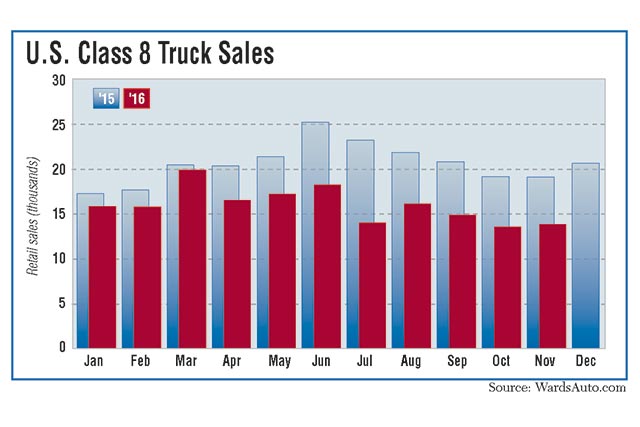

Class 8 U.S. retail sales in November were off 27.5% from a year earlier amid weak demand for longhaul trucking. November’s was the lowest total for that month since 2012, analysts said.

Sales were 13,943, down from 19,231 a year earlier as results were mixed among truck makers, WardsAuto.com reported.

Also, sales for the first 11 months were 177,035, down 22.4% from 228,021 in the 2015 period.

Sales in November 2012 (the year the 2016 market most resembles) were 14,370, according to Ward’s.

“The only category of trucking employment that has not recovered to its pre-recession level is truckload long distance,” said Bob Dieli, chief economist at the research firm MacKay and Co., citing the company’s Truckable Economic Activity measure and figures from the Bureau of Labor Statistics.

Brands at two companies, Daimler Trucks North America and Paccar Inc., accounted for nearly three-quarters of the monthly volume.

Market leader Freightliner, a unit of DTNA, fell the most in November with year-over-year sales down 39.9% to 5,538 units, good for a 39.7% market share.

Sales at Western Star, also a unit of DTNA, rose 5.5%, or by 21 trucks, to 403, and a 2.9% share.

Peterbilt Motors Co. posted the largest monthly increase, up 11% to 2,062 trucks, marking a 14.8% share. Kenworth Truck Co. saw sales fall 27.2% to 1,965 and a 14.1% share. Both Peterbilt and Kenworth are Paccar brands.

Between them, DTNA and Paccar had 71.5% of all the sales.

Volume at International Truck was off by 0.1% year-over-year as sales fell by two trucks to 1,418, and a 10.2% share. International is a brand of Navistar Inc.

Volvo Trucks North America posted sales of 1,451 trucks, down 33.8% but registering a 10.4% share.

The truck maker continued to point to industrial manufacturing levels that remained low due to high inventories while freight volumes were once again flat, which cut into November’s Class 8 retail sales.

“This is particularly true in longhaul, a core segment for Volvo Trucks,” said Magnus Koeck, Volvo Trucks vice president of marketing and brand management.

Koeck said the truck maker continued to focus on producing innovative models that deliver improved fuel efficiency and productivity.

Mack Trucks North America reported sales fell 25.5% to 1,096 units and a 7.9% share.

“With less freight to move, fewer trucks are needed, particularly in the longhaul segment. The construction segment remains a relative bright spot, which has allowed Mack to grow market share in 2016 [to 8.6% through November, up from 7.7% in the 2015 period],” said Jonathan Randall, Mack Trucks senior vice president of sales.

Both VTNA and Mack are units of Volvo Group.

Neil Frohnapple, an analyst with Longbow Research Co., surveyed Freightliner and Volvo dealers in December and they indicated the “pricing environment for new model year 2018 heavy-duty trucks is normal, but meaningful incentives are still being offered on existing stock inventory,” he said.

Other truck makers either declined or did not respond to requests for comments.

Dieli also noted November was an improvement, albeit slightly, over October’s sales of 13,618 trucks.

“Up is up,” he said.

However, he suggested the real gauge of the willingness of people to purchase Class 8 trucks will come in February or March “when we begin to see how business psychology is forming up in terms of what they think is going to go on and how they are reacting to replacement need and other capacity utilization issues [as new rules kick in].”

At the same time, his forecast calls for the economic expansion to continue, Dieli said.

The Equipment Leasing & Finance Foundation’s 2017 outlook noted: “As 2016 draws to a close, the U.S. economy appears to have finally moved past a growth pause and is poised for a rebound. Labor markets are this year’s persistent bright spot, and continued labor market strength is likely to drive additional gains in wages and income, consumption and housing growth.”

The report found, “business investment and manufacturing activity were 2016’s big disappointments, but most indicators suggest that investment is emerging from a trough and should improve in the coming months. Overall, the economy is well-positioned for decent GDP growth in 2017.”

Class 8 retail sales are expected to total 199,000 this year, in the opinion of ACT Research Co.

ACT Vice President Steve Tam called November’s sales “another chapter in the same book.”

Sales in 2012 totaled 194,715 and last year were 248,379 trucks.